Investors always have a lot to worry about, and the current environment is no different. Markets continuously climb walls of worry. One day interest rates are the concern, the next its upcoming elections, the day after perhaps economic growth. Assessing risks is central to sound investment, but be careful of inertia. Thinking from a long-term perspective can mitigate near-term volatility. Stay invested, and remember that even in turbulent markets, there are usually pockets of opportunity.

Optimism is usually rewarded, and the economic dynamism that is just taking hold is extraordinary. The steam engine, electricity, and the automobile fundamentally changed the economies of their time, forever altering the behaviour of businesses and consumers. I believe that the current automation and digitalisation revolution is analogous.

This time last year Inflection Points talked entry points and burning buildings, focusing on the difficulty of seizing opportunities in challenging times.1 Twelve months later, that sentiment seems relevant, and this article explores potential catalysts and themes that may be attractive in the coming year.

Key Takeaways

- Alongside mega-cap tech, growth equities broadly outperformed in 2023, driven by artificial intelligence, automation, connectivity, and consumer themes amid resilient consumption and corporate investment.

- Getting ahead of the Federal Reserve’s rate pivot by adding more conservative or established growth themes when valuations and sentiment seem soft may make sense for investors underweight equity.

- We identify four themes that can benefit from catalysts across the current macro, fundamental, and geopolitical backdrops simultaneously: AI & Automation, U.S. Infrastructure, Cybersecurity, and healthcare tied to Aging Population.

Growth Beyond the Mega-Cap Tech Stock Headline

Mega-cap technology stocks generated strong returns for investors year-to-date through mid-October. The NYSE FANG+ Index of 10 companies was up 60%. A closer look at the relative performance of major indexes, however, shows that size was not the only winning strategy.2 Equal weighted Nasdaq, where mega-tech firms are weighted the same as other constituents, outperformed the market cap weighted S&P 500 (see chart). Big companies delivered big returns, but growth also recovered after a challenging 2022.

Of the 30+ themes regularly followed in these pages, 10 beat the S&P 500 and 16 generated positive return (see chart). The high correlations across themes in 2021, when most boats rose, and 2022, when the tide went out, broke down in 2023 with greater dispersion of returns across themes. Markets were more discerning in identifying winners from losers with fundamentals like growth, profitability, and liquidity playing a bigger role. This stock, or theme, pickers market may persist until the Fed begins cutting rates.

The themes that performed best year-to-date will not come as a surprise. Among them, Artificial Intelligence, Robotics & AI, and Cloud Computing are expected to grow sales this year by 17%, 10%, and 29%, respectively. Forecasted sales growth for the broader S&P 500 is 4%.

Themes tied to the resilient consumer like Social Media, Metaverse, and Millennial Consumers also performed well after being shunned to start the year.3 These consumer-connected themes are forecast to deliver double-digit sales gains for 2023.

Energy transformation themes did not perform well. Despite a series of extreme climate events making headlines this summer, including 100-degree ocean temperatures in the Atlantic and a record-long heat wave in Arizona. The cost intensive nature of the energy transition combined with higher rates did not help. Materials cost also hurt demand as new projects were pushed out.4

Three Potential Catalysts Heading Into 2024

A number of factors could drive returns across the thematic investing landscape in the year ahead. This analysis focuses on three broad categories: the macro backdrop, corporate fundamentals, and geopolitical landscape.

Emerging Clarity in a Muddled Macro

Consensus’ 2023 estimates for the U.S. economy missed the mark. The actual results were in line with our expectations to start the year: Economic growth accelerated, consumers continued to spend, inflation dropped, and interest rates remained high. Quarterly GDP estimates ranged from -0.1% to 0.8% at the start of 2023, whereas actual growth over three quarters was 1.7%, 2.4%, and 4.9%.5

Heading into 2024, it feels like back to the future. Forecasters remain pessimistic, simply pushing out the timing of an economic slowdown (see chart). We expect the economy to slow from its current blistering rate, but expect a gradual normalisation rather than a precipitous drop in 2024.

The 3Ls critical to economic stability, labour, leverage, and liquidity, remain reasonably strong. The labour market pulled back ever so slightly with unemployment at 3.9%. Surprising strength in jobs data fuelled the belief that the Fed must keep rates higher for longer to cool demand. The impact of higher rates on households thus far has been moderate. Obligations, or debt payments to income, remain near record lows and well below pre-pandemic levels, as many homeowners took advantage of low fixed rate mortgages.6 While car and credit card payment rates increased, their size is modest relative to mortgages, making household obligations seemingly less sensitive to rate hikes.

Fed Chair Jerome Powell confidently stated that the U.S. economy was strong enough to handle higher rates during his speech to the Economic Club of New York on October 19, though he did note a range of potential risks.7 Powell’s comments suggest that investors should prepare for rates to remain near current levels for some time. Something to remember is that higher rates are not necessarily bad for stocks whose valuations are more sensitive to changes in rates than the level.

Powell also noted that the rapid 550-basis point (bp) increase in rates alongside Fed balance sheet reduction creates a sufficiently restrictive environment. The numbers tell a different story (see chart). Financial conditions have remained in expansionary territory through the entire hiking cycle and now are actually less restrictive than they were in March 2023. Looser conditions are usually supportive of equity valuations, but inflows to money market funds continue at a rapid rate amid oscillating market sentiment.

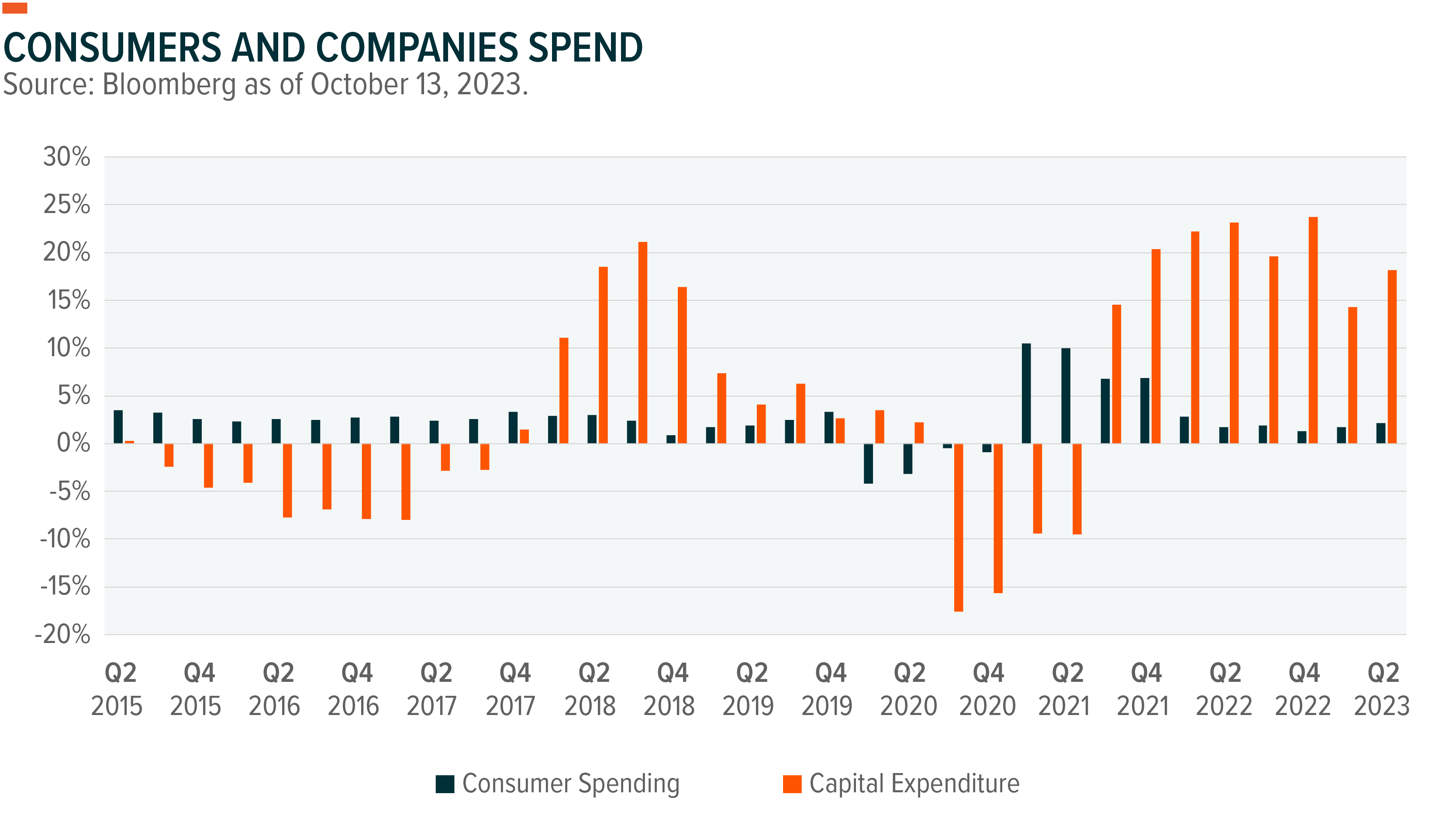

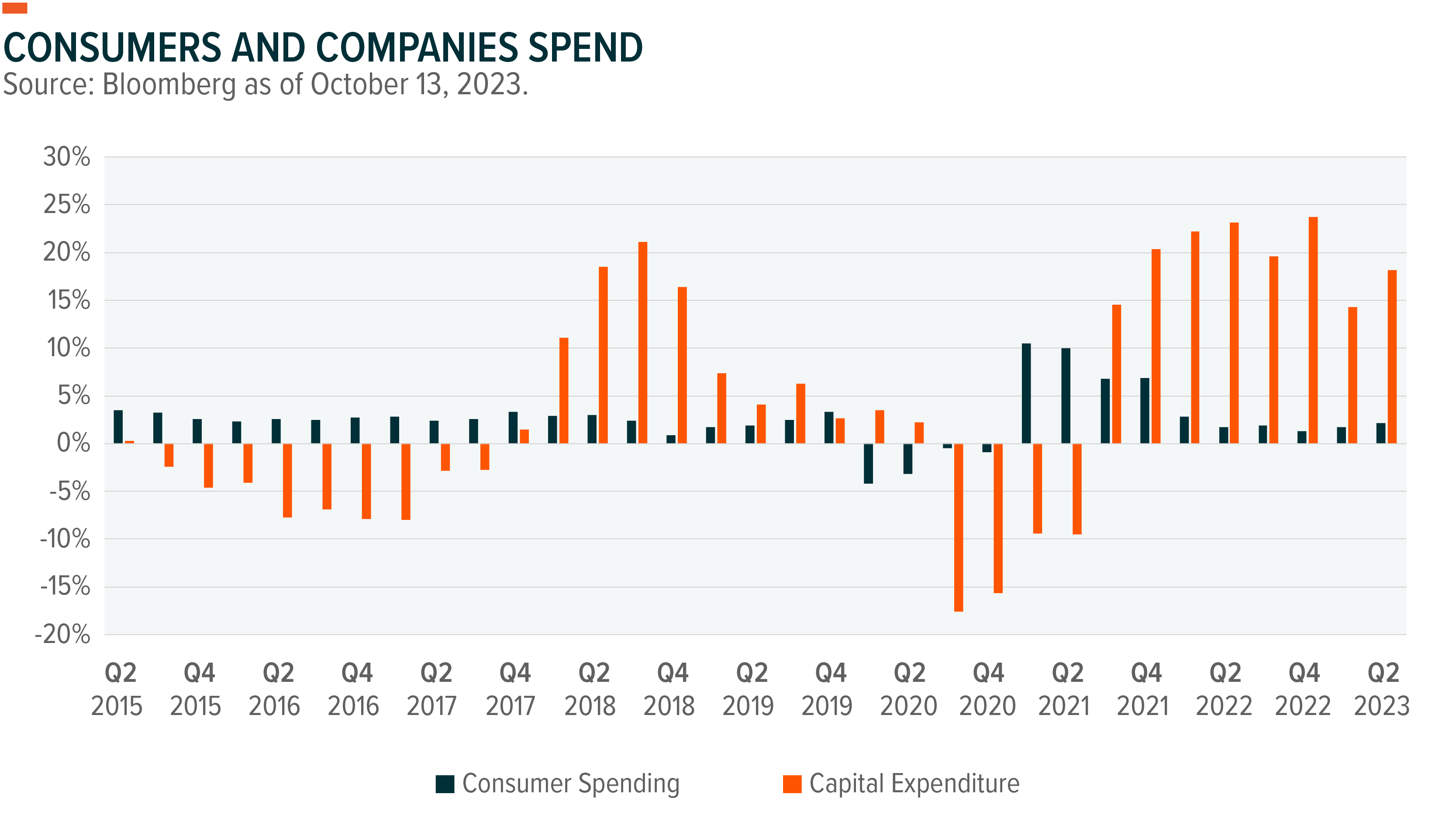

A combination of corporate investment and consumer spending over eight consecutive quarters is one reason for the continued strength in the U.S. economy. For much the decade prior to COVID, consumers drove the economy as companies pulled back investment. No longer.

Companies continue to spend, but the health of the consumer is a mounting concern. Bank deposits are down 4.6% from the April 2022 high, and savings rates are lower. The end of excess pandemic savings could translate to a slowdown in consumer spending, but there are questions about the dry powder available. The U.S. government recently revised down pre-pandemic savings rates, suggesting there could be as much as $1 trillion dollars in savings still left to fuel demand.8 While consumer confidence declined in recent months, the excess savings may help explain why readings have been in a tight range and above the 50-year average (see chart).

Strong Fundamentals Amid Structural Shifts

In a year where the S&P 500 is up 8%, beating bonds and money markets, and fundamentals are relatively strong, the negative sentiment is a little surprising. Currently, the AAII Bullish Sentiment indicators is below the long-term average. Reaction to positive earnings announcements were underwhelming in recent quarters.

The irony is that slowing economic growth is not necessarily bad for equity returns.

The current lack of enthusiasm for equities may present an opportunity. Valuations seem reasonable, and two plausible scenarios may help swing investor sentiment. The first is obviously tied to rates and the end of the hiking cycle. Second, companies continue to show strong fundamentals despite an unfavourable operating environment.

While the S&P 500 is up 8% and the Nasdaq 23%, valuations compressed from this year’s peak. The S&P 500 is at 19.0 times forward PE, compared to its long-term average of 18.6 times. The Nasdaq is at 23.5 times, compared to its historical average of 24.8 times. Equal weighted S&P 500 valuations seem even more reasonable at 15.7 times. Stocks are not necessarily cheap, but they are not expensive.8

Earnings improvement or multiple expansion spur equities, and often one can be more prominent than the other (see chart). Multiple expansion only recently supplanted earnings as the primary driver of performance. Near record-high earnings growth of 80%, twice the average, is largely responsible for the gains over the past three years.9

Meaningful multiple expansion has a history of following peaking rate cycles. When interest rates peaked in February 1995, the S&P 500 forward PE increased from 16.4 times to 20.8 times in 10 months.10 The S&P 500 multiple was 14.7 times when the Fed stopped hiking in 2006 and expanded to 16.5 times 7 months later. When rates hit a cycle top in December 2018, the S&P 500 increased from 15.6 times to 20.2 times a year later.

Investors may be nervous about positioning ahead of dropping rates, but multiples begin expanding after the hiking cycle is complete and before cuts begin. The shift in valuation can occur rapidly.

Continued corporate success and a normalisation of fundamentals in the new higher rate and inflation regime could also revive interest in equities. Ordinarily, earnings grow more rapidly than sales. This relationship flipped in recent quarters, reflecting a difficult operating environment of higher operating and financing costs (see chart). S&P 500 constituents still grew sales 6% with operating and profit margins slightly above the 10-year average.11 Strong economic growth and efficiency gains from capex investment in technology likely played a role.

If companies can show an ability to handle a slowing economy and higher rates by growing earnings faster than sales, the investment calculus for equities may turn positive.

Corporate investment is a critical part of recent economic growth alongside the consumer, with innovative practices probably helping to sustain margins at current levels. A big test of these new capabilities came in June 2021 when producer prices rose more than 18%, but consumer price increases peaked at half that rate. This differential was the largest in the history of the data, reflecting remarkable operating leverage as companies absorbed half the cost increase.12

Shifting incentive structure could be driving corporate investment (see chart). From 1997 through 2017, the benefits of increasing capex declined. A 1% increase in capex from 1997 to 2002 correlated with a 7% increase in profit margin.13 That number dropped to 3% in the following 15 years before almost tripling to a current level of 8%. Companies may be yielding real benefits from capital expenditure, and historically, economic slowdowns do not impact capex spending.

Many of the themes tied to this resurgent capital investment, including those tied to automation and digitalisation themes, are selling for relatively sensible, if not cheap, valuations. Using market cap as net present value, consensus cash flow estimates, and the weighted average cost of capital, we can calculate the market implied long-term growth rates.14 Long-term S&P 500 cash flow growth has averaged 7.7%.

Geopolitics and Headline News

Public policy and global affairs frequently induce periods of asset volatility, but market selloffs are usually short-lived.15 Geopolitics is often thought of as a risk factor, but it can also be a source of opportunities. Shocks or unexpected events likely have the greatest impact on the market and investor sentiment.

The post-World War II global order seems to be fraying at the edges. President George W. Bush’s “Axis of Evil” seemed a stretch in 2003, but may be resonant today as Iran, North Korea, and Russia work together.16 The Ukraine-Russia conflict continues in Europe, and Middle East tensions are rising after the Hamas terrorist operation and Israel’s response. Seemingly distinct, these conflicts share important interconnections that will be challenging to manage.

U.S.-China relations will likely remain critical in setting risk-on/risk-off sentiment. China’s sluggish economy and a U.S. slowdown might make cooperation more attractive in the coming months, but the long-term trajectory in bilateral relations is not on a positive path (see last month).17 Both countries are adopting policies focused on self-reliance, potentially creating a new set of opportunities and risks for investors.

U.S. politics is likely headline news as the 2024 election heats up. The presidential election may weigh on markets. The baseline assumption is a Trump-Biden rematch, but historically frontrunners this early do not wind up as nominees.18 Real policy solutions will likely be scant, but spilled ink and headlines may create opportunities around specific themes.

4 Themes Backed by Multiple Catalysts for ’24

Assets often only need one powerful catalyst, but we try to identify themes that can benefit from multiple catalysts simultaneously. Looking across the macro, fundamental, and geopolitical context, we highlight four themes. Generally, these themes are a little more mature and further up the adoption curve, and as a result may be considered defensive growth.

AI and Robotics & Automation Lead the Way Into the Future

The addressable market for AI services, including the full ecosystem of hardware, software, and data, is set to expand rapidly in the coming years. Demographic shifts alongside near-term global economic slowdown increases incentives for firms to invest in efficiency-enhancing technology.19 The working age populations in the United States, China, Europe, and Japan are shrinking relative to their total populations, meaning workers must become more productive. Companies facing labour inflation seem to be exploring ways to offset those costs through automation.

The strength of AI and automation themes in 2023 may well prove persistent as reality tries to live up to their hype in 2024. Valuation still seems attractive with the market pricing long-term expected cash flow expectations of just 4% (see chart above). The market for AI could grow by double digits and reach almost $1.6 trillion by 2028 (see chart).20 AI software and processing gets much of the attention possibly reaching $300 billion. The broader ecosystem includes segments like the cloud computing market, which could grow to $600 billion alongside Internet of Things forecasted at $280 billion.

AI as headline financial news is a trend that could accelerate as competition in AI heats up across industries and countries. Worldwide Google searches for AI were almost 15x times higher than queries on the S&P 500 and increased almost 4x over the past 12 months.21 In the United States, searches for AI even beat out those for Taylor Swift, the most searched celebrity, in 28 of the past 52 weeks.22 Companies are in on this trend as well. Second-quarter mentions of AI in S&P 500 earnings calls totalled 177, up from 117 in the first quarter and well above the 5-year average of 60.23

U.S. Infrastructure Builds New Foundations

Infrastructure-related spending bills translate to sales even in a slowing economy. The Infrastructure Investment and Jobs Act (IIJA) called for $1.2 trillion in spending over seven years. The CHIPS Act adds another $600 billion of public and private funds to construct new facilities over several years.24 Together, the government is set to spend approximately $300 billion a year, potentially translating to a 37% increase in revenue for infrastructure companies.25

Infrastructure remains reasonably priced despite outperforming the S&P 500 by 13% the past two years.26 The current forward multiple for those firms is 16.0 times, three times lower than the S&P 500, and seems attractive based on the implied long-term growth analysis above.27 Meanwhile, the first tranches of public funds are hitting income statements of companies tied to infrastructure.28 These funds could lead to upward revisions in top and bottom-line guidance. Since the infrastructure bill was passed in November 2021, sales have been revised up 18%, with earnings expectations increased by just 15% (see chart).

In the election cycle, both parties may look to claim victory on infrastructure spending, which was a priority for the Trump administration before President Biden came into office. Republicans are likely to claim that audacious spending was their idea while Democrats take credit for implementation. Both parties will likely outline hawkish policies on China, and infrastructure supporting U.S. competitiveness will likely be part of that discussion.29

Cybersecurity’s Relevancy Rises

The push to automate and digitalise should improve productivity, but also creates new risks and vulnerabilities. Company CFOs identified data and analytics and digital retail as the top business building priorities.30 Another survey found that 73% of C-suite executives identified AI as the top investing priority and concluded that management wants to digitise faster.31

Cybersecurity companies, which are not richly priced based on market implied free cash flow growth, seem to have adopted a balanced strategy of growth with margin improvement. The shift to software-as-service should lead to better earnings quality. Demand for cybersecurity services is increasing, but stock performance has been subject to boom-bust cycles. This trend may shift with companies emphasising profitability and consistency in 2022 and 2023.32 Profit margins and growth are now expected to exceed that of the S&P 500 (see chart).

Deterioration in U.S.-China relations along with persistent conflicts in Europe and the Middle East could trigger increased risk of cyber intrusions. The Office of the Director of National Intelligence recently published a report about the increased cyber risks from China, Iran, North Korea, and Russia.33 With norms still undefined, cyberspace will remain a contested theatre. The average organisation faces 1,258 cyberattacks per week, amounting to billions of attempted intrusions worldwide conducted by state and non-state actors.34

Healthcare Tied to Aging Population Breaks Through

The aging populations of the four largest economies in the world, the United States, Europe, China, and Japan, is not breaking news, but this is an economic reality. Historically, slowing growth and higher rates drive returns across the Healthcare sector.35 When growth is 1% or below and interest rates above 2.8% (long-term average), the S&P 500 Healthcare sector outperforms the S&P 500 by 6% a quarter on average. Macro conditions might be aligning to support the sector.

Favourable macro tailwinds would be welcome to investors in the space after a difficult year. The broader S&P Healthcare sector was down 10%, and the companies most closely linked to aging populations contracted 13% from the 2023 peak.36 This underperformance creates a potentially attractive entry point given multiple contraction of 3 times and market implied cash flow growth at just 1%. Meanwhile, fundamentals remain strong with sales growth of 15% and operating margins at 19%.37

Among the most followed healthcare stories of 2023 is the breakthrough of weight loss drugs like Ozempic, tied to preventative medicine. News coverage on Ozempic increased 10-fold.38 While weight loss received the most attention, this may be shifting the dialogue on preventative medicine. The election cycle may also be kinder to healthcare, which currently seems like a relatively low priority for 2024 candidates.