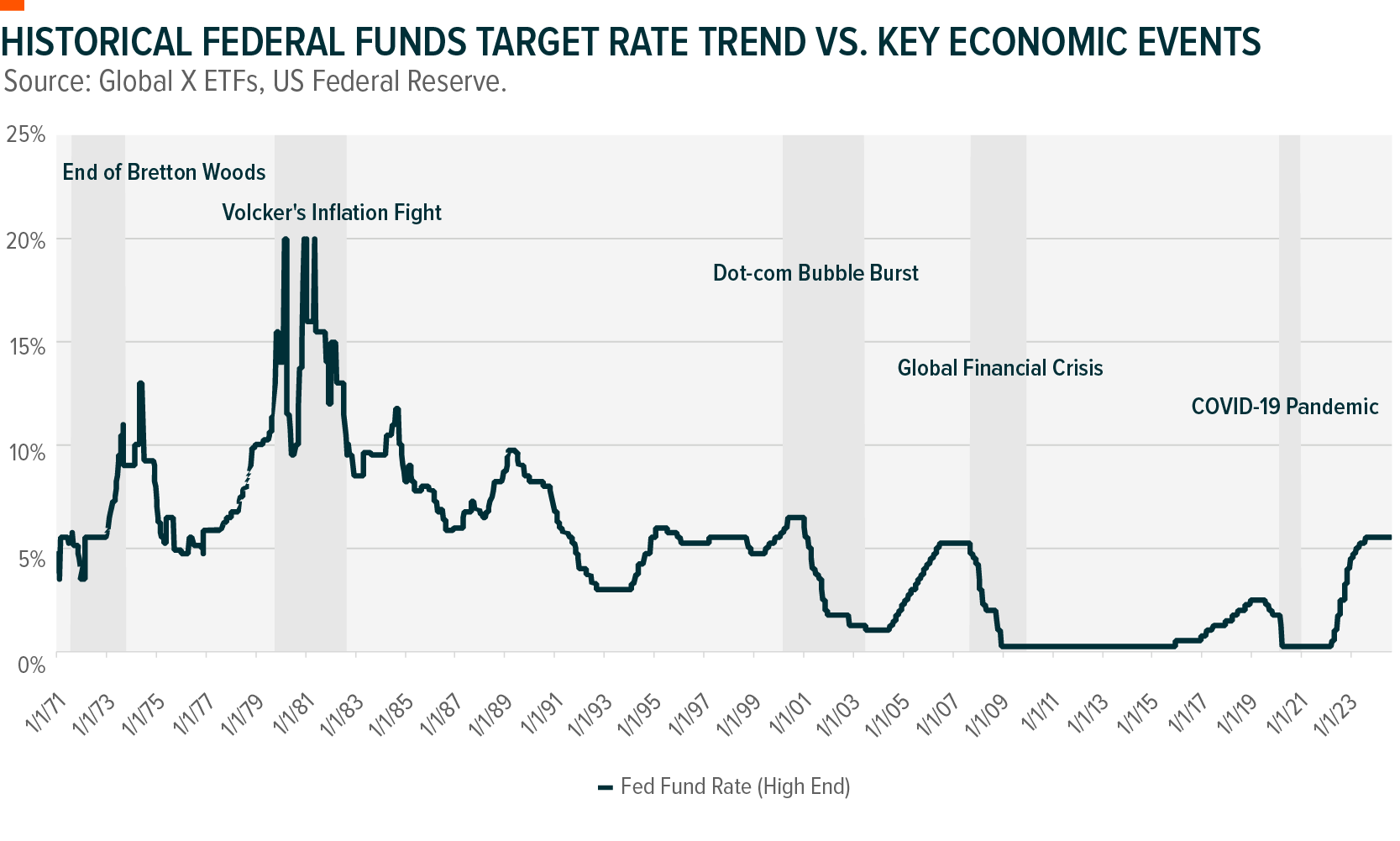

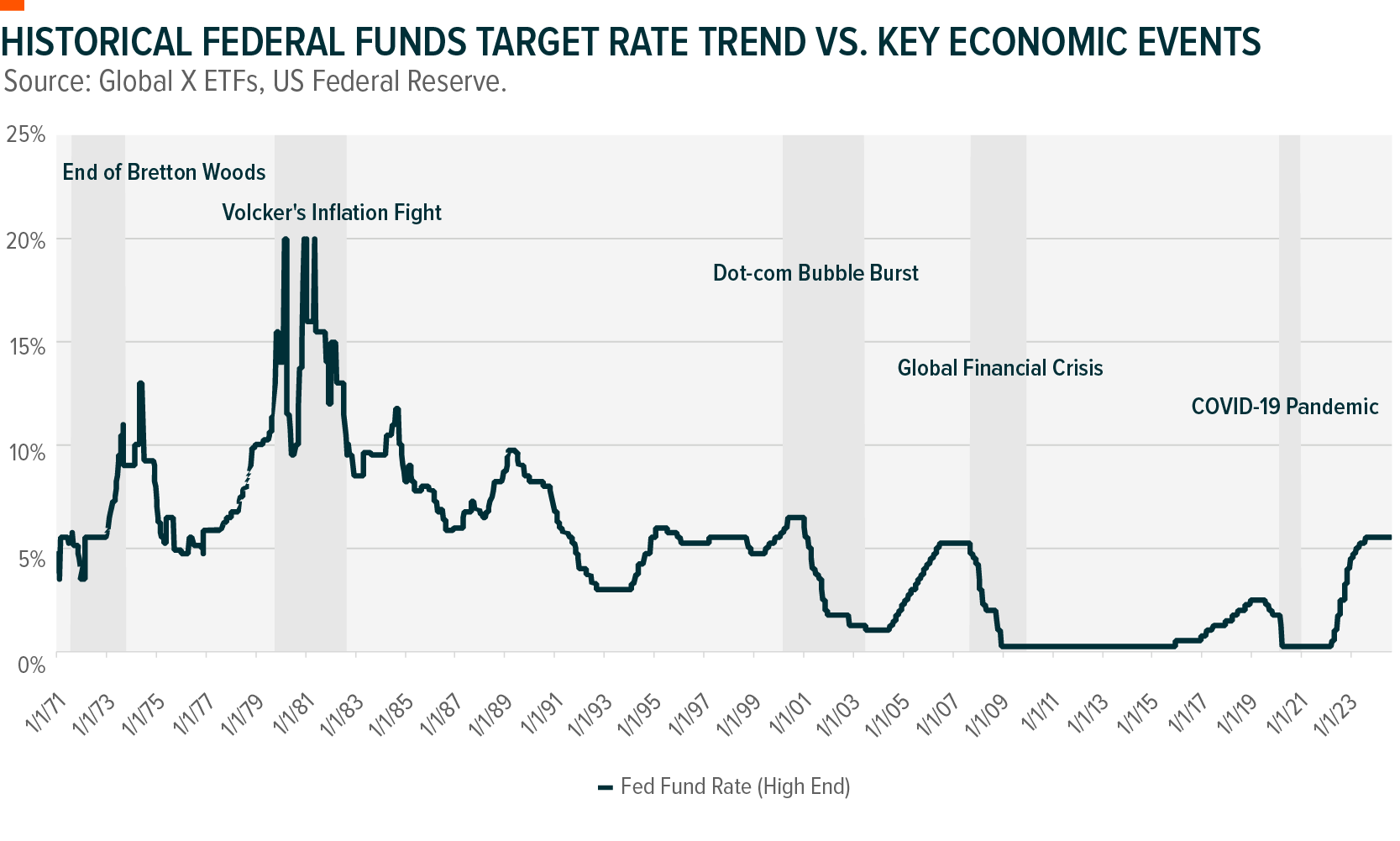

As the Federal Reserve gears up for a likely interest rate cut, investors are keenly observing the potential ripple effects across financial markets. Historically, such monetary policy shifts have not only influenced the direction of equities but have also created distinct opportunities and challenges across different sectors. In this report we explore the anticipated outcomes for equities, fixed income, and commodities, offering insights into how investors can strategically position themselves to navigate the evolving landscape.

Key Takeaways

- Equities: Quality growth and diversified market cap exposure are likely to lead during interest rate cuts.

- Fixed Income: Treasuries and Investment Grade Bonds provide stability and potential gains, while credit risk plays a crucial role for high-yield bonds.

- Commodities: Precious metals like gold may benefit from rate cuts alone, but industrials require more concrete economic return to growth.

Equities: Navigating Market Volatility and Opportunities

With equities often exhibiting notable volatility around the onset of rate cuts, understanding historical trends and sector-specific reactions is crucial. In this analysis, we explore, not just sectors, but which segments are likely to outperform or underperform and examine the potential impact of varying economic scenarios—whether the economy experiences a soft or hard landing.

Historical Trends: Mixed Outcomes in Equity Performance

Historical data shows that the market's reaction to interest rate cuts is shaped by broader economic conditions. For instance, rate cuts following the 1973 oil crisis and the late 1980s helped the S&P 500 rebound, driven by investor optimism. In contrast, during severe downturns like the early 2000s dot-com bubble burst and the 2008 financial crisis, the S&P 500 declined despite rate cuts, as economic weaknesses outweighed the benefits of lower rates.

When rate cuts support ongoing economic expansion, as seen in the mid-1990s, markets generally respond more positively. Timing is crucial—rate cuts made before significant economic deterioration tend to be more effective, while those during crises often result in more cautious market reactions.

Currently, no catastrophic risks are evident. The implied rate cut trajectory suggests a more gradual approach, akin to the 1989 cycle, contrasting with the aggressive cuts of recent years. This indicates a more controlled and stable economic environment.

While interest rate cuts are a powerful tool for economic stimulus, their effectiveness in boosting equity markets depends significantly on the timing and the specific economic challenges being addressed. Historical evidence suggests that periods of rate cuts are often associated with slower growth and declining inflation, which can favour companies with quality growth and strong pricing power. Today’s situation appears more stable compared to past crises, with the current rate cut trajectory reflecting a more deliberate and gradual adjustment process rather than an urgent response to economic distress.

Sector Strengths During Rate Cuts: Quality and Non-Discretionary Lead

Interest rate cuts are typically accompanied by slower growth and declining inflation, creating an environment that favours companies with quality growth and strong pricing power. While the current cycle suggests a positive outlook for equities, historical performance has been mixed, highlighting the importance of diversification and a focus on thematic investments rather than broad market exposure.

Our sector and style analysis reveals that consumer staples and healthcare consistently outperformed the S&P 500 during the last five rate cut cycles. This can be attributed to their essential nature—these sectors provide goods and services that remain in demand regardless of economic conditions, making them less sensitive to economic downturns.

Interestingly, the technology sector’s overall performance matched the index, though this was skewed by the dot-com bubble. Excluding that period, technology would have outperformed the index by an average of 2% during rate cut periods, suggesting that its inherent innovation and growth potential drive long-term strength, even during economic slowdowns.

Strategic Allocation: Leveraging Growth and Broadening Market Leadership

Historical data suggests that during interest rate cut cycles, growth and quality stocks tend to deliver stronger returns as investors prioritise companies with robust fundamentals and pricing power. Additionally, broader market indices such as the S&P 500 Weighted and S&P 500 Small Cap have shown relative outperformance during these periods, reinforcing the view that market breadth typically increases when interest rates are reduced. This broadening of market leadership creates opportunities across a wider range of equities.

In our analysis, we focused on identifying funds that align with the Quality Growth and Broadening Trade themes, using metrics such as EPS growth and return on equity (ROE) for quality growth, and PEG ratio combined with weighted market cap for the broadening trade. Notably, the Global X Cybersecurity ETF (ASX: BUGG) consistently appears in the favourable quadrant across both analyses, highlighting its strong positioning in a favourable growth and quality environment. Other funds worth noting include the Global X Artificial Intelligence ETF (ASX: GXAI) and the Global X Semiconductor ETF (ASX: SEMI), both of which exhibit high-quality growth traits.

Fixed Income: Positioning for Yield in a Changing Rate Environment

Signs of a US economic slowdown have led to calls for a dovish shift by the Federal Reserve (the Fed), signalling that investors may want to consider adding fixed income exposure for a potential rate-cutting scenario.

Given their inverse relationship, existing fixed-rate bonds prices normally rise when interest rates fall. However, it's not a guaranteed outcome that rate cuts will lead to bond price appreciation, as this largely depends on the economic cycle and market expectations for future interest rates. Historically, Fed rate-cutting cycles have come deep and fast to overcome recessionary conditions, but this time could see a slower easing process if a softer landing is achieved. The below table shows historical US fixed income returns during the prior five Fed easing cycles.

US Treasury bonds (aka Treasuries) could be an attractive option in a rate-cutting environment, as they can provide capital appreciation, particularly for investors seeking stability and liquidity in uncertain economic times. Over the most recent interest rate cutting cycles (see table above), they have always resulted in a positive return for investors, unlike corporate bonds. Fears of an economic recession may also see a demand for safe-haven assets like US Treasuries. Investors wanting exposure to this asset may want to consider being in the “belly” of the US bond curve (i.e. the middle of the curve structure) if interest rate declines primarily occur at the front end of the curve, rather than the long end which may have less scope to fall.

Investment Grade Bonds: Higher Quality and Potential Returns

US investment-grade (IG) bonds may also benefit from declining yields as their interest rate duration profile is longer than US treasuries (~8 years vs ~6 years respectively) providing a greater sensitivity to interest rate movements. IG bonds’ performance is also influenced by credit spreads - the difference in yield between corporate bonds and treasury bonds. Rate cuts may compress these spreads, particularly if the economic outlook stabilises, as investors seek higher returns in a low-rate environment. However, if economic conditions deteriorate, credit spreads could widen, reflecting increased potential default risk, which could offset some of the gains from falling yields. Even though there was a slight tick-up in US corporate bankruptcies in the second quarter of 2024, high-quality US businesses have deleveraged since the COVID-19 pandemic and have historically lower debt levels and better balance sheets, with default rates still low.1

High-Yield Bonds: Balancing Risks and Opportunities

US high-yield (HY) bonds are rated below investment grade and tend to follow broader credit markets, economic trends, and company-specific factors rather than Treasuries, making them less sensitive to interest rate changes. This characteristic can offer diversification benefits in a bond portfolio. Fed rate cuts might also benefit HY issuers by improving liquidity and easing debt burdens. While these cuts generally lead to lower yields, the higher risk of these bonds means that credit spreads play a key role. In a soft landing, rate cuts could trigger a rally as spreads tighten and demand for high-yield assets grows. However, in a hard landing, credit spreads may widen significantly due to rising default risks, potentially leading to HY bond price declines. Once HY spreads reach a “ceiling” it could provide an attractive entry for investors point given their cheaper valuations. Historically, it has proven accretive to be underweight risk going into a recession and overweight coming out, as HY bonds tend to outperform 12 months after negative GDP results.

If US interest rates fall, Australian fixed-income securities could become more attractive to global investors due to their higher relative yields. As yields decline, the steady income from bonds becomes more valuable, especially in a low-rate environment. Since Australia may lag the US in its rate-cutting cycle, global investors seeking extra carry might find Australian bonds appealing, potentially driving up demand. Investors may want to consider being exposed to high-quality Australian banks across the broad capital structure such as senior, subordinated and hybrid securities.

Commodities: Strategic Allocation in a Shifting Rate Environment

Commodities, particularly precious metals, have historically been highly sensitive to US interest rate changes. As with equities and fixed income, understanding how commodities may react to shifts in the economic environment is crucial for investors. In this section, we examine key trends that have guided investors in previous rate cut cycles and assess whether these patterns remain reliable or are beginning to diverge. We also explore the two potential scenarios the Fed could be addressing in September: a soft landing with low inflation and growth, or a hard landing driven by significant labour market weakness.

Gold’s Relationship with Real Yields: Breaking Up… Or Taking a Break?

Gold is a natural focus for investors when considering the prospect of interest rate cuts in the US. The precious metal’s inverse correlation with US interest rates is a well-established investment thesis, clearly demonstrated when comparing the price of gold to US real rates. The logic is straightforward: as a safe-haven asset and store of value, gold does not generate income. Therefore, as risk-free rates rise, the opportunity cost of holding non-yielding gold increases, typically leading to lower prices in higher rate environments.

However, while this thesis has held true for the past 20 years, gold has reached multiple new all-time highs over the past two years, even as real rates have consistently risen. Does this mean the relationship has broken down? We don’t think so.

Though rare, gold has shown a positive correlation with US interest rates at certain points in history. A recent example is the COVID-19 pandemic when both real yields and gold prices collapsed in early 2020. For a more comparable timeframe, we can look to two other periods: Fed Chair Volcker’s fight against inflation in the late 1970s to early 1980s, and the three-year lead-up to the Global Financial Crisis (GFC).

In both instances above, gold showed considerable positive correlation with interest rate expectations for extended periods of time, before regressing to its usual negative relationship (marked by the dotted line). More importantly, studying these particular instances reveals surprising similarities to our current market environment.

Volcker’s fight in the 80s was characterised by sky-high inflation rates, a US recession, and heated geopolitical tensions. The years leading up to the GFC also saw geopolitical conflict, an energy crisis driving inflation, and the emergence of the Subprime Mortgage Crisis. Today, we observe an eerily similar combination of the above catalysts. Since 2022, we’ve experienced inflation at its highest in 40 years, Russia invading Ukraine, the Chinese economic engine spluttering, and multiple escalations of the Middle Eastern conflict. All these catalysts have acted as demand drivers of gold, allowing it to perform despite the historic rate hike cycle. However, as we’ve seen in our examples, these factors will eventually cool, and the historical negative correlation between gold and real yields could return to provide a positive tailwind over the upcoming rate-cut cycle.

With our trust in the gold/interest rate relationship hopefully restored – just what is the actual price implication of changes in real rates on the gold price? A simple regression of gold price and real rates over the low interest era (post-2000, excluding 2022-24), reveals that gold appreciates approximately US$400 for every 1% fall in real yields. Applying this logic to implied real yields over the next 15 months reveals a rudimentary price target of ~US$2885 by December 2025.

Looking around the money management industry, JP Morgan, Morgan Stanley, Citibank and Goldman Sachs, on average expect that gold will hit US$2760 by the end of 2025. In general, this collated average appears more reasonable than the near US$2900 figure our analysis has arrived at. Our simulation assumes that the current environment remains unchanged and only real rates are adjusted. The current environment being that of a weakening labour market, languishing Chinese economy, rising defaults in the US, and an equities market begging for rate cuts from the Federal Reserve. This will likely not be the case as we head into 2025. Analysts have continually cut the odds of recession over the past few months, with the Bloomberg United States Recession Probability Forecast index now showing just a 30% chance as of August 2024.

Thus, in the context of the two possible scenarios within which the fed could cut rates: a soft-landing vs hard landing, our basic price target appears to account for the latter, where a US recession powers gold demand. In the more likely scenario of a soft-landing, it is likely that gold will not perform as real rates imply, but nonetheless benefit from an overall decline in opportunity cost.

*Orange: Negative catalyst. Teal: Positive catalyst.

There’s Always a Silver Lining

Silver is a special case in commodities investing, it is both economically reliant (more than 50% of its demand is industrial) and a precious metal/diversifier.2 And exactly as you would expect, silver has had slightly higher correlation with both US and Australian equities as well as US treasuries than gold over the past 20 years.

In other words, silver can be considered a high beta variant of gold, providing ample diversification with near-zero correlation to traditional assets, while also capturing some economic expansion. So how have silver’s unique qualities translated into performance in the face of rate cuts?

In the table below, we analyse silver’s performance during unambiguous rate cut cycles since the 1990s (silver saw wild volatility swings in the 80s have been excluded due to wild volatility swings caused in part by the Hunt Brothers episode and low liquidity).

Silver shows low correlation with US equities and offers downside protection during downturns. The timing of rate cuts has been crucial; silver saw moderate gains when cuts supported expansion, but weaker performance followed cuts made after economic deterioration. Silver has outperformed immediately after rate-cut cycles, especially post-major downturns like the dot-com bubble, GFC, and pandemic. Interestingly, the gold-silver ratio consistently compresses during recovery phases, regardless of relative valuation, indicating potential for enhanced performance and diversification.

*Orange: Negative catalyst. Teal: Positive catalyst.

Dr. Copper: Soft Landing for the Flying Doctor

Copper is considered by many to be the pulse of the economy, an indicator of good times and bad times marked by the expansion/contraction of manufacturing and industrial demand. With that in mind, the prospect of a soft-landing appears particularly attractive for copper investors. Below is a familiar table of copper’s historical performance before, during, and after rate-cut cycles – but this time compared to global equities. As one would expect, the two assets generally demonstrate similar performance, showcasing copper’s high degree of leverage to the global economy.

Silver and copper share similarities in performance due to their industrial uses. While silver benefits from safe-haven demand, copper tends to trade flat during constructive rate cuts that avoid recessions. However, global crashes like 2008 and 2020 had more severe impacts on copper. Given the lack of catastrophic risks currently, copper is likely to trade within a range until the economy stabilizes, at which point it could see significant gains.

A key factor to consider is the divergence in economic performance between the US and China over the past two years. This rare occurrence, driven by China’s weak recovery from COVID-19 lockdowns, deglobalisation, and a renewed focus on national security, poses a challenge for copper. As the largest consumer of copper, China’s economic slowdown is expected to weigh on copper prices in the near term.

Nonetheless, there is reason to believe that copper will benefit more than the Chinese economy might suggest over the coming rate cycle. For one, Chinese domestic demand, which had been stunted by copper’s speculative rally in May, looks to be returning over the summer season. This is most evident through observing the SHFE stockpile of copper.

Copper demand in China usually dips from January to March due to the lunar new year, with stockpiles typically falling in April and May as consumption normalises. However, in 2024, stockpiles remained high, reflecting weak consumer demand and a deteriorating economic outlook. A US rate cut, weakening the USD and reducing RMB prices, could reignite Chinese purchases. Additionally, potential Chinese policy support might further boost copper demand, enhancing the soft-landing scenario. Copper miners, known for their leveraged response to price changes, could benefit from this upside.