Growth at a Reasonable Price (GARP) is an investment strategy that blends the strengths of growth and value investing in a disciplined, rules-based way, and one that has resonated strongly with Australian investors. The Global X S&P World ex Australia GARP ETF (GARP) has already demonstrated how this approach can deliver attractive returns (compared to the broad market and other factors) by targeting high-quality global companies with strong growth characteristics trading at reasonable valuations.

Now, with the launch of the Global X S&P Australia GARP ETF (ASX: GRPA), investors can harness the time-tested methodology, but this time applied to Australia’s equity market. GRPA enables investors to gain exposure to Australia’s leading companies through a systematic strategy that blends growth, value, and quality, wrapped up in one tradeable security.

Key Takeaways

- Localised GARP Strategy: GRPA brings the globally proven GARP approach to Australia to provide a smarter approach to domestic equity allocation.

- Bridging Growth and Value: The investment strategy balances earnings and sales growth with valuation discipline and quality filters, a methodology that enables investors to blend the best of both worlds without having to decide between growth or value alone or deal with active factor rotation.

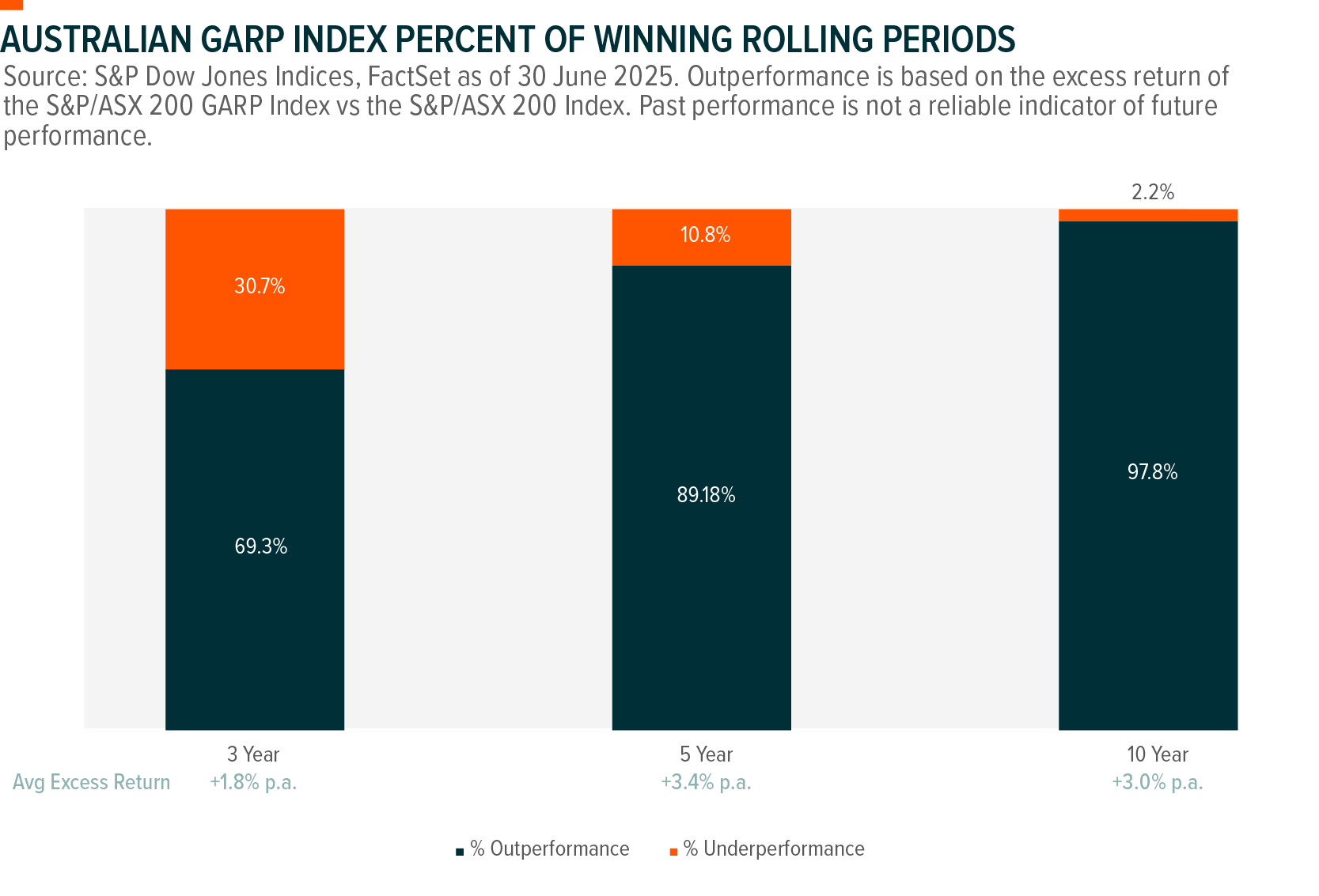

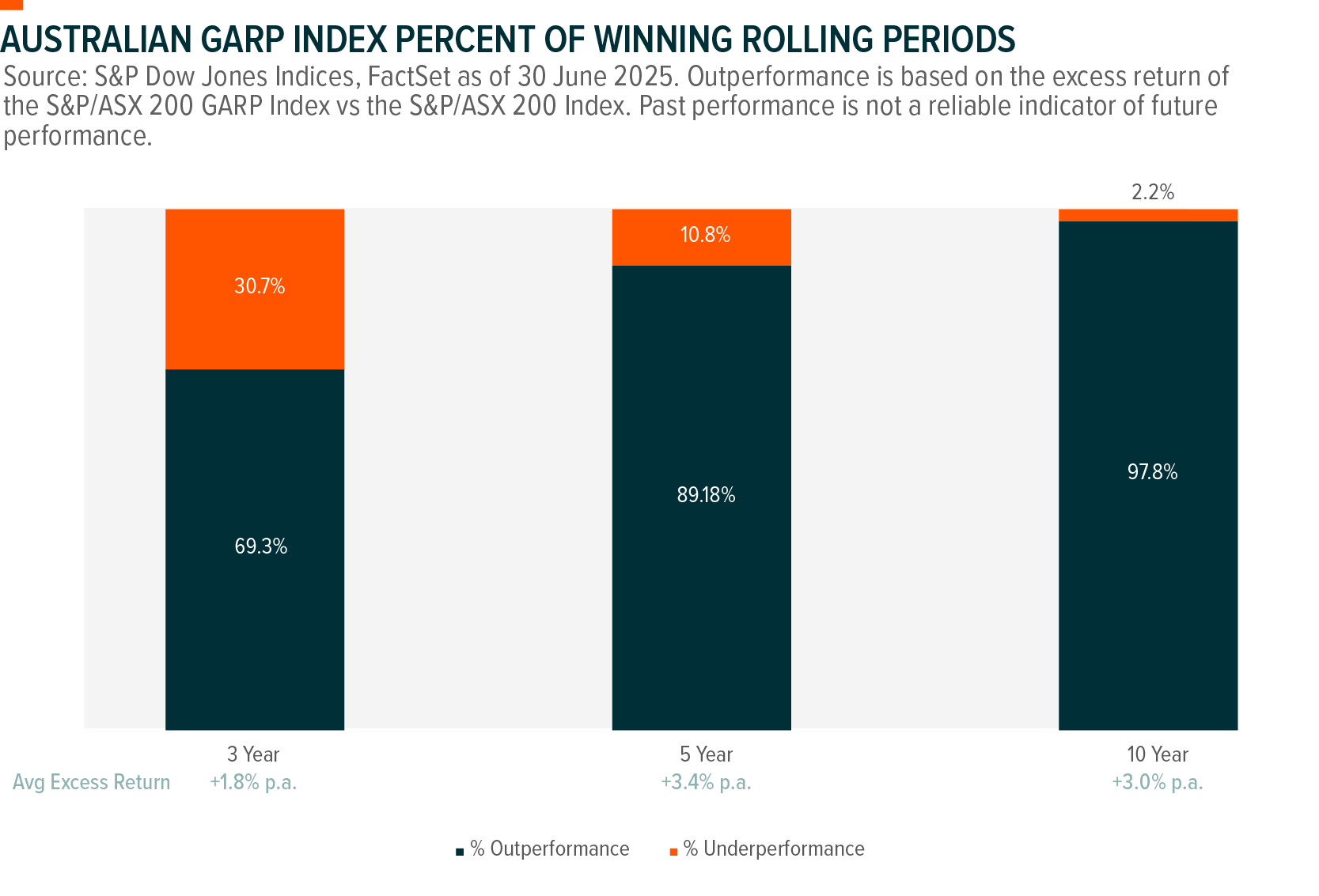

- Outperformance Potential: By applying the GARP framework to the Australian market, investors have the potential to outperform the broader Australian share market, with the underlying index strategy outperforming the broader market ~98% of the time in rolling 10-year period horizons.

Australia’s Equity Market: Stagnant Growth Meets Elevated Valuations

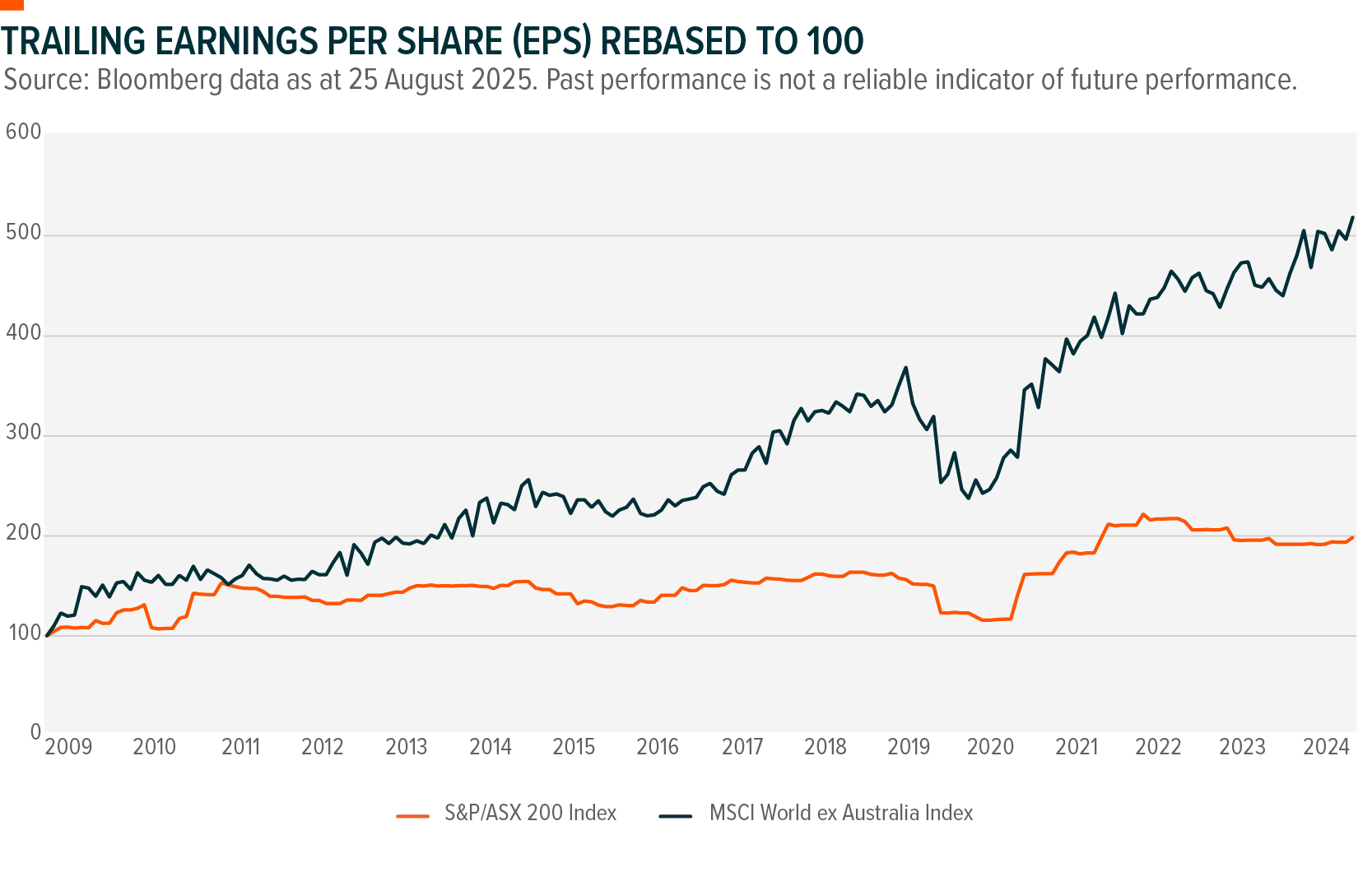

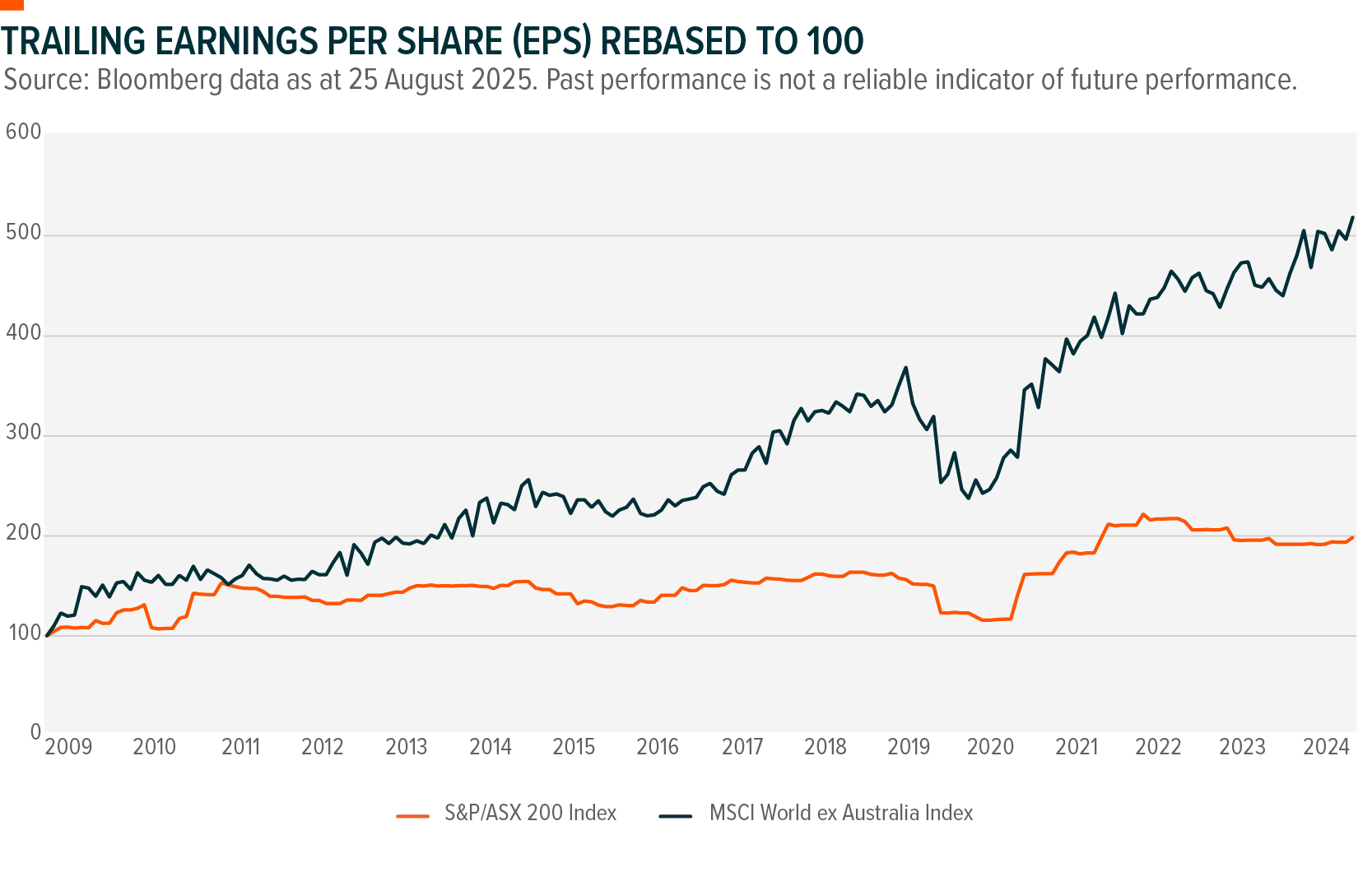

Australian equities have long been considered a reliable source of income through dividends, but when it comes to growth, the market has lagged global peers, especially since the Global Financial Crisis (GFC). The Australian market has delivered lower earnings growth compared to global peers, reflecting Australia’s concentrated exposure to certain sectors like financials. While these companies provide stability, they have offered limited opportunities for sustained earnings expansion, leaving investors underexposed to the type of high-growth businesses that drive long-term wealth creation.

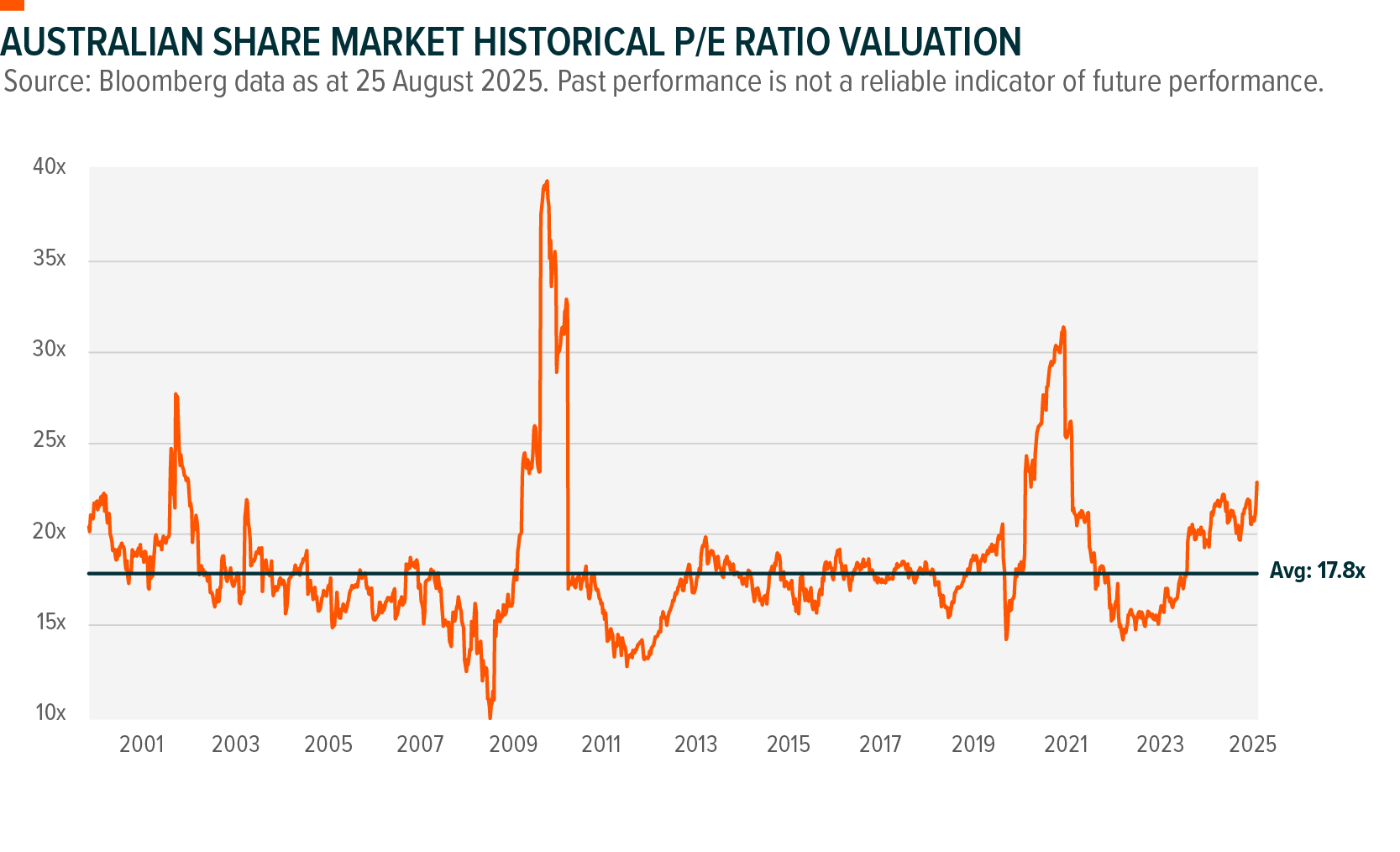

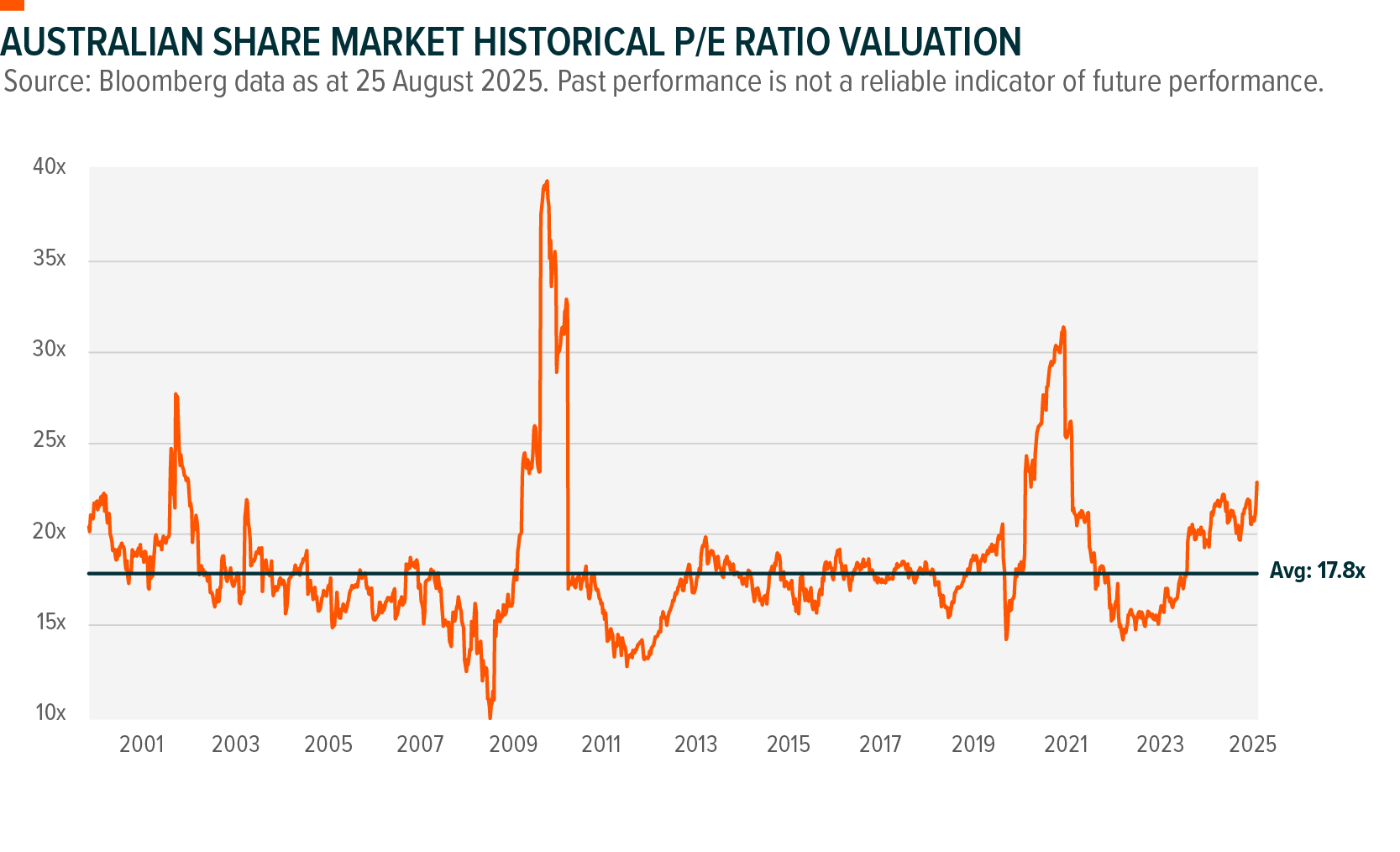

At the same time, valuations in the local market remain stretched, with Australia trading at a P/E ratio well above its historical average and sitting in the 90th percentile. Once adjusted for earnings growth, which is projected to remain in the single digits over the next couple of years1, this indicates that investors may be paying premium prices for relatively modest growth potential.

This combination of lackluster growth and relatively expensive valuations poses a challenge for those seeking to build wealth through Australian equities. As a result, investors may benefit from adopting a more discerning approach, targeting companies that are growing their earnings while avoiding the pitfalls of overpaying in a market where true growth is scarce.

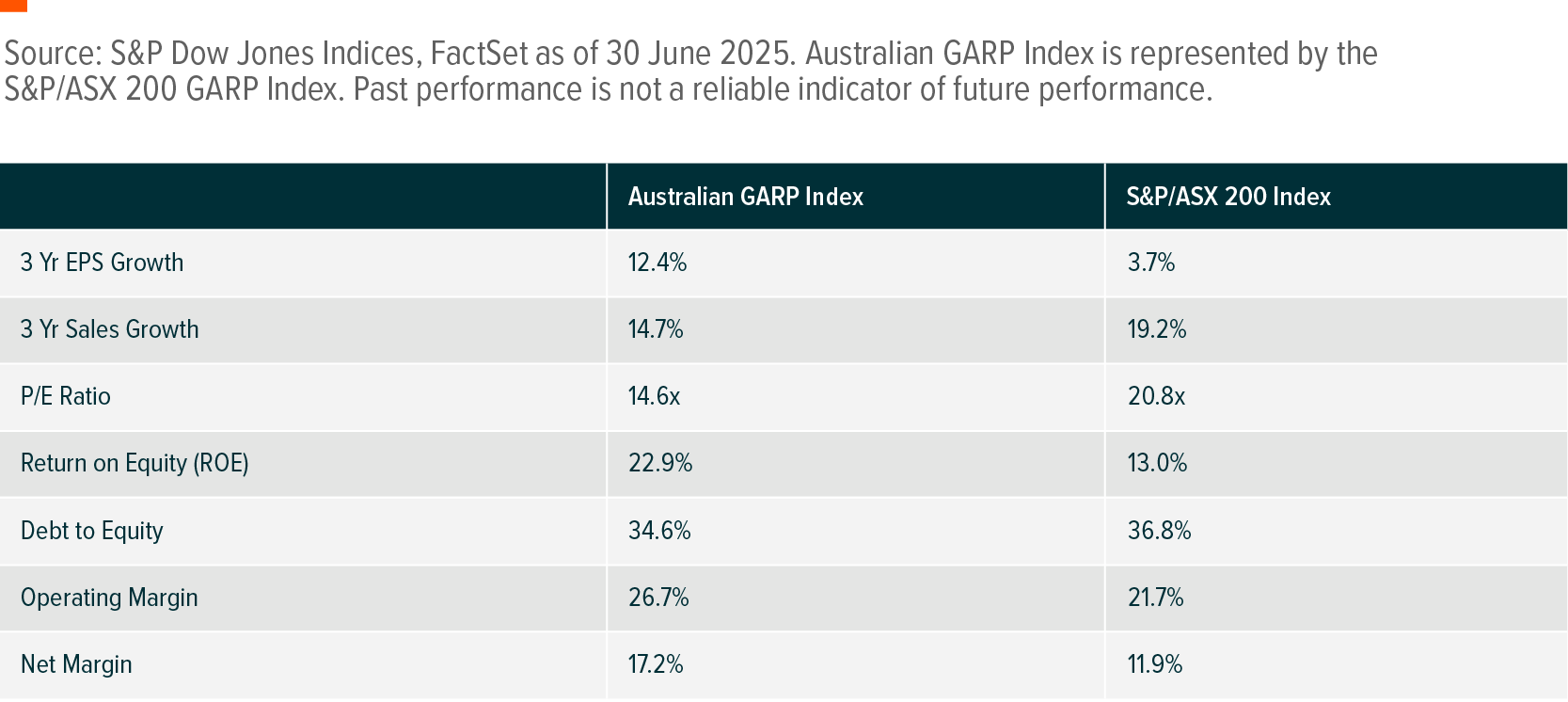

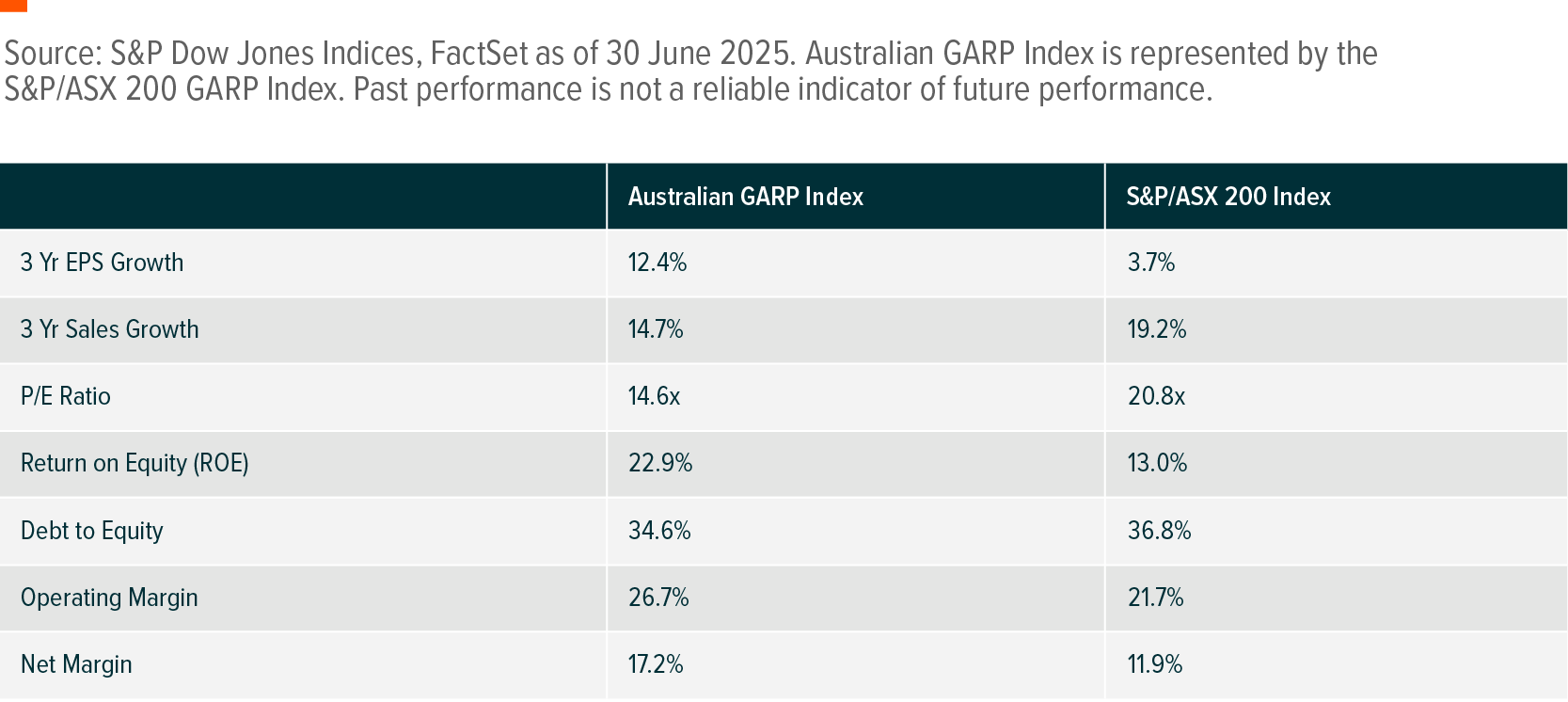

By incorporating smart-beta factors into index construction, investors can address the challenge of finding genuine growth at reasonable valuations. As shown in the table below, the Australian GARP Index delivers stronger fundamentals than the broader market, with higher EPS growth, return on equity, and profit margins, while still trading at a more attractive valuation (14.6x vs 20.8x P/E).

While the historical sales growth of the S&P/ASX 200 Index may currently look better than the Australian GARP Index, this is mainly due to the big four banks experiencing strong sales growth under a rising rate environment, and as of the date of this article are not currently qualified as a ‘GARP’ stock. Sales is only the top-line measure, as sustainable portfolio performance ultimately depends on earnings growth and other quality factors that drive long-term shareholder value. By screening out overpriced sectors, the GARP approach focuses on durable earnings growth, ensuring that quality companies, rather than temporary market cycles, are the main source of performance.

Outperformance Potential

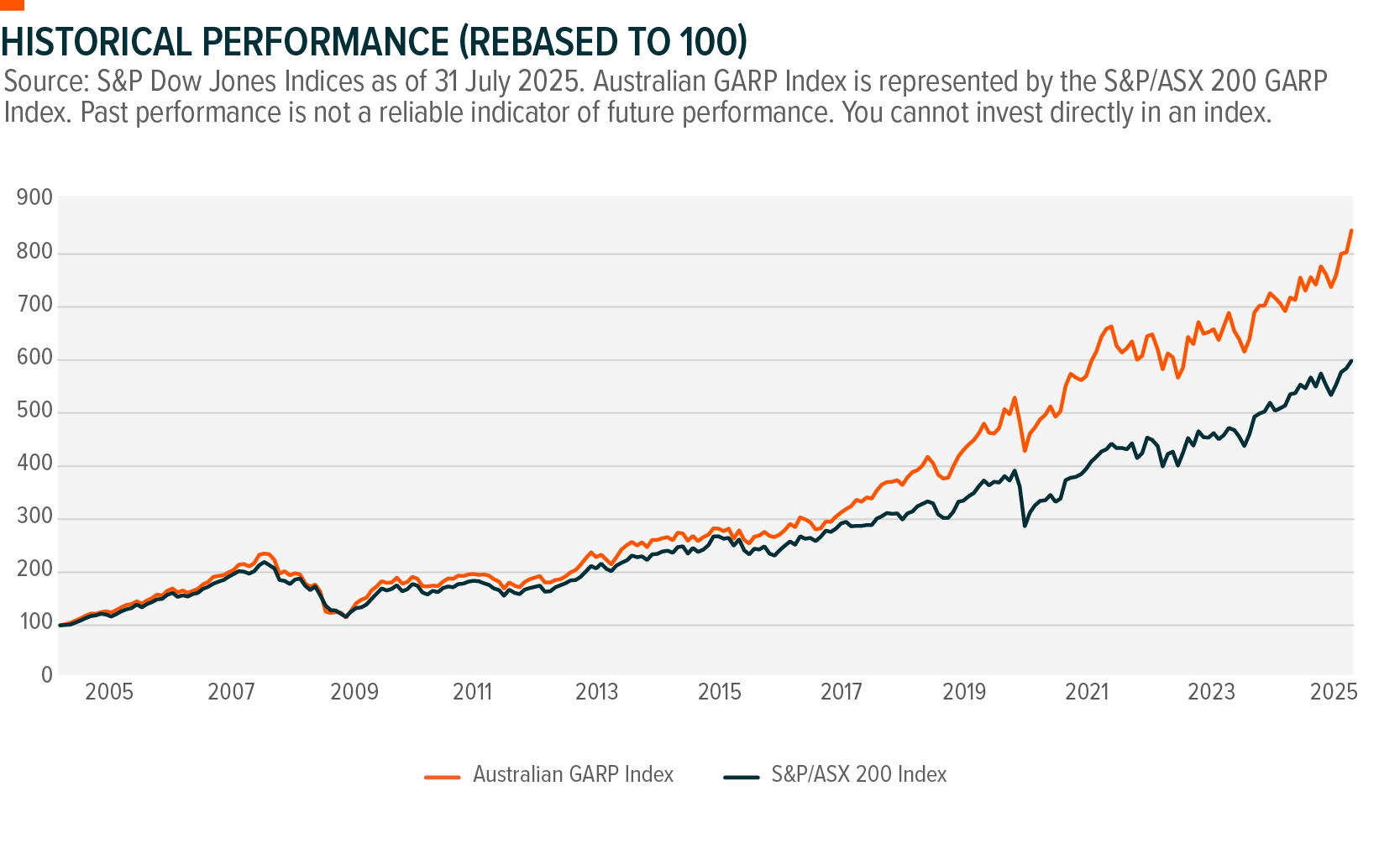

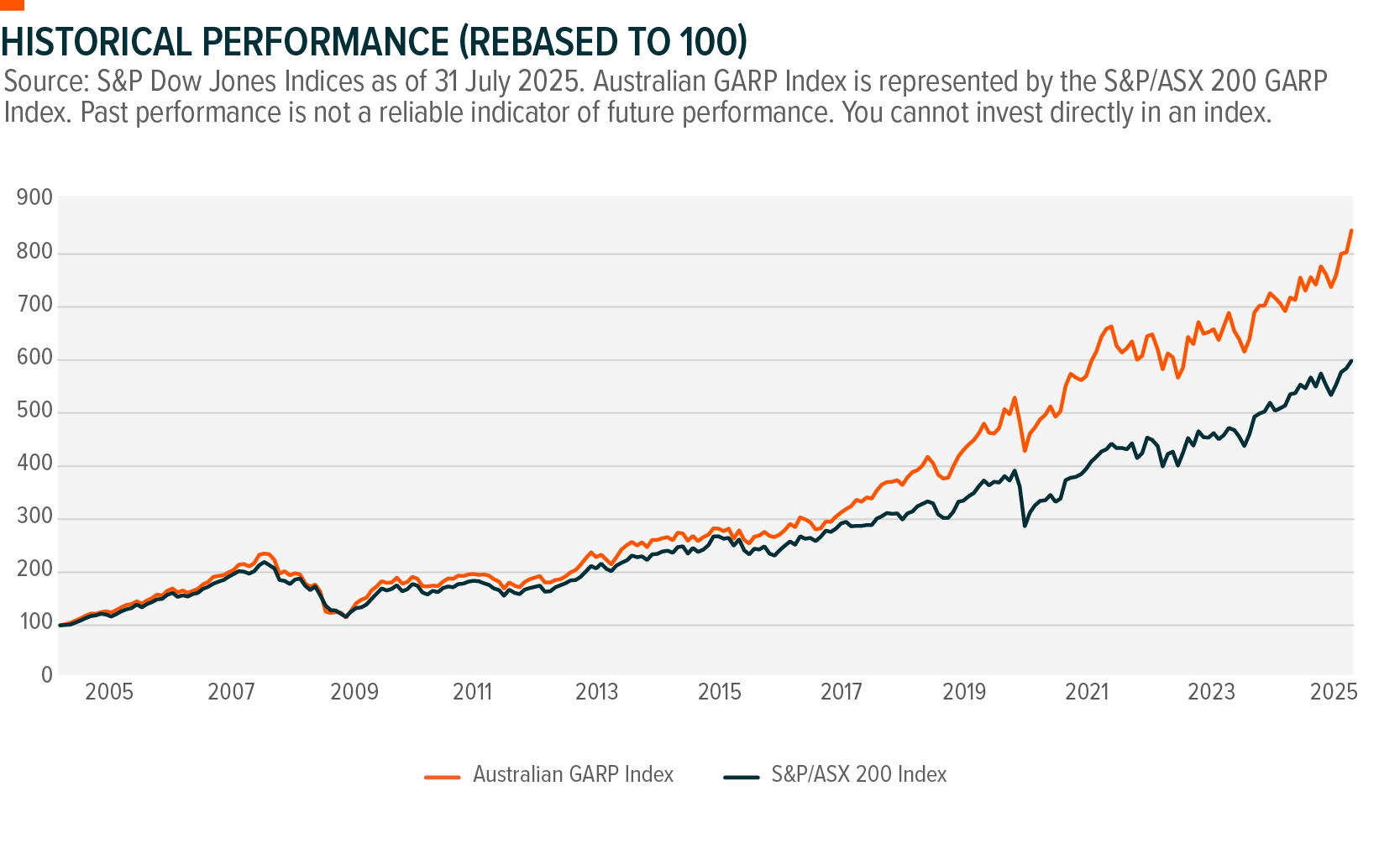

The Australian GARP Index has demonstrated a consistent ability to generate superior returns versus the broader market. Since common inception, the underlying index has delivered stronger risk-adjusted performance, with a Sharpe ratio of 0.87 compared to 0.71 for the S&P/ASX 200 Index.2 This reflects the effectiveness of the GARP methodology, tilting toward companies that combine growth with reasonable valuations and quality fundamentals, allowing investors to capture upside while mitigating valuation risk. Importantly, the Australian GARP Index has shown resilience across different market environments, outperforming in both up and down markets, underscoring its balance of growth potential and defensive characteristics.

Looking at longer-term results further highlights the strategy’s consistency. Over rolling 10-year periods, the Australian GARP Index has outperformed the broader market ~98% of the time, with an average annual excess return of around 3% p.a. This persistence across cycles makes GARP a compelling addition for investors seeking enhanced return potential.

While short-term relative performance may fluctuate, history shows that maintaining a disciplined GARP allocation can materially improve portfolio outcomes over time. The key question for Australian investors, then, is how best to integrate an Australian GARP strategy into their existing equity portfolio.

Enhancing the Core: Blending GARP with the Broader Market

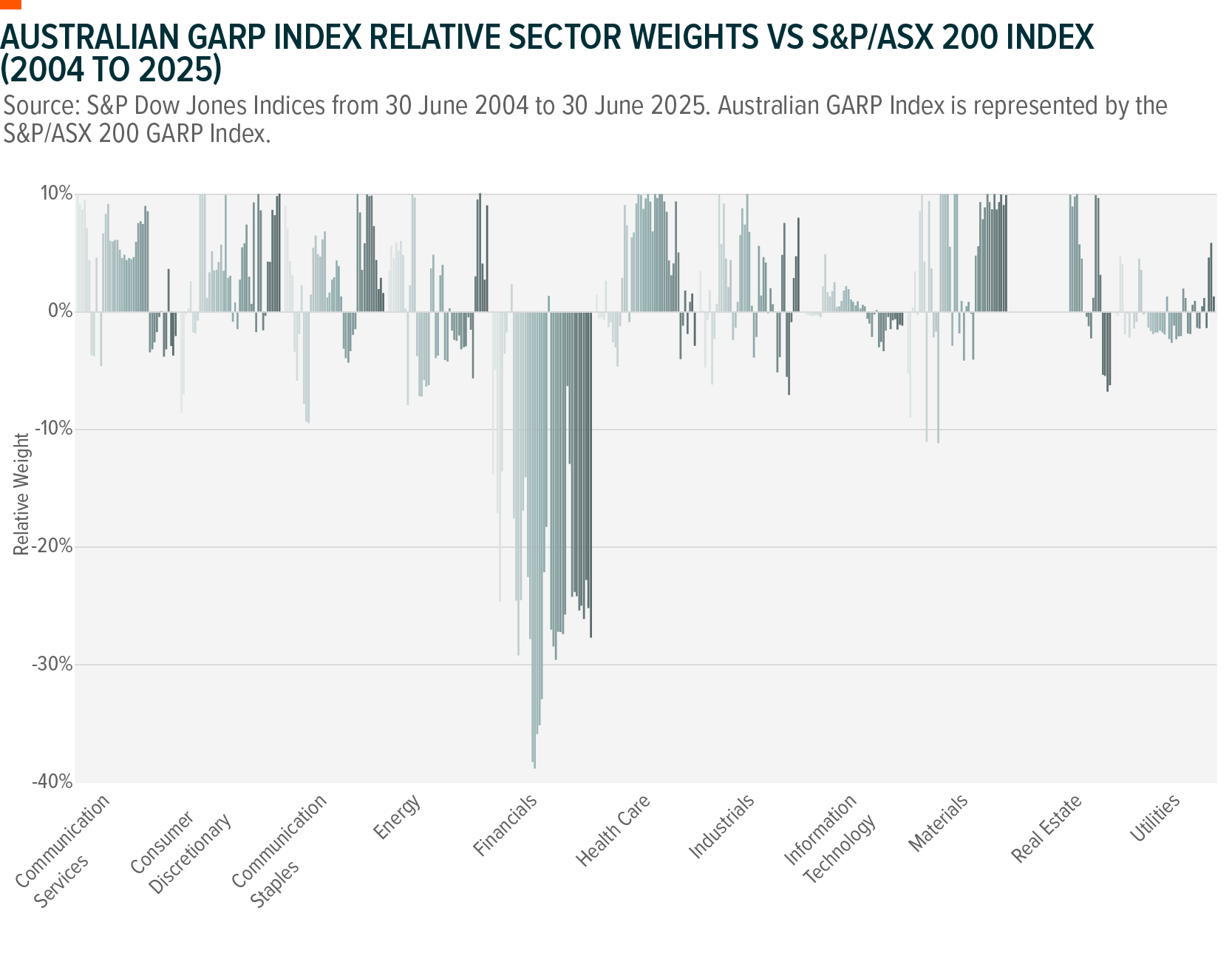

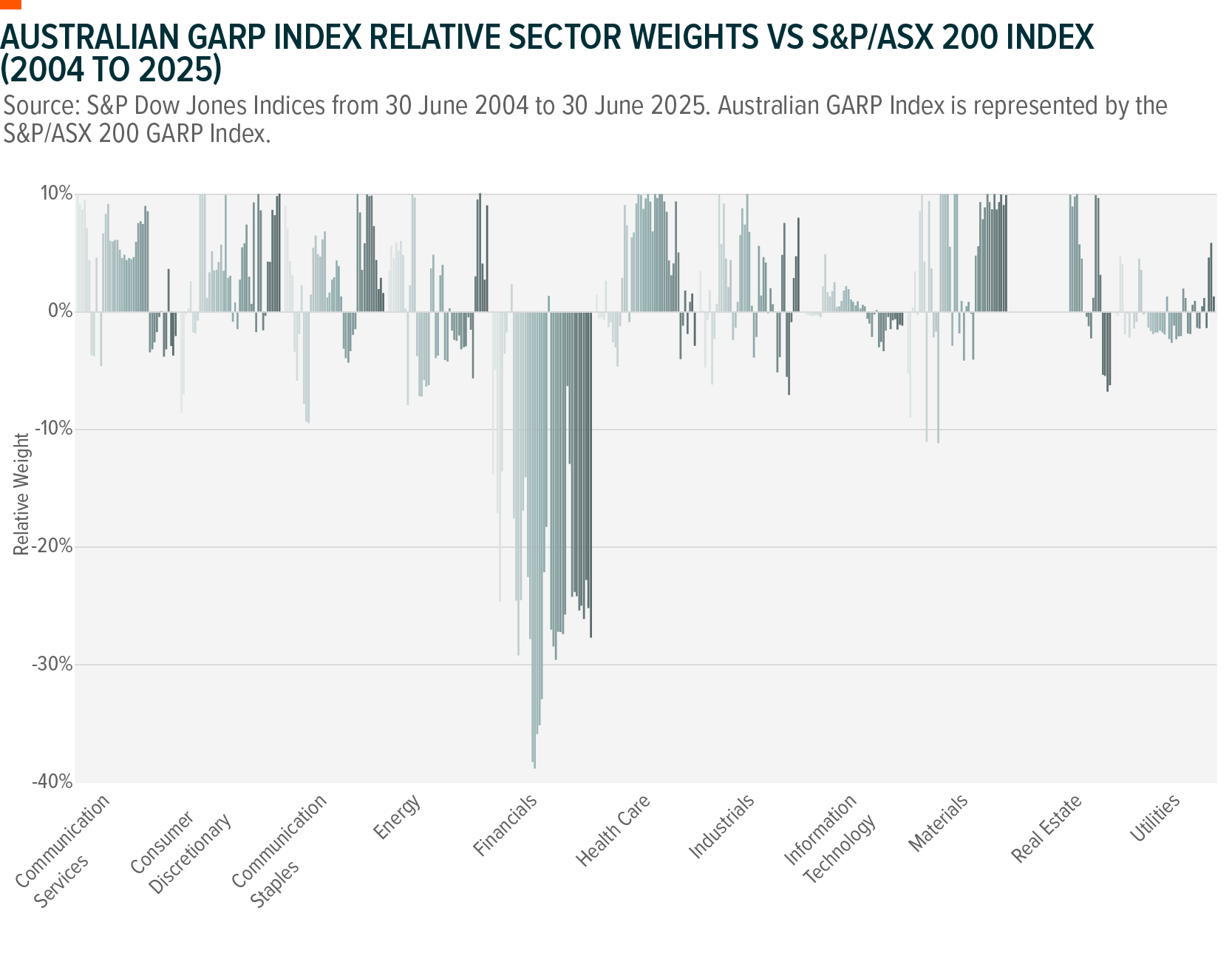

A GARP approach can help investors diversify away from Australia’s traditional sector concentration, particularly its heavy tilt toward financials. Historically, GARP strategies have maintained an underweight position in financials, an area where earnings growth is typically in the low single digits and valuations remain stretched, with Australian banks trading at over two to three times book value, among the most expensive in the world.3 By shifting focus toward companies that balance growth with reasonable valuations, investors can capture a broader opportunity set beyond the banks that dominate the market.

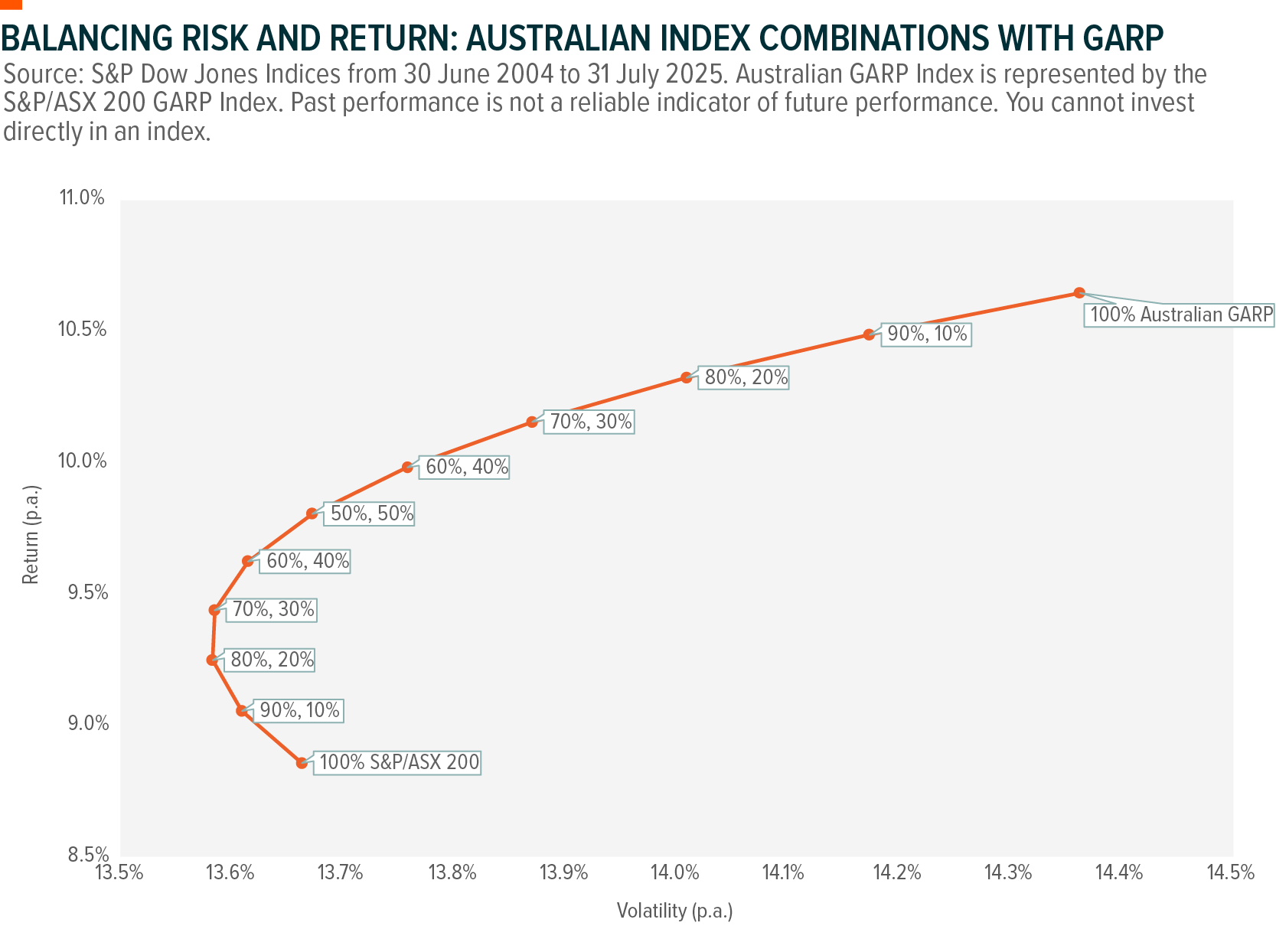

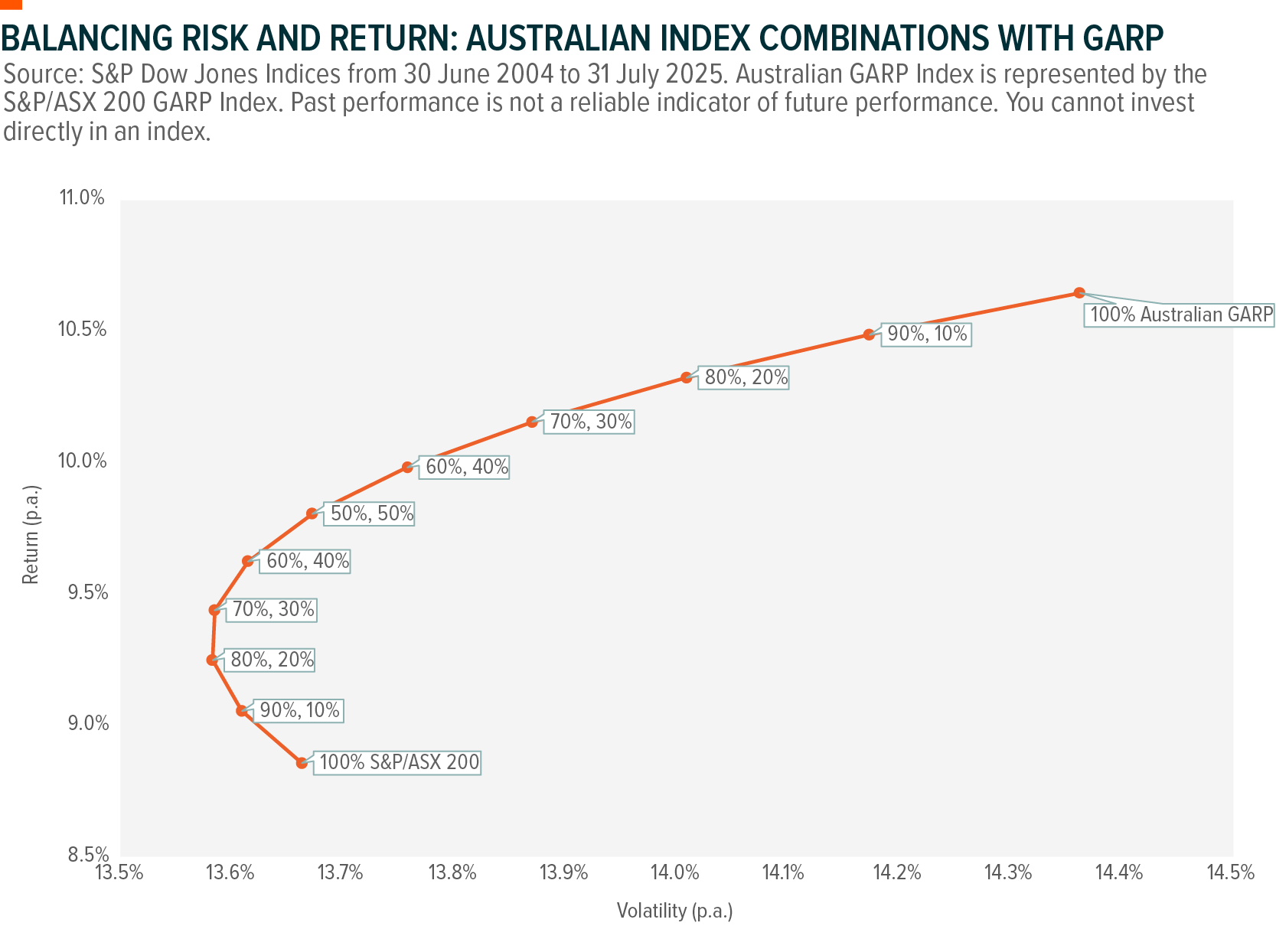

Incorporating GARP into an Australian equity allocation can also potentially improve portfolio outcomes. While a pure allocation to an Australian GARP Index has historically delivered stronger long-term returns, this approach can sometimes carry higher volatility. A blended allocation of combining a broad market index with a GARP strategy may offer a more balanced profile. This allows investors to maintain exposure to the overall market while tilting toward higher-quality, growth-oriented companies at fair valuations.

The above chart illustrates how blending a broad-based Australian equity allocation with an Australian GARP strategy has historically balanced risk and return. A portfolio made up of around 20-30% Australian GARP exposure achieved the lowest volatility, representing the minimum variance point. From there, increasing allocations to an Australian GARP strategy delivered higher historical returns, although risk also rose incrementally. This shows that investors can tailor their mix based on their risk appetite, using GARP alongside traditional Australian shares, to either enhance portfolio resilience or pursue stronger long-term performance.

Conclusion

By targeting companies with robust earnings, strong profitability and capital efficiency, and reasonable valuations, GARP embodies the principles of valuation-disciplined quality-growth investing, reinforcing the idea that growth and value can coexist harmoniously in Australia. This balance helps investors avoid overpaying for high-growth stocks while still capturing meaningful upside, creating a more resilient and disciplined approach to Australian share market investing.

Related Funds

GRPA: The Global X S&P Australia GARP ETF (ASX: GRPA) provides investors with exposure to Australian companies with strong earnings growth, solid financial strength, and trading at reasonable valuations. These characteristics are common when describing stocks that meet the definition of an investing strategy known as Growth at a Reasonable Price (GARP).