Periods of market noise often tempt investors to chase momentum or retreat to defensives. However, the most durable outcomes tend to come from discipline – owning companies that can consistently grow earnings, maintain balance sheet strength, and trade at a fair price.

That philosophy continues to underpin the Global X S&P World ex Australia GARP ETF (GARP) following its December 2025 semi-annual rebalance. The latest rebalance resulted in a measured refresh rather than a wholesale shift. While some individual holdings changed, the portfolio’s core identity remains intact, being tilted toward high-quality global companies with improving earnings momentum, resilient fundamentals, and reasonable valuations.

Key Takeaways

- Discipline Drives Opportunity: GARP’s rebalance demonstrates the power of disciplined stock selection, adding companies like Rolls-Royce, Disney and SoftBank, while exiting names where growth has slowed, balance sheets have weakened, or valuations have stretched. This combination of selective additions and thoughtful exits has helped capture upside while managing risk, reinforcing the strategy’s consistent, rules-based approach.

- A Proven Track Record Since Launch: Since launching in September 2024, GARP has outperformed the average global equity ETF in the Australian market, reflecting GARP’s ability to deliver a quality-focused growth exposure even amid periods of market volatility.

- Positioning for a Global Growth-Oriented Focus in 2026: GARP’s portfolio now leans toward regions and sectors with supportive earnings momentum, including Japan and Europe. As investors increasingly chase growth globally, maintaining valuation discipline and quality selection will be key to navigating 2026’s opportunities.

Selective Growth, Not Growth at Any Price

One of the defining features of the December 2025 rebalance was the addition of companies where earnings are improving, but valuations have yet to fully re-rate.

Rolls-Royce: A Turnaround with Structural Tailwinds

Often mistaken for a luxury car brand, Rolls-Royce’s economic engine lies in aerospace, defence, and power systems. Commercial aviation recovery, rising engine flying hours, and a growing share of high-margin servicing revenue have driven a sharp improvement in profitability.

Earnings margins have expanded, driven by higher engine flying hours, improved pricing, a greater mix of recurring services revenue, and disciplined cost control. As shown in the chart below, analysts have steadily revised earnings forecasts upward since 2022, reflecting stronger fundamentals.

More importantly, the company is emerging as a beneficiary of the AI-driven power generation theme through its involvement in small modular nuclear reactors (SMRs), following recent agreements with the UK and Czech governments.1 Despite a step-change in margins and cash generation, the stock trades at a meaningful discount to broader industrial peers (16x P/E vs 26x P/E respectively)2 – an example of growth improving faster than valuation.

Walt Disney: Diversified Business Meets Capital Discipline

Disney’s rebalance inclusion reflects improving earnings momentum across its diversified entertainment ecosystem. Parks & Experiences continue to anchor profitability, while streaming losses are narrowing toward breakeven. Recent capital allocation decisions, such as resuming buybacks and lifting dividends, and investing heavily in AI-enabled content creation, signal renewed financial discipline following a valuation reset earlier in the year.

Disney today is far more than a traditional entertainment studio, with revenues increasingly diversified across streaming platforms such as Disney+ and Hulu, live sports through ESPN, and high-margin Parks and Experiences.

At its latest results, Disney delivered strong earnings momentum with full‑year adjusted EPS up ~19% in FY25 and management guiding for double‑digit adjusted EPS growth in both FY26 and FY27, while return on equity has improved into the double digits for the first time in six years, reflecting stronger profitability and continued balance‑sheet health.3

SoftBank: Asymmetric Exposure to the AI Stack

SoftBank is a global technology investment conglomerate, best known for its Vision Funds and strategic holdings across artificial intelligence, semiconductors, robotics, cloud infrastructure, and next-generation software.

The Japanese group is uniquely leveraged to the AI megatrend, with exposure spanning the full AI stack, from Arm Holdings’ semiconductor architecture to enterprise and applied-AI platforms, robotics, and automation. This positioning has been further reinforced by SoftBank’s US$40 billion investment in OpenAI, making it one of the few global investors with direct and meaningful exposure to the core of generative AI.

Following a multi-year reset, SoftBank has undergone a sharp financial turnaround, delivering returns on equity of around 25% over the first half of the 2026 fiscal year, trading on a compressed valuation of roughly 8x earnings, and benefiting from improved balance-sheet discipline and stronger portfolio performance.4 Together, this creates asymmetric upside potential should AI adoption continue to accelerate across its ecosystem.

Key Stock Deletions

Just as important as what enters the portfolio is what exits. Several high-quality franchises were removed not because their businesses are broken, but because growth has slowed, balance sheet risks have risen, or valuations are no longer warranted.

- Visa was exited as earnings growth moderated, balance sheet leverage increased, all amidst regulatory and competitive pressures intensified.

- Costco, despite its exceptional business model, faced slowing revenue momentum and emerging margin headwinds, challenging to reconcile with a premium valuation.

- General Motors (GM) screened as optically cheap, but weakening margins and falling returns on equity, perhaps due to uncertainty around EV strategy, meant GM no longer fit a GARP framework.

This discipline of selling quality when growth fades or valuations stretch is central to GARP’s framework of avoiding growth or quality traps that can sometimes emerge.

GARP Driving Returns Between Rebalances

Since the June 2025 rebalance, GARP has returned ~9%, with roughly a third of that return driven by stocks added at the prior rebalance.5 Contributions to the overall return were led by:

- A rebound in healthcare, validating the strategy’s willingness to add quality growth following sharp sell-offs.

- Strong positioning in Japan and select cyclicals benefiting from reflation and corporate reform.

- Overweight exposure to Alphabet, providing meaningful participation in AI-driven earnings growth.

Detractors largely reflected opportunity cost from stocks sold too early and selective underweight exposure to the most momentum-driven areas of mega-cap technology – an intentional trade-off consistent with valuation discipline.

Since launching in September 2024, GARP has been one of the best performing global equity funds in the Australian ETF market.

Current Positioning

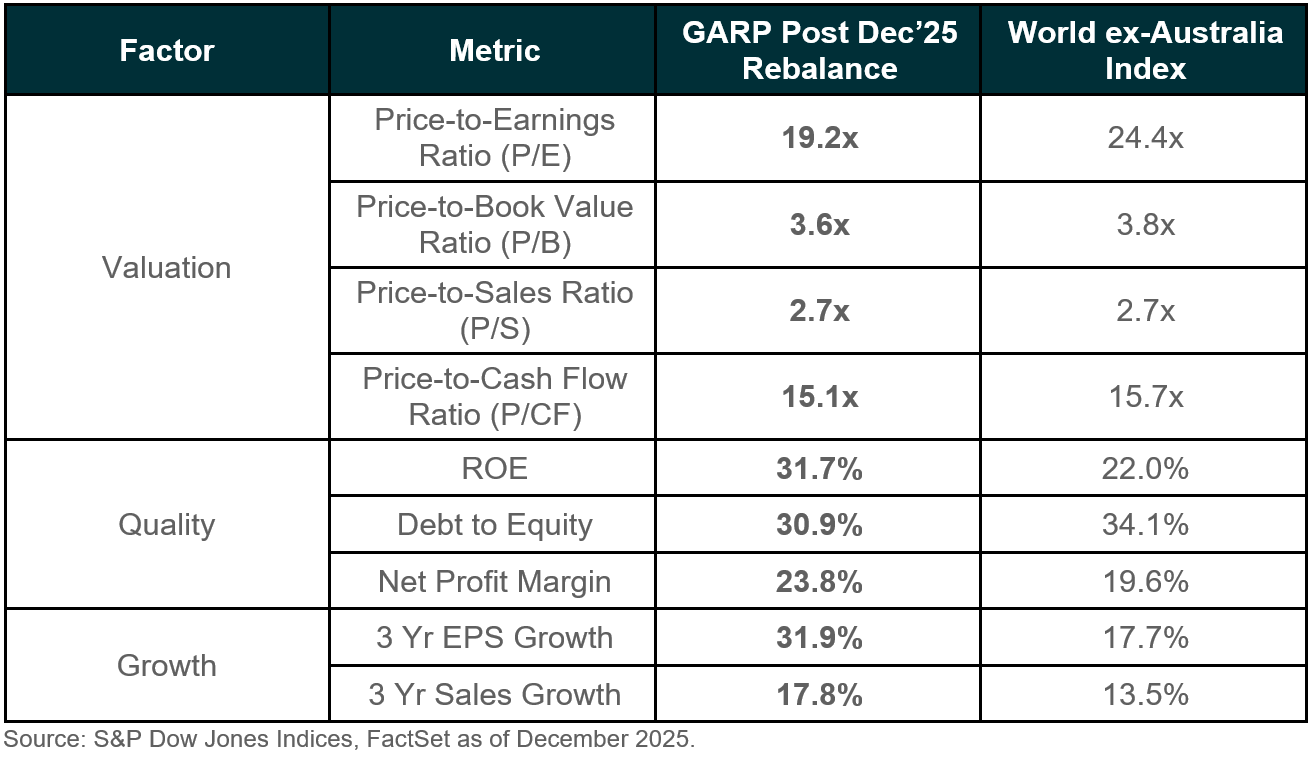

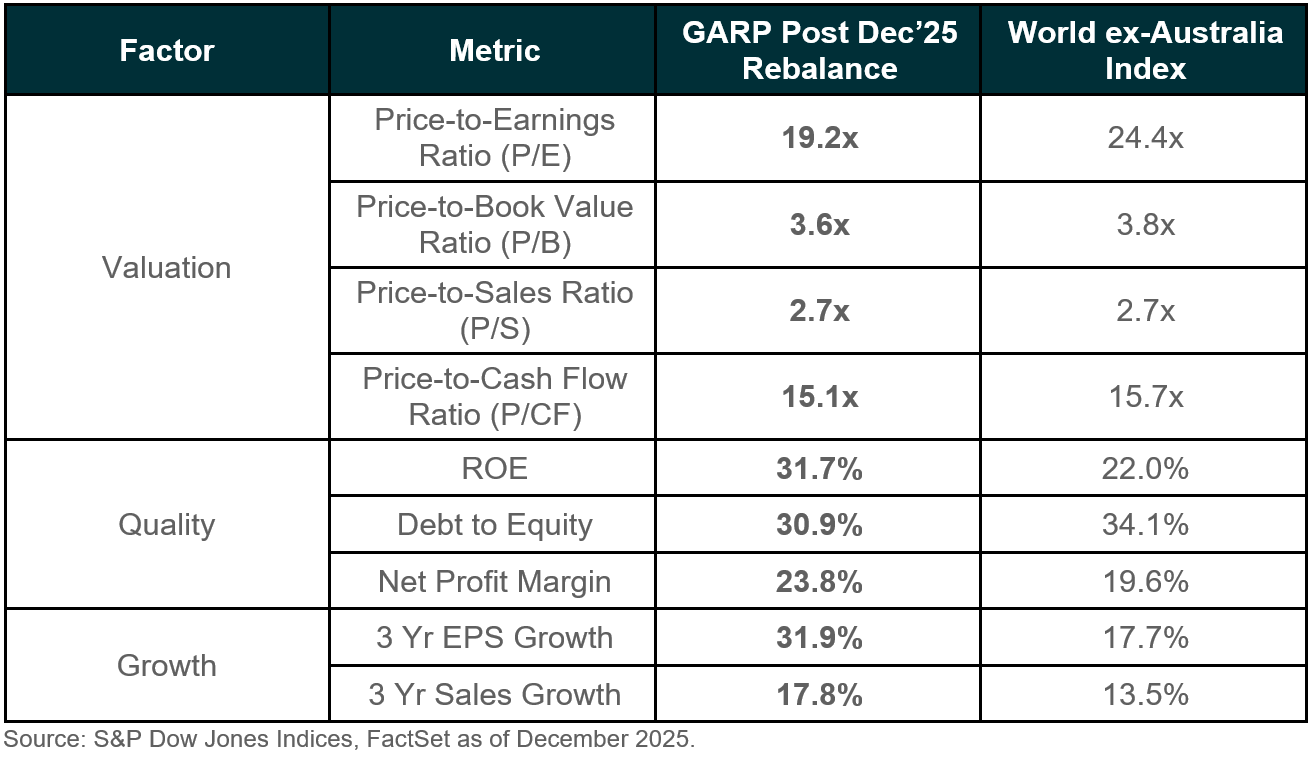

Following the rebalance, the portfolio’s valuation became more attractive, with the P/E ratio falling while maintaining a material growth and quality premium versus the broader global equity index. Dividend yield also improved modestly, reinforcing the strategy’s balance between growth and income resilience. At a portfolio level, exposure shifted away from North America toward Europe, Japan, and the UK – regions where earnings momentum and valuations appear more supportive, while sector tilts favoured health care, industrials, and communication services.

Looking Ahead into 2026

The December rebalance reinforces what GARP is designed to do – not predict markets, but prepare portfolios for the next phase of the cycle.

Our 2026 Market Outlook has identified opportunities emerging as investors position for a more growth-oriented and increasingly global opportunity set, making valuation discipline more important than ever. By continuously recycling capital toward companies where growth, quality, and valuation align, the strategy aims to deliver a balanced return profile through changing market regimes.

In a world increasingly dominated by extremes such as high-multiple growth or deep value, GARP continues to occupy the middle ground where discipline matters most, offering exposure to global growth while remaining mindful of price.