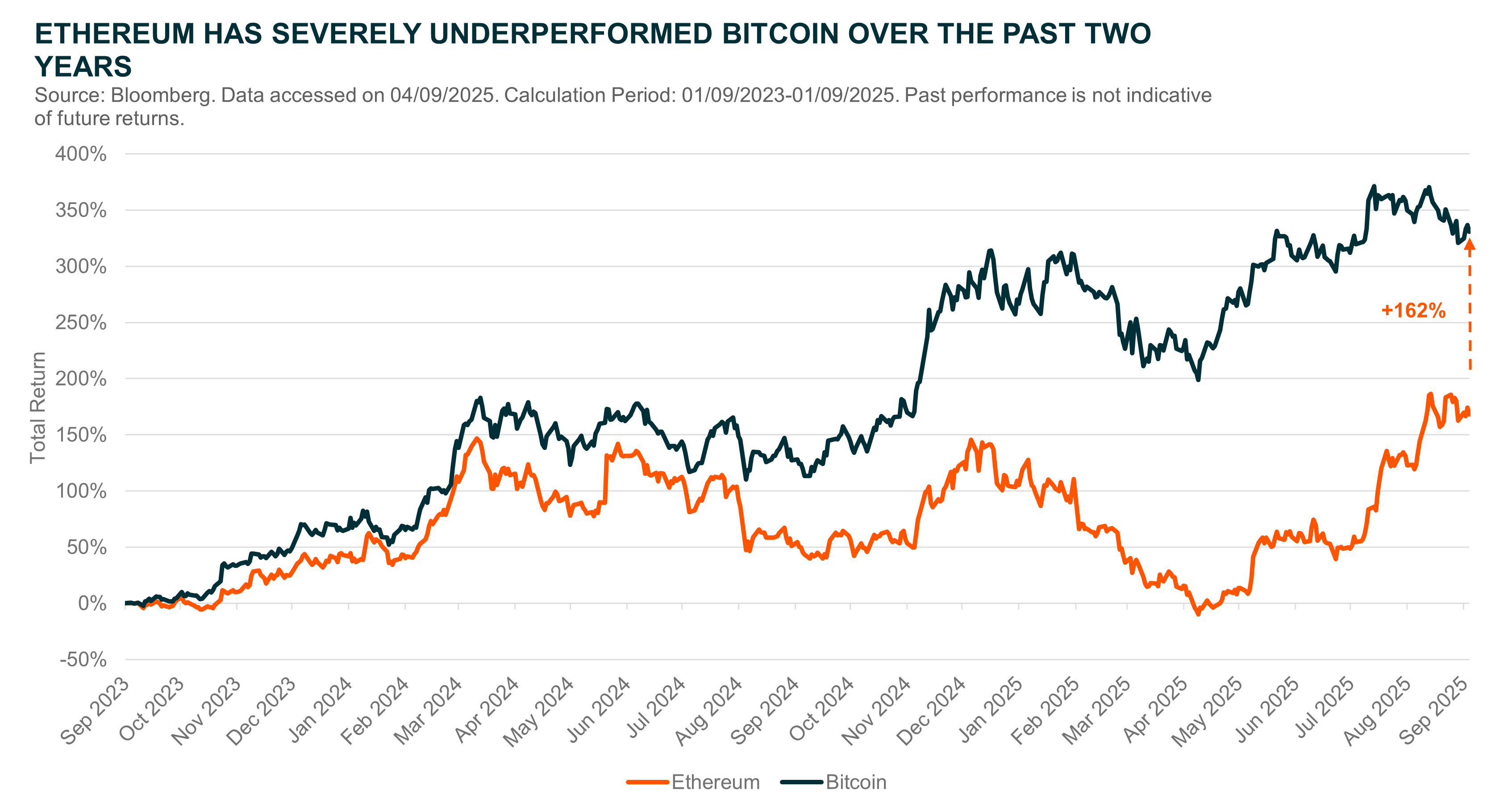

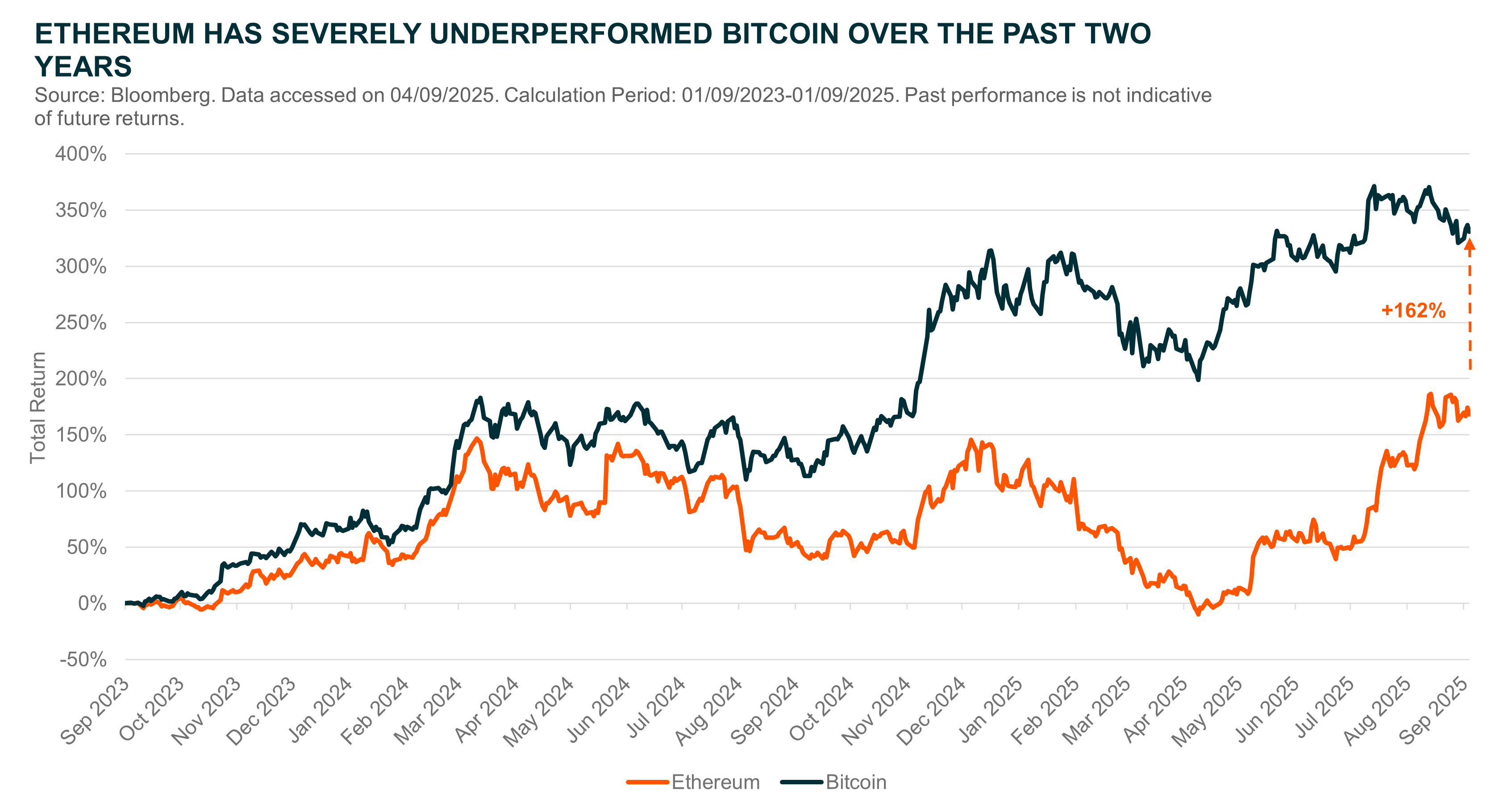

Over the past two years, the cryptocurrency market has played out like a tale of two cities. On one side, Bitcoin has enjoyed a powerful rally since the approval of its US-listed ETFs, climbing to fresh records again and again. On the other, Ethereum (Ether) has lagged behind, only recently breaking through the ceiling it first set back in 2021.

That contrast may now be giving way to a new chapter. Improving regulatory clarity, strong ETF inflows, and a string of high-profile crypto IPOs are beginning to shift sentiment. With Bitcoin’s momentum easing, it may finally be time for Ether to step out of the shadows and take centre stage.

Key Takeaways

- Ether has historically outperformed Bitcoin in bull markets. The timing and narrative behind spot Bitcoin ETFs disrupted the balance, but Ether ETF adoption is catching up.

- High profile crypto-IPOs and improving policy clarity are driving renewed interest and enabling stronger participation from both retail and institutions.

ETFs: The Difference Maker

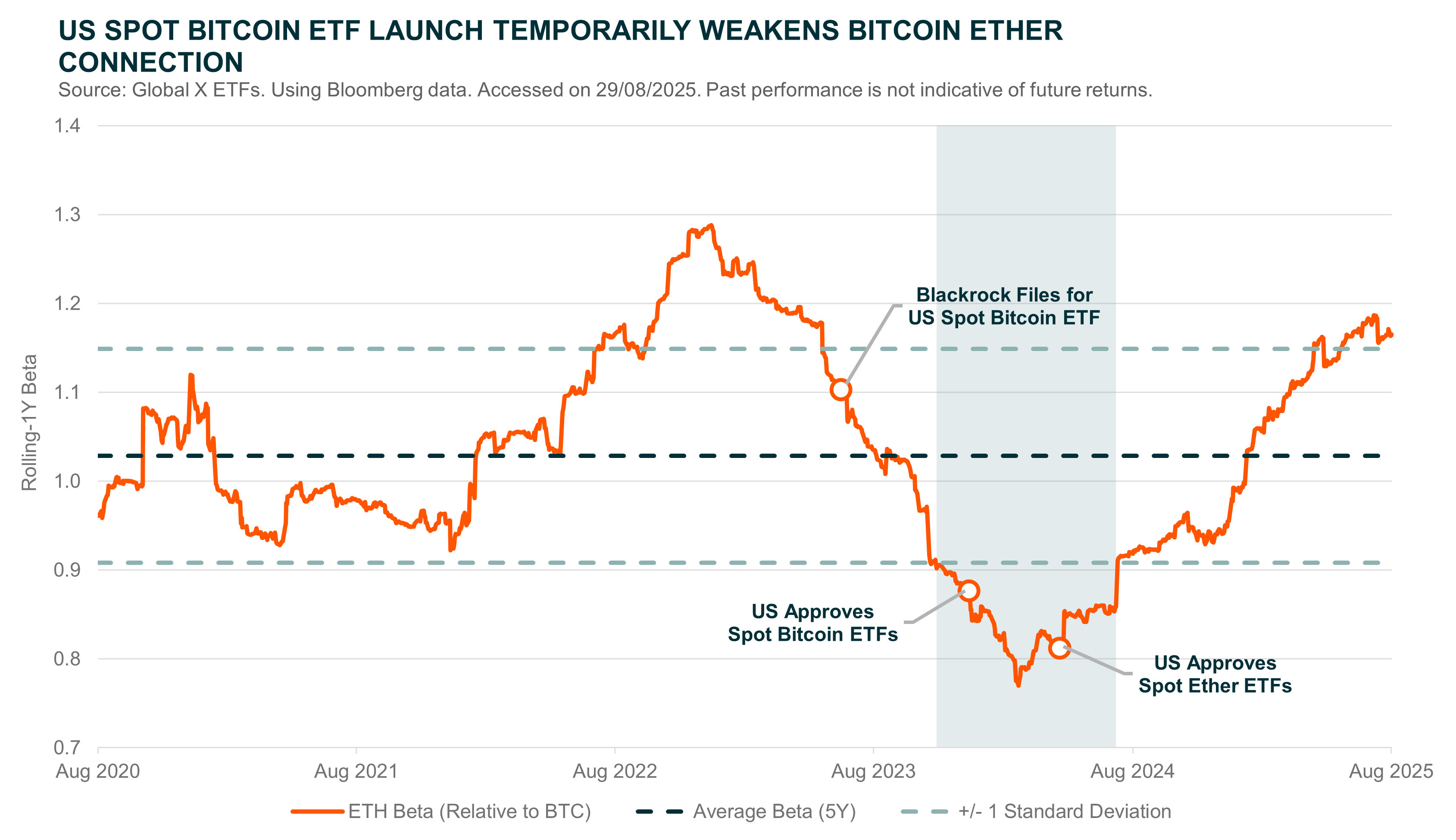

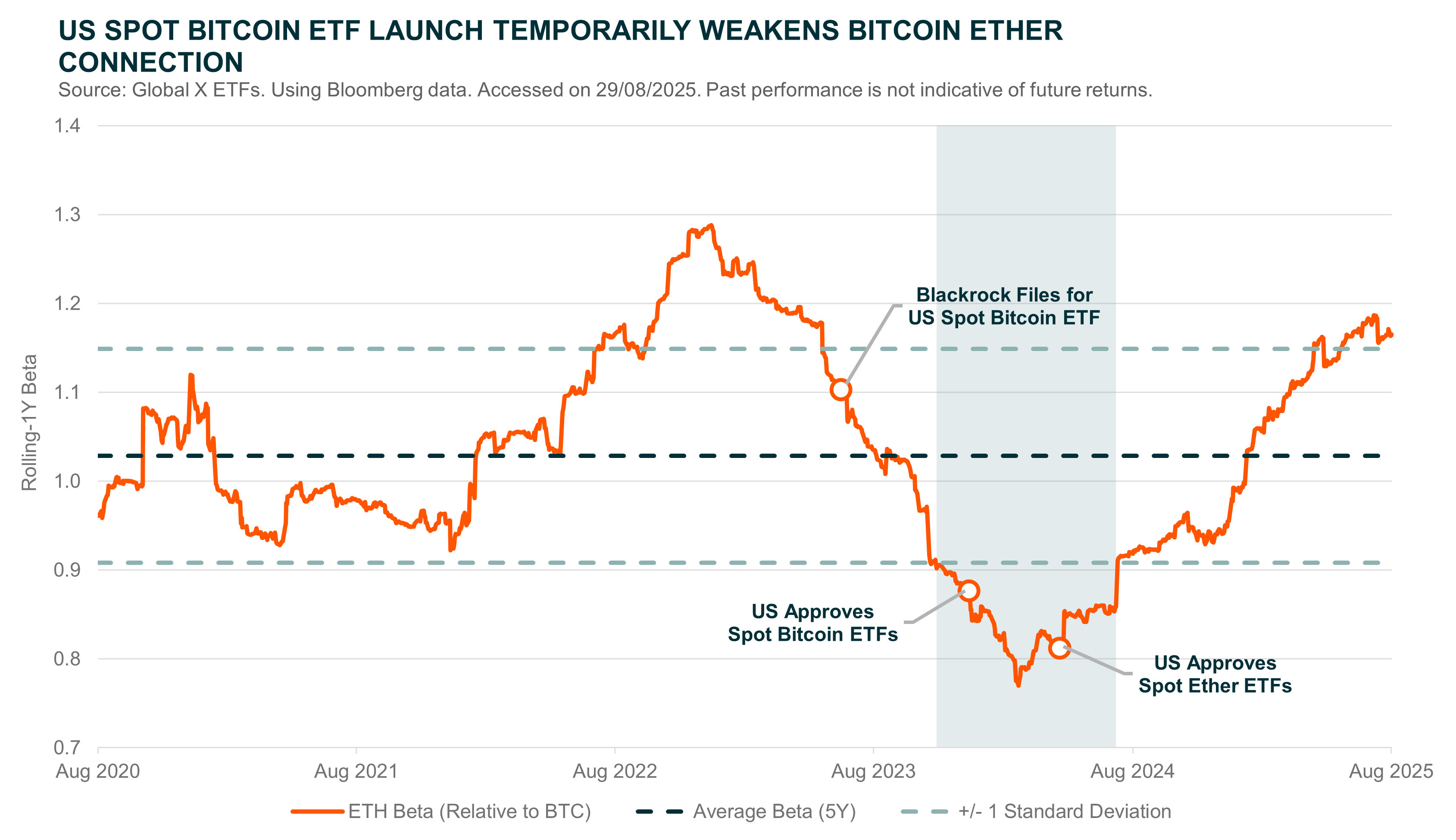

Ever since Ether established itself as a crypto heavyweight and the definitive blue chip alternate coin (altcoin) in the late teens, investors have come to expect the token to trade roughly in tandem with Bitcoin. Furthermore, given its smaller market cap and more “tech-like” profile, Ether has also been seen as a leveraged play on Bitcoin’s larger price swings.

Against that backdrop, Ether’s underperformance over the past two years has come as a surprise to many in the crypto space. While Bitcoin has pushed to new highs, Ether has struggled to revisit its 2021 peak, leaving enthusiasts puzzled.

Why the change?

From our perspective, the clearest differentiator between the current crypto bull cycle and those that came before appears to be the arrival of US-listed spot crypto ETFs.i The development of these new investment vehicles has been a powerful democratising force for the asset class, unlocking billions in new capital and broadening investor access. Bitcoin ETFs, in particular, have seen dramatic uptake with net inflows exceeding US$50 billion since its inception in January 2024.1

But then again, these developments should be positive for the entire crypto space – not just Bitcoin. Afterall, both assets received spot ETF approvals, so why has this new gateway of capital tilted the balance so decisively toward Bitcoin?

We believe there are two main factors help explain the spread in performances and change in relationship: market timing and simplicity.

Does Timing the Market Matter?

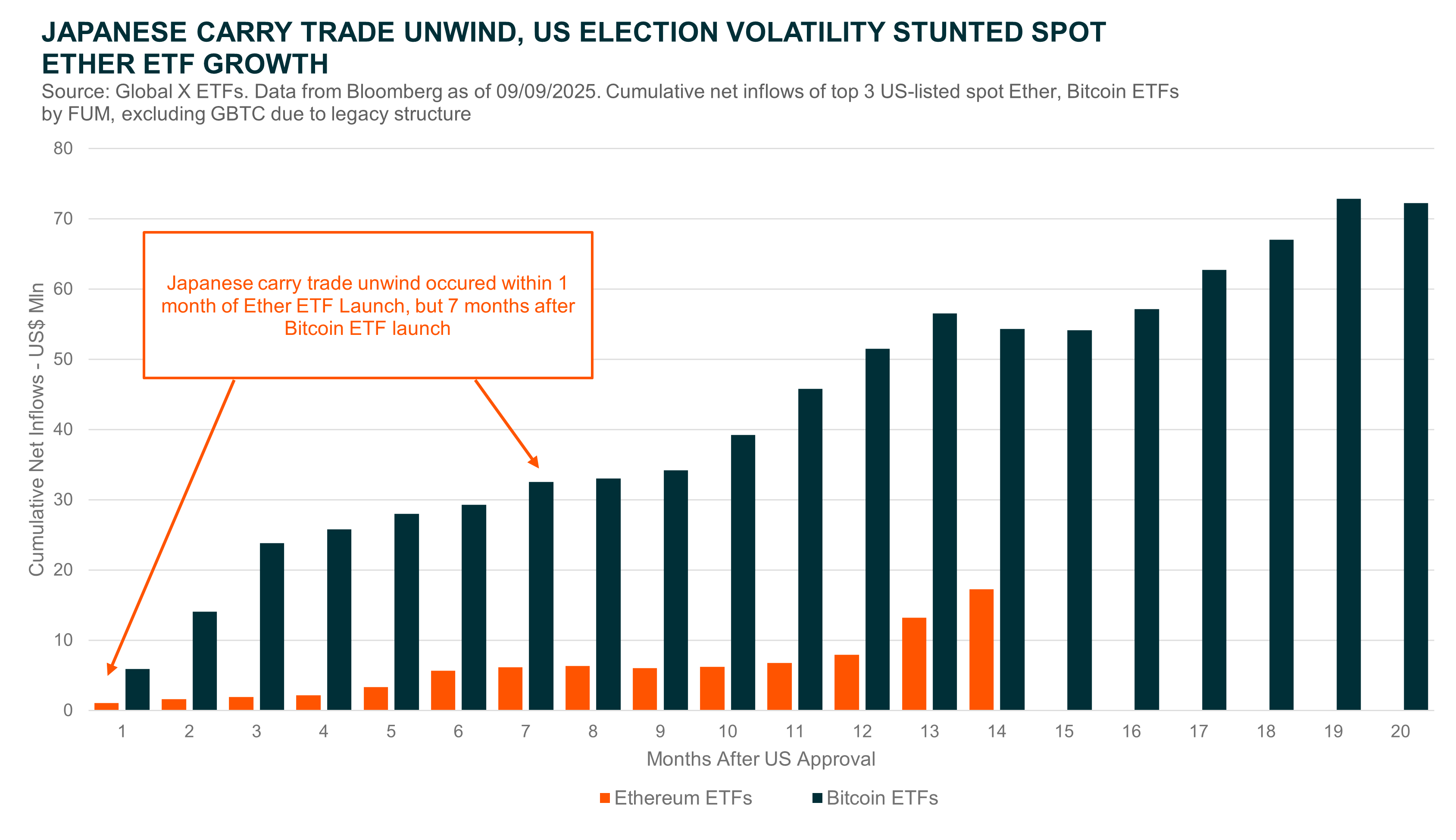

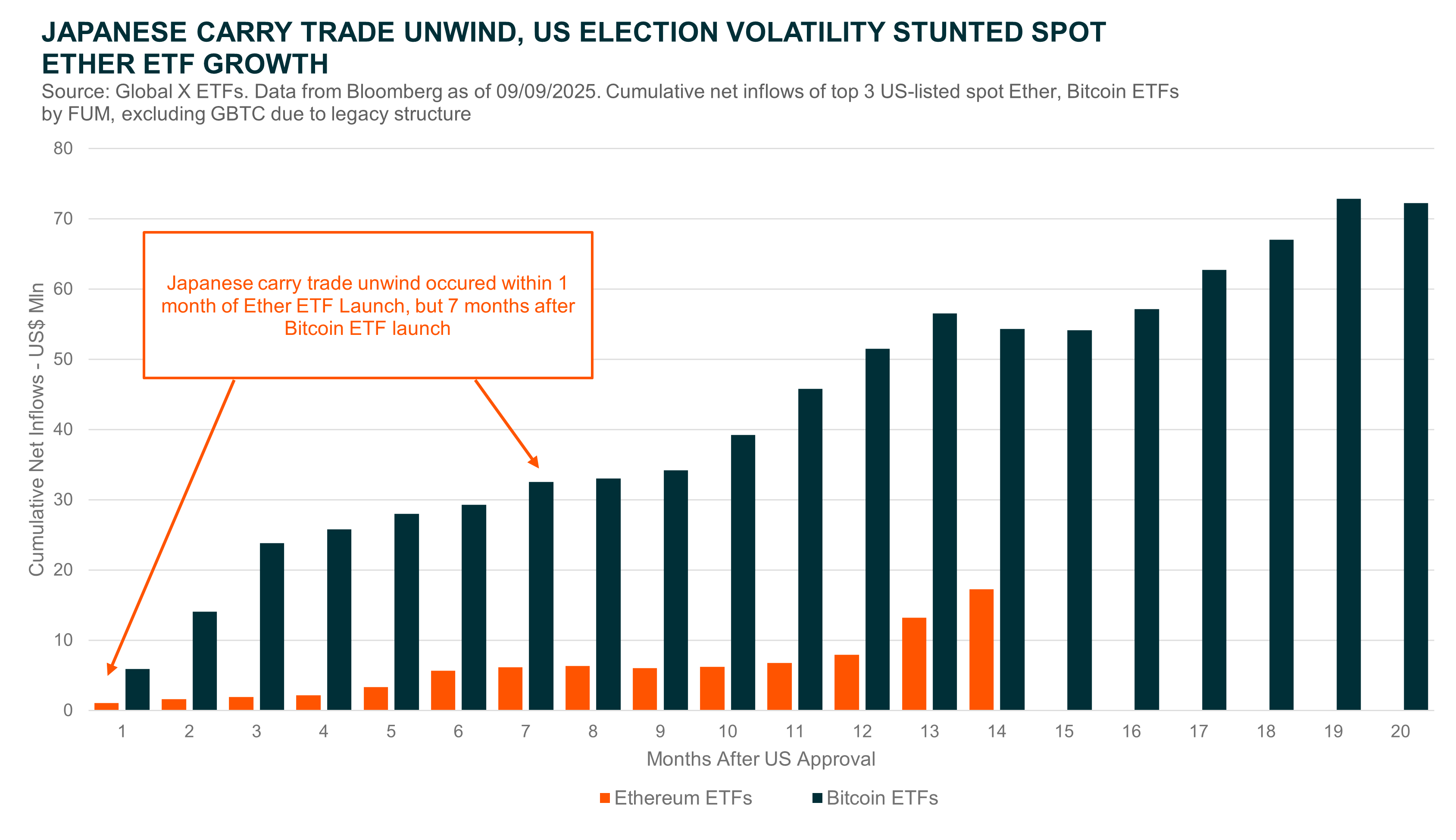

The first, market timing, is easy to spot and intuitive to understand. When spot Bitcoin ETFs were first launched in the US, the market was undoubtedly bullish with investors carrying momentum from a strong 2023 off the back of AI-driven enthusiasm. Risk-on investors were happy to jump on the Bitcoin wagons with the new “halving-cycle” technically approaching.ii Ether’s spot ETF debut, by contrast, came in late July, just a week before the unwinding of the Japanese carry-trade. That shock set off a period of heightened volatility in the lead-up to a pivotal US election, creating a far less favourable backdrop for new risk assets.

Unlike in past market cycles, when Bitcoin and Ether often moved in lockstep, this time the paths of the two assets diverged. Bitcoin ETFs had already established themselves as a major force, building a new investor base that cushioned the asset during the downturn and provided a platform for recovery. Ether ETFs, on the other hand, entered the selloff without that same foundation. With little time to build scale, Ether had neither the parachute to soften the fall, nor the expanded investor base needed to reignite momentum – effectively lowering its beta to Bitcoin.

As the new year unfolded, this difference became even more pronounced. Bitcoin’s traction snowballed, drawing in new flows and reinforcing its resilience, while Ether struggled to keep pace. The result was a widening gap in performance that underscored just how much the depth of an asset’s investor base (in this case enabled by ETFs) can shape outcomes in a maturing crypto market.

Simple Is Easy, Simple is Good

With new and emerging asset classes like cryptocurrencies, being “simple to understand” can be an understated but powerful advantage. Bitcoin’s story is intuitive, the idea of “digital gold” is easy to grasp, and after a decade of repetition, it has slowly become accepted.

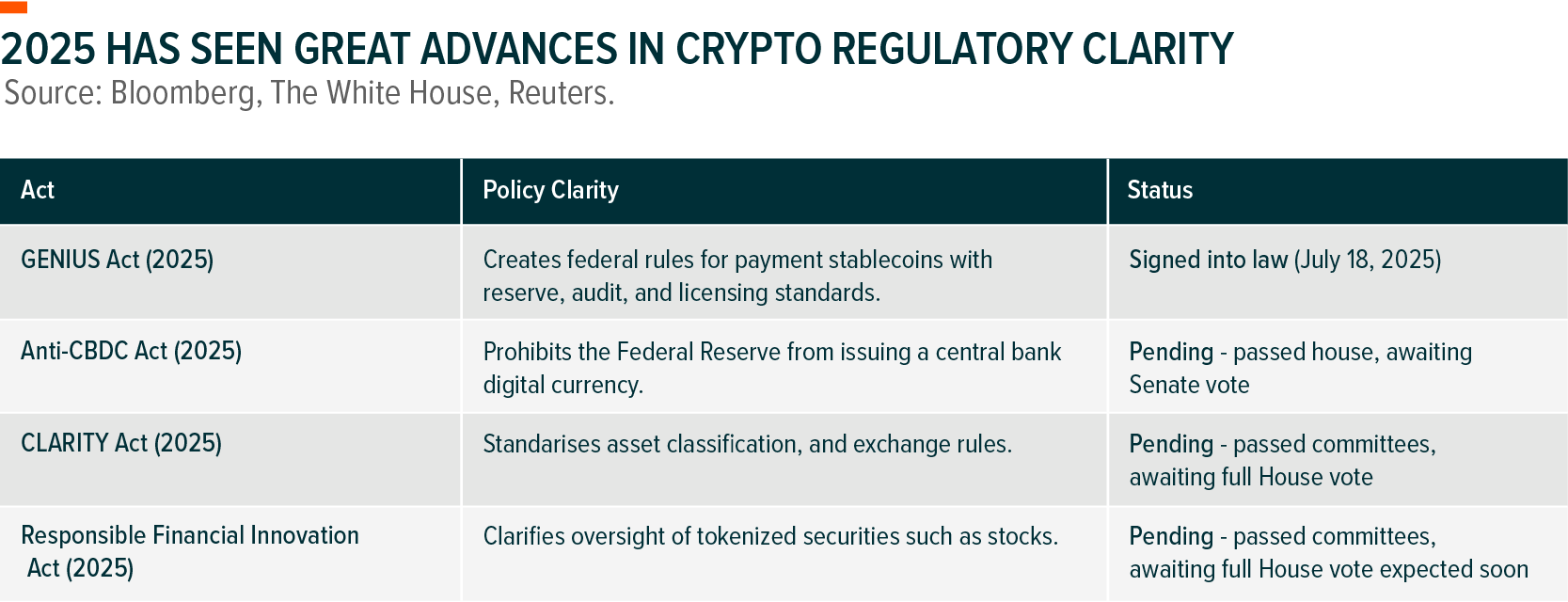

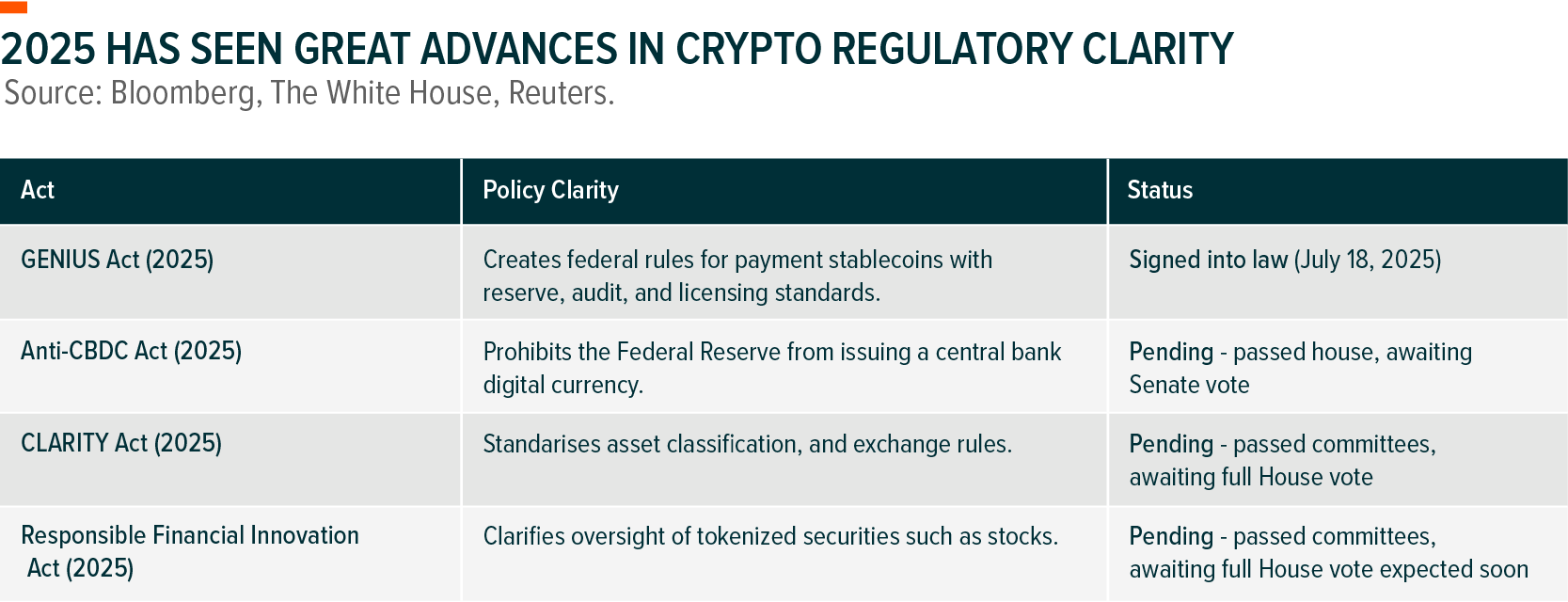

Ethereum, by contrast, is far more complex. It’s pitched as a “programmable smart chain” that enables DeFi, allows staking, incorporates deflationary tokenomics, and runs on a proof-of-stake system. While these features give it immense potential, they also make Ethereum harder to explain and more challenging for regulators to design clear policies around. For ETF issuers and financial advisers alike, that complexity has been a barrier to wider adoption.

In 2025, however, the landscape has shifted. The US recently passed the landmark GENIUS Act, delivering long-awaited regulatory clarity for stablecoins – a cornerstone of the broader crypto ecosystem – with several other crypto-related bills enjoying strong bipartisan momentum. At the same time, high-profile IPOs such as Circle and Bullish have strengthened confidence in the non-Bitcoin space.2 As a result, demand for spot US Ethereum ETFs has surged, with inflows now exceeding US$13 billion.3

All told, with a new crypto bull market emerging and the same investment infrastructure that propelled Bitcoin now in place, Ethereum is poised to finally close the gap.

Conclusion: Set Up for Catch Up

Ethereum’s story right now is less about what it lacks compared to Bitcoin and more about the foundations it has finally secured. With clear regulatory momentum, surging institutional inflows, and a maturing ecosystem of applications that give ETH real utility, the conditions are in place for it to narrow the gap. Markets have shown that once a framework and access points exist, capital follows quickly. That same infrastructure is now in Ethereum’s corner, positioning it not as a perpetual “number two,” but as the asset most likely to close the distance.