We believe the global defence industry is entering a super-cycle, shaped by geopolitical urgency and a structural pivot toward technology-first military capabilities. Nations worldwide are rapidly moving beyond traditional weapons systems, investing heavily in autonomous platforms, AI-powered command and control systems, and sophisticated cyber defence architectures engineered for speed, precision, and adaptability.

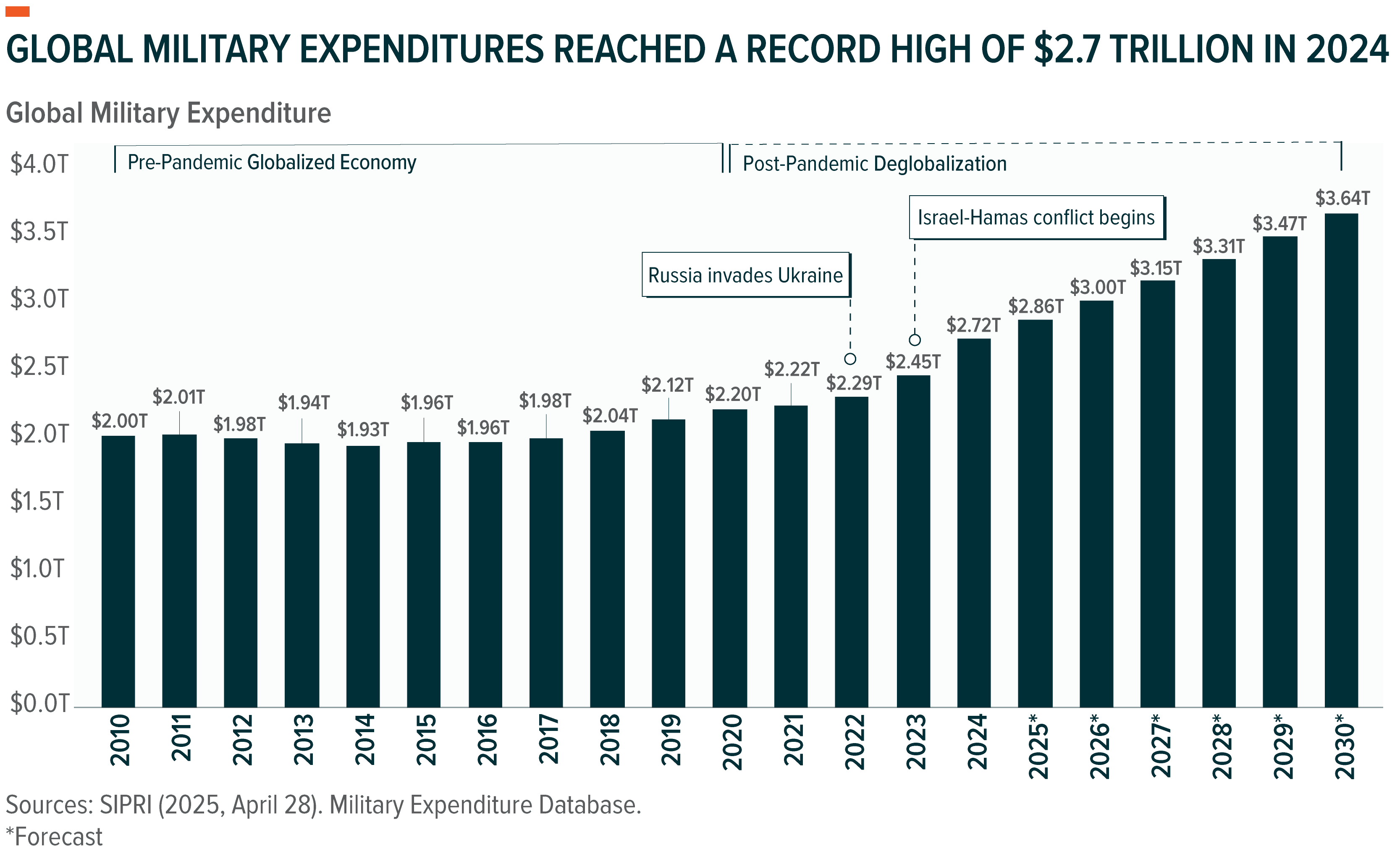

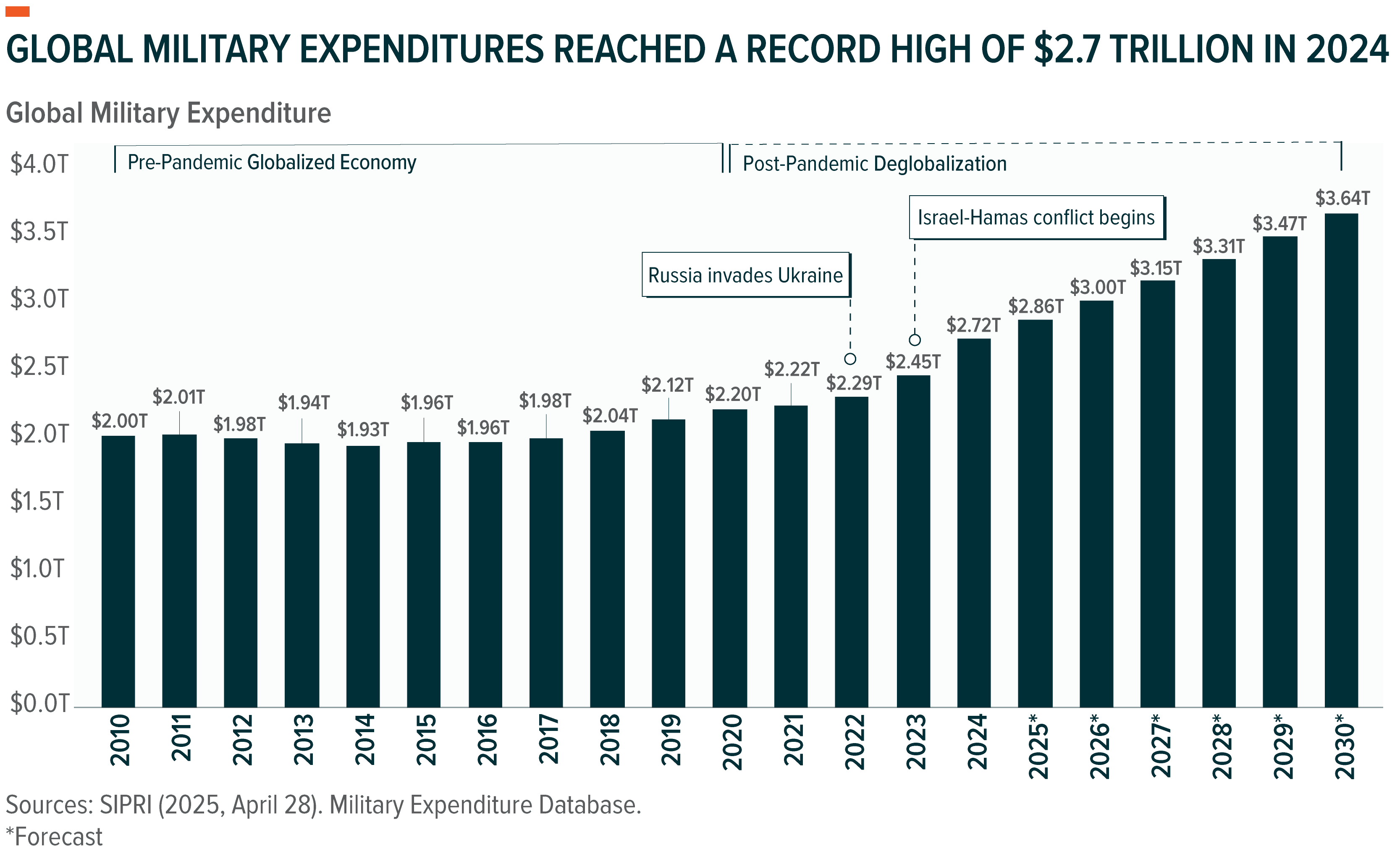

The urgency is evident in rising global military spending, which reached US$2.7 trillion in 2024, growing at the highest pace since at least the end of the cold war.1 U.S. defence budget is on track to hit a trillion dollars, nearly five years ahead of prior projections, marking a sharp reversal in fiscal posture under the new administration.2 The European Union is moving to reduce its historical dependence on U.S. security guarantees, mobilizing €800 billion in defence investments by 2030 to build a self-reliant and modernised posture.3

But the more significant shift lies not in the scale of spending, but in its direction. Procurement is shifting decisively toward tech-enabled solutions and battlefield AI, marking a generational overhaul of global defence infrastructure.

This transformation is opening new lanes for investment. The Global X Defence Tech ETF (DTEC) offers investors strategic exposure to this evolving defence and military landscape through its global reach and technology-forward focus.

Key Takeaways

- Global defence budgets are rising at the fastest pace in decades, with structural and geopolitical tailwinds likely to sustain momentum through 2030.

- Defence modernisation is becoming a central priority. Technology remains under-penetrated in the defence sector, pointing to a long runway for growth in the years ahead.4

- The Global X Defence Tech ETF (DTEC) provides targeted exposure to companies driving the technological transformation of defence, and we believe is positioned to benefit from the realignment of a multi-trillion dollar industry.

Why Defence Technology? Why Now?

For decades, defence has been a sleepy corner of the market for investors, with predictable budgets, legacy contractors, and little innovation. That era is rapidly coming to an end.

A global rearmament cycle is now underway, fuelled by rising geopolitical tensions, advances in technologies like AI, and new threats such as swarms of low cost and autonomous drones. Recently emerging conflicts in regions like the Middle East, Ukraine, and the India-Pakistan border - along with China's growing tech-driven military power - further underscore the urgency to act for major military powers. This is enforcing a structural overhaul in how militaries procure, integrate, and operationalise technology.

For investors looking for potential secular growth, defence tech is emerging as a rare intersection of defensibility and potential for innovation. Below, we outline the key forces driving this shift and factors investors should consider.

1. Geopolitical Pressure Is Forcing a Global Rearmament Cycle

Conflicts around the world continue to grow and, in response, defence budgets are shifting from restraint to acceleration. Worldwide, nearly 30 active conflicts are being tracked by the Council on Foreign Relations.5

As a result, more than US$2.7 trillion was spent on defence in 2024, up 9.4% year-over-year (YoY). Annual budgets haven’t grown this quickly since the end of the Cold War.6 The United States, which is responsible for more than a third of the world’s military expenditures, was a key driver of this growth as it continued its support of Ukraine and Israel.7 That trend appears far from over. The new administration is proposing nearly US$1 trillion in defence spending this year, years ahead of prior expectations.8 It marks a sharp reversal from earlier efforts to rein in budgets and reflects the urgency of intensifying global threats, including new adversaries like China.

Other countries, from European nations to emerging economies like India, are also ramping up procurement and investing in advanced technologies to secure against domestic and regional threats. This broad, multi-region alignment marks one of the most synchronised global rearmament cycles in decades and could drive total military expenditures to nearly US$3.6 trillion by 2030.9

2. Technology Is Redefining the Defence Industry Playbook

Defence contracts tend to be long-term, often planned decades in advance. This extended sales cycle has historically limited the influence of the technology sector, which is used to operating at a much faster pace. However, rising threats and a new wave of spending are necessitating a faster adoption of technology. More broadly, the need for speed, agility, and precision achieved using data, algorithms, and chips is compelling militarised nations to take a more aggressive stance on modernisation.

For example, in the U.S., the Department of Defense created the Defense Innovation Unit (DIU) to accelerate the adoption of commercial technologies – such as AI, autonomy, cybersecurity, and advanced computing - into military applications.10 Similarly, in Europe, NATO’s Defence Innovation Accelerator for the North Atlantic (DIANA) is funding dual-use startups and coordinating with member nations to ensure technological interoperability and resilience.11 These efforts signal a broader shift in Technology and Defence cooperation.

From a procurement standpoint, we believe three areas stand out over the next few years:

- Drone Technology: Cheap, fast, and lethal, drones are reshaping conflict dynamics, forcing militaries to rethink strategy and procurement cycles. China has pulled ahead in this domain, while the U.S. scrambles to catch up.12 We expect investments to accelerate over the next five years to fill gaps.

- Artificial Intelligence: Modern battlefields generate vast amounts of data. AI-enabled systems are already being deployed to streamline targeting, intelligence, and logistics. For example, NATO recently selected Palantir to develop an integrated AI command platform.13

- Cybersecurity: Cyber defence now protects not just classified networks, but civilian infrastructure. More than US$200 billion is expected to be spent on cybersecurity in 2025, but government-focused spending is only getting started.14

3. Europe’s Strategic Pivot Is Likely to Be a Multi-Year Catalyst

The European Union is dramatically increasing defence outlays, shifting away from reliance on U.S. security guarantees and toward building independent capabilities. In 2024, EU defence spending rose a record 17% YoY—and the momentum is only accelerating.15 In early 2025, the bloc announced an €800 billion “Rearm Europe” initiative to fast-track procurement and attract private capital into the sector.16

Germany is leading the charge. Its defence budget surged 28% YoY to US$88.5 billion in 2024, making it the fourth largest spender globally.17 Berlin is also bypassing fiscal constraints with a €500 billion off-budget fund targeting defence and infrastructure.18 By the end of 2025, at least 20 members are expected to reach NATO’s 2% of GDP target, more than triple the number in 2021.19 The UK, while outside the EU, is also ramping up, aiming to reach 2.5% of GDP in defence spending by 2027.20

We see this rearmament cycle as a multi-year catalyst and not a short-lived exercise. In our view, Europe’s defence posture remains significantly under-digitised, compounding the opportunity for integration of advanced technologies across platforms and command systems.

4. Defence May Offer Rare Resilience in a Volatile Market

Defence, with its heavy industrials backbone, stands out as one of the few sectors offering both demand predictability and long-cycle visibility – attributes that become increasingly valuable in a volatile macro environment such as 2025. Crucially, defence spending is largely decoupled from traditional economic cycles, unlike consumer-facing or rate-sensitive industries. Multi-year contracts, often funded well in advance by well capitalised governments, may provide a cushion of budgetary stability.

Within this space, we believe the Defence Tech theme holds a particularly attractive position. It blends the resilience of industrials with exposure to frontier technologies. From AI and autonomous systems to secure communications and cybersecurity, a growing share of defence budgets are being directed toward innovation. This creates a compelling mix of durability and upside potential.

In our view, the theme remains in the early stages of a capital expenditure-driven upcycle. After decades of underinvestment, global militaries are just beginning to realise gaps requiring modernisation. For example, software still accounts for less than 1% of total defence spending in the U.S.21 That underscores how early this shift may be, and why the push toward digital modernisation may be unlikely to reverse any time soon.

5. DTEC Targets Opportunities from Disruption in the Defence Industry

The Global X Defence Tech ETF (DTEC) offers targeted exposure to the convergence of rising global defence budgets and accelerating technological disruption. DTEC seeks to track the Global X Defense Tech Index.

Key index methodology highlights include:

- Targeted Sub-Segments: The fund focuses on companies in three sub-themes - Advanced Military Systems and Hardware, Defence Technology, and Cybersecurity, delivering a unique combination of established defence-industrial leaders and next-generation tech innovators.

- High Thematic Purity: Companies must derive at least 50% of their revenue from these core sub-segments. This strict revenue filter ensures a concentrated portfolio aligned with the most innovative and mission-critical areas of modern defence.

- Geo-Agnostic Exposure: DTEC inherently takes a global approach, capturing companies across North America, Europe, and Asia. As militaries in these regions simultaneously ramp up investment, we view this exposure as critical and as something that traditional sector-based strategies may lack.

Additionally, the fund excludes aerospace and commercial aviation companies, maintaining a sharp focus on defence and military applications only.

Conclusion: Technological Transformation of Defence Could Be a Multi-Decade Opportunity

Defence in the modern world is no longer just about aggression, but increasingly about intelligence, automation, and resilience. Adapting to this new playbook means rethinking how militaries plan, buy, and invest. In our view, the urgency and pace of investments will continue well throughout this decade, making Defence Tech a top theme for investors to consider. DTEC offers focused exposure by zeroing in on companies best positioned to shape the future of security.