While global interest rates increased in unison in response to rising inflationary pressures in 2022 and 2023, the pathway to lower rates may not be as synchronised. As US Federal Reserve Chair Jerome Powell remarked at the Jackson Hole Symposium in August this year, “The time has come for policy to adjust”. Yet, as we approach the end of 2024, the expected pace of interest rate cuts and the extent of easing varies across major economies. Although there is a degree of uncertainty, investors may look to Australian bonds to provide some compelling opportunities as they navigate shifting global monetary dynamics.

Key Takeaways

- Australia remains one of the few countries yet to begin its rate-cutting cycle, with markets forecasting the Reserve Bank of Australia (RBA) to make its first move around early-to-mid-2025 as inflation has remained relatively sticky.1

- While other central banks like the US Federal Reserve (Fed) have taken a more dovish stance, Australia’s yield curve dynamics may offer a more favourable environment for investors seeking both defensive stability and attractive income.

- The Australian bond market has seen its strongest start to the year since 2020, and with its relatively higher yield profile, investors may find compelling opportunities in areas like Australian banking credit from well-capitalised financial institutions.

The Race to Ease Amongst Global Central Banks

As markets increasingly anticipate dovish policies from major central banks, Australia stands out as one of the few countries that has held rates steady for nearly a year, alongside nations like India, Malaysia, Taiwan and Norway – all whose last monetary policy move was a hike.

Although this divergence may seem unusual, there are some fundamental reasons for the difference between Australia’s monetary policy vs the rest of the world:

- Australian inflation remains elevated, particularly with services inflation being stickier than goods inflation. The last mile to get inflation back down to the lower end of the central bank’s target band (2-3%) is usually the hardest.

- The RBA did not hike rates as much as our global peers during the monetary tightening cycle, so there is less room to cut.

- Australian employment data is still strong with unemployment at 4.1% (vs long-term average of ~6%), record participation rates and employment growth now at a 16-month high.2

- Australia generally lags countries like the US in terms of the macroeconomic cycle by six to nine months.

The market is currently pricing the Fed to reduce rates by another 140bps by the end of 2025, while predictions for the RBA to cut rates keep getting extended with some only pencilling in a rate cut towards the middle of 20253. Currency markets have already reflected the higher-for-longer interest rate mantra in Australia, as the AUD has increased 10% over the past year from US$0.62 to an intra-year high of $0.69 in September 2024.

The Bond Market Provides Some Directional Insight

While central banks control short-term interest rates, the bond market plays a crucial role in determining long-term rates. In the US, the 2-year Treasury yield is often seen as a reliable indicator of where the market expects the Fed funds rate to move in the future. Historically, it tends to lead to changes in the Fed funds rate, reflecting market sentiment about future monetary policy. Currently, the 2-year yield stands at 3.6%, notably below the Fed funds upper band rate of 5%, signalling that investors anticipate rate cuts in the short-to-medium term as economic conditions evolve.

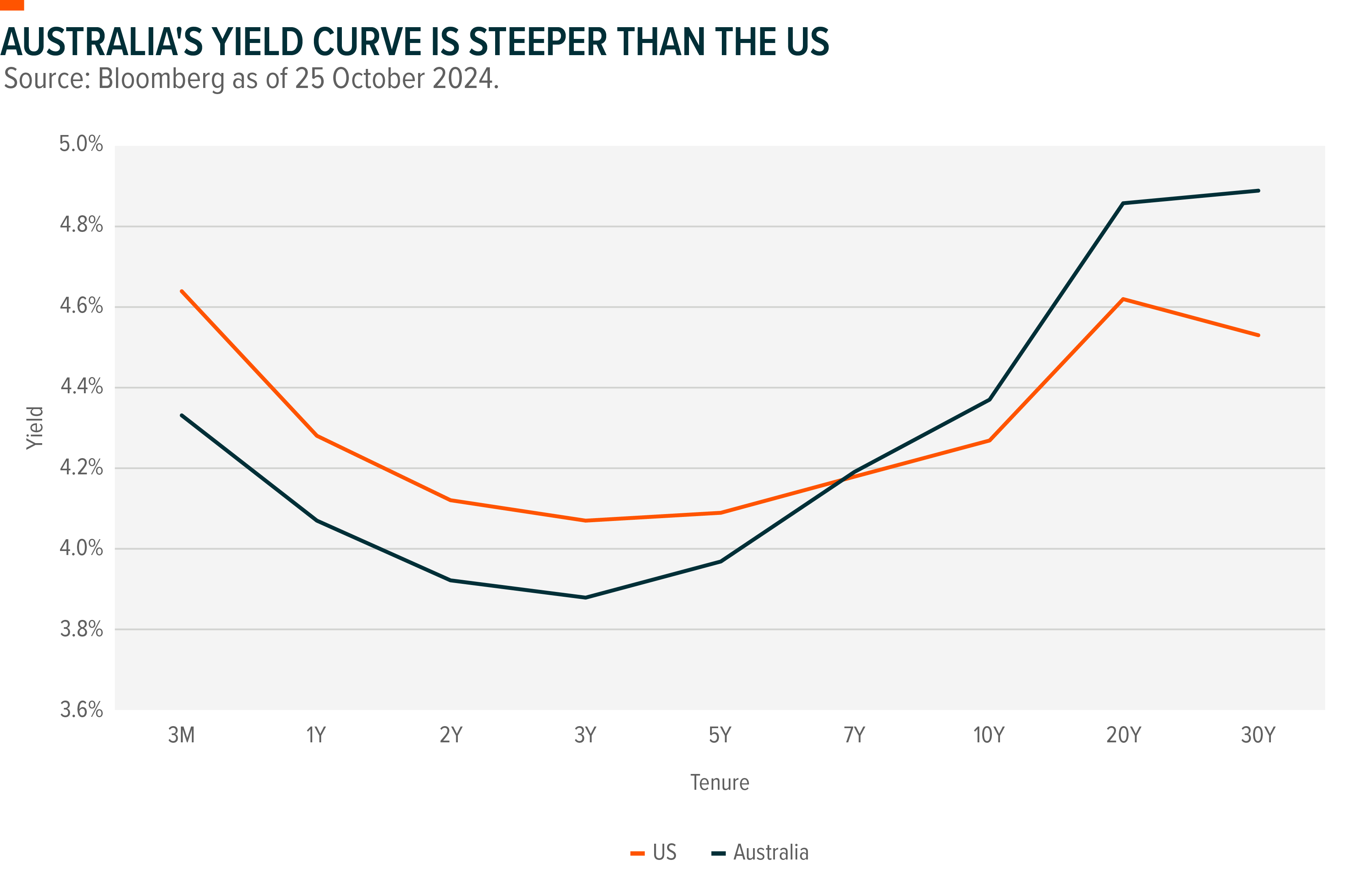

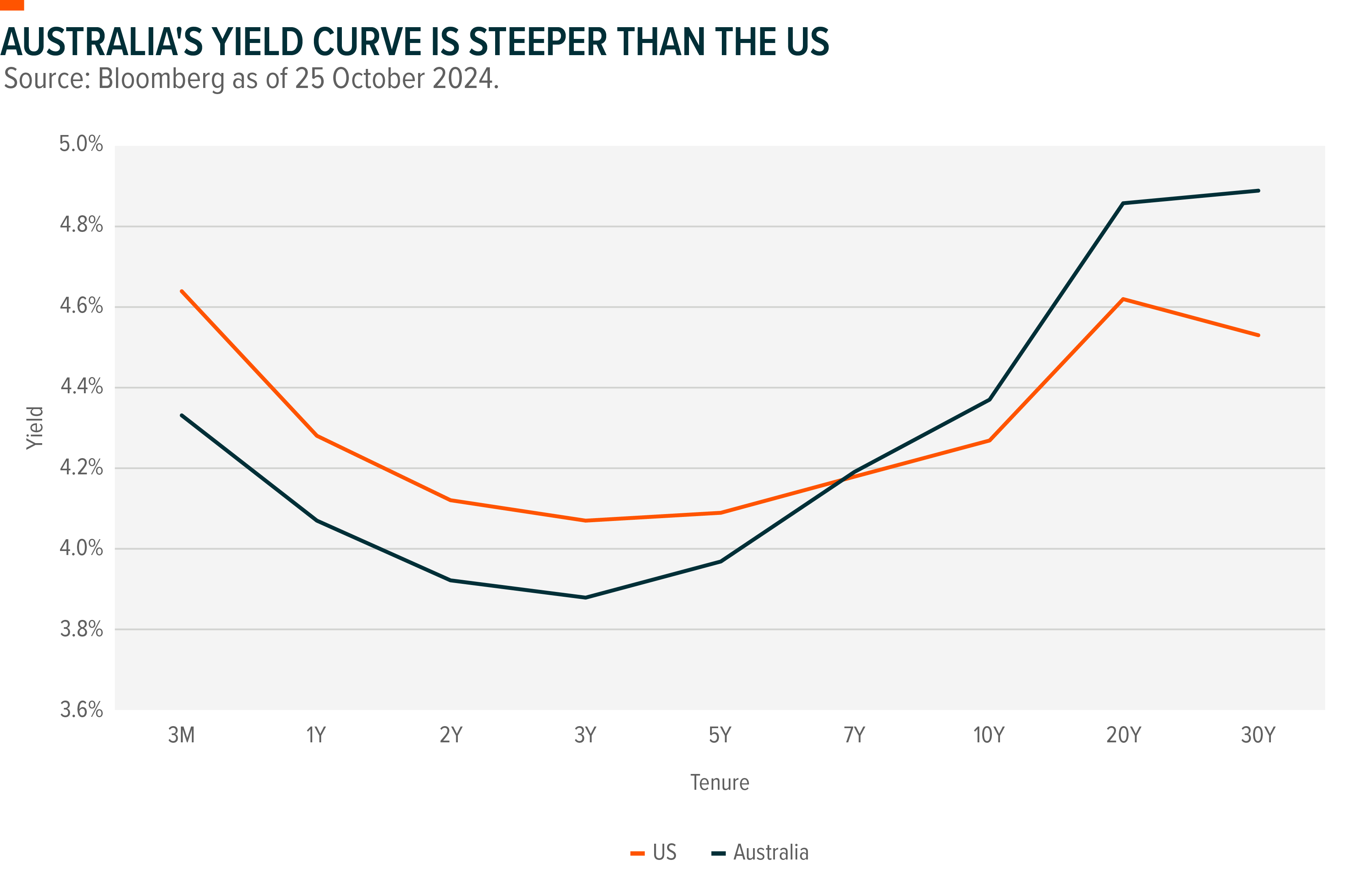

The US yield curve (measuring the difference between 10-year bond yields and 2-year bond yields), which had inverted in July 2022, has recently flattened and temporarily dis-inverted, reflecting a more cautious economic outlook and the potential for future rate cuts. In contrast, Australia's yield curve remains steeper and uninverted, potentially signalling a healthier economic environment and less immediate concern about recessionary pressures. For Australian bond investors, a steeper yield curve can be more favourable as it offers higher yields on longer-dated bonds and suggests a more stable rate trajectory. This can provide income opportunities and more attractive risk-adjusted returns compared to other markets, where the yield curve’s flattening indicates more uncertainty around future growth.

Following one of the worst drawdowns in recent history, the broader bond market is beginning to recover. Notably, the Australian bond market had its best third quarter performance since 2011 and the strongest start to the year since 2020.4 As central banks shift their monetary policy stance, fixed income has emerged as a compelling area of interest for both investors and asset allocators seeking strategic opportunities.

Implication for Australian Investors

Investors may be eagerly anticipating a rate cut from the RBA, but playing the waiting game can be a risky strategy. Timing the stock market is hard but timing the bond market is not a walk in the park either. While the RBA has yet to begin easing, major Australian banks have already reduced the term deposit rates available to customers.5 Interestingly, cash as an asset class has underperformed bonds in all but two of the last 12 cutting cycles.6 This shift has major consequences for Australian savers who depend on these stable income streams.

The RBA’s relatively hawkish stance has kept Australian bond yields higher compared to global markets, making this a potentially opportunistic time for investors to deploy capital into income-generating fixed income securities. High-quality bonds from well-capitalised and reputable issuers, such as Australian banks, are currently offering attractive yields, even when compared against the countries’ equity market. By acting before the RBA cuts interest rates, investors could lock in these elevated yields, potentially hedge against potential economic weakness, and might have an added dual benefit of capital appreciation if interest rates were to decline further.

There may be a global flight of capital in search of attractive yields, which could lead to increased capital flows into the Australian market. Investors can take a diversified approach by considering both floating and fixed-rate bonds across the debt capital structure of Australian banks through the Global X Australian Bank Credit ETF (ASX: BANK). BANK offers exposure to senior bonds, subordinated bonds (Tier 2 Capital) and hybrids (Additional Tier 1 Capital) from APRA-regulated banks. With a running yield of ~6%7, it presents an attractive income opportunity compared to cash, term deposits, and other global bond markets.

Although Australia may be late to the party in cutting interest rates, it’s not too late for investors to take advantage of the country's diverging monetary policy. By exploring opportunities in the fixed income markets, investors can add diversification to their portfolios and enhance their overall yield profile to better navigate the constantly evolving macroeconomic landscape.