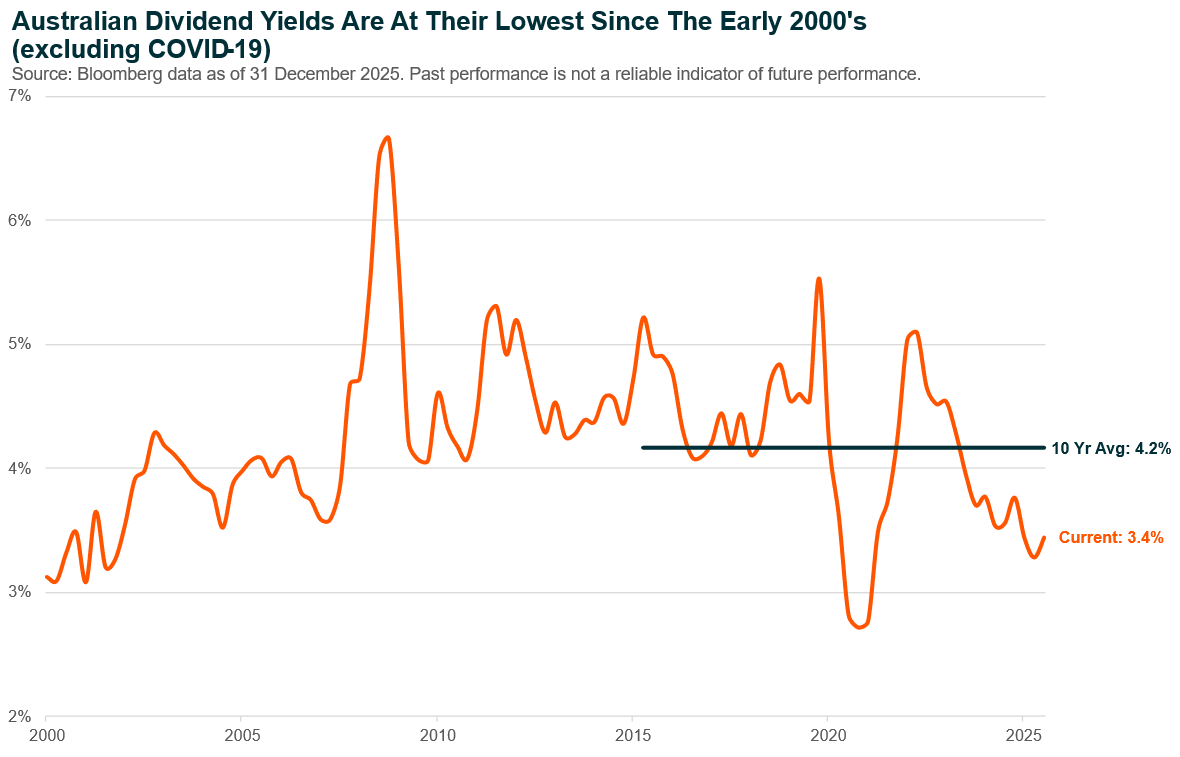

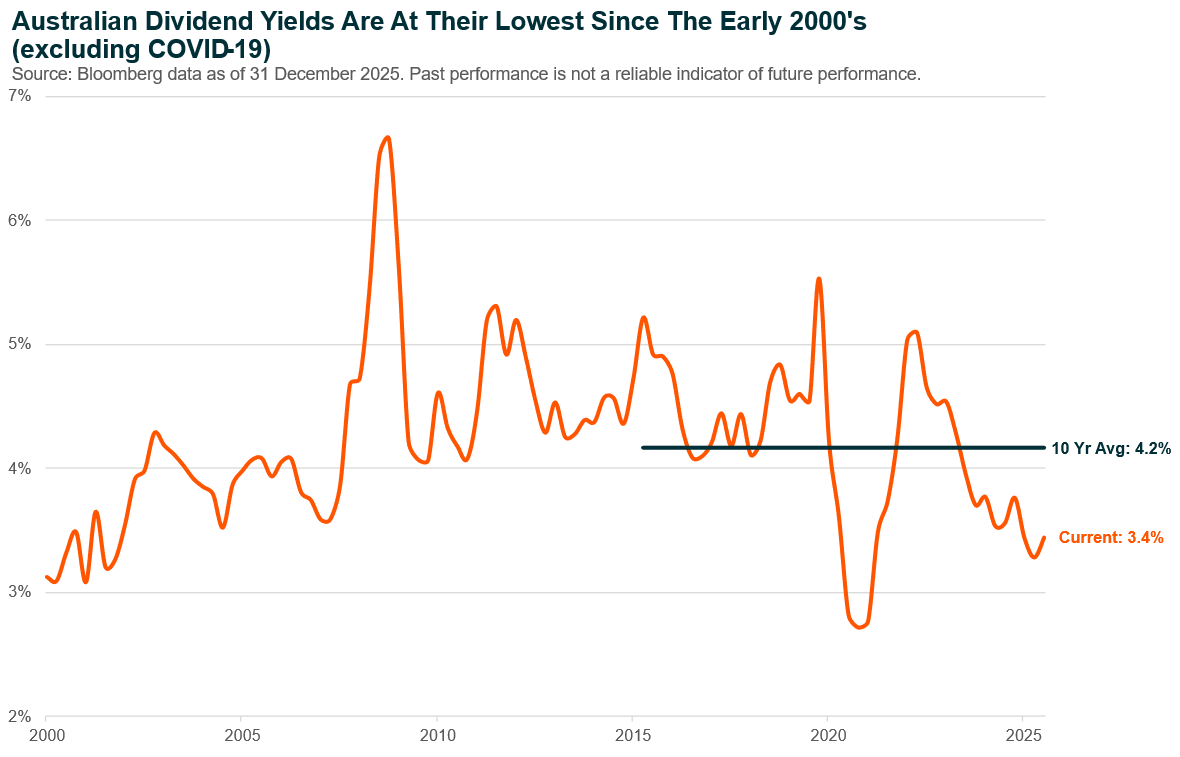

Australia’s share market has long been a cornerstone of local portfolios, prized for its income, familiarity and stability. However, today’s environment presents a more complex set of challenges for investors. Dividend yields have come under pressure, making it potentially harder for income-focused investors to meet their objectives. At the same time, growth opportunities domestically are scarce, valuations remain elevated, and the market is dominated by a narrow group of large companies.

These structural features are reshaping the risk-return trade-off for investors thinking of deploying capital in 2026. We explore the key challenges facing the Australian market and outline smarter ways investors can adapt their portfolios to navigate these constraints and potentially improve long-term outcomes.

Key Takeaways

- Income Isn't What It Used to Be: Dividend yields are at multi-year lows, and traditional income sources like hybrid securities are being phased out. Investors may need smarter strategies to generate passive income in today’s market.

- Growth Remains Scarce: Australian equities have historically delivered muted earnings growth compared to global markets. Combining quality and valuation disciplines with growth can potentially aid investors in targeting sustainable returns without chasing overhyped stocks.

- Beyond Ordinary ETFs Can Solve Structural Challenges: Blending high dividend, covered call, and GARP-focused ETFs allows investors to potentially address low income, capture growth, and reduce overall volatility, creating the opportunity for a more resilient approach to the concentrated Australian market.

Meeting the Income Challenge

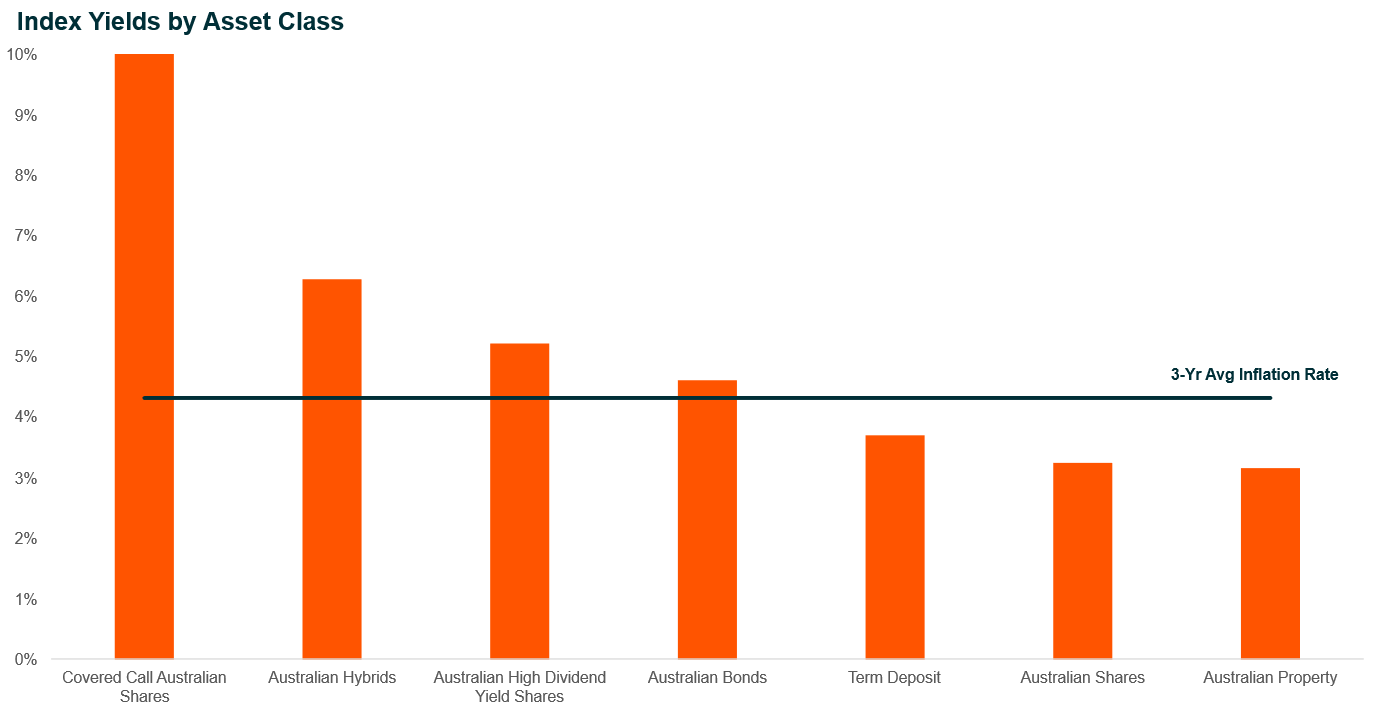

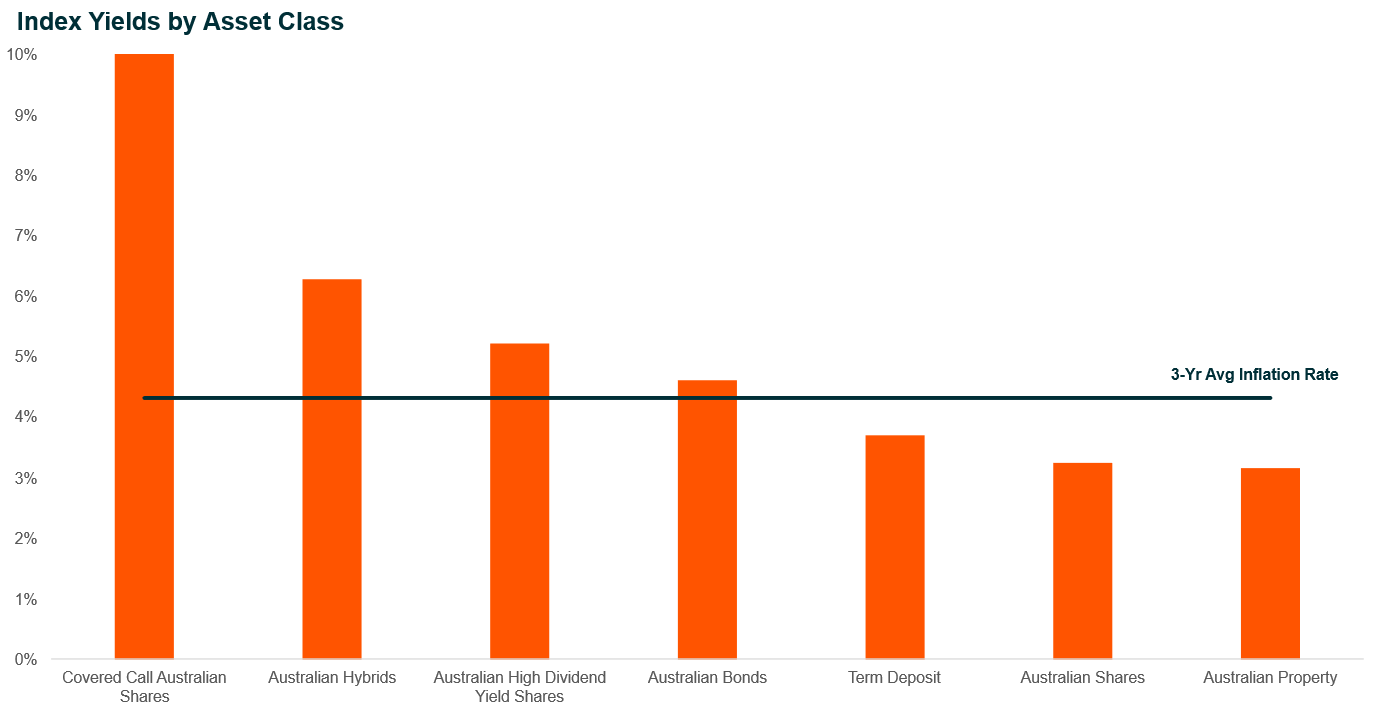

For a market long celebrated for its generous dividends, generating income in Australia has never been harder. Dividend yields are at multi-year lows and hybrid securities, often seen as a supplement for income-seeking investors, are being phased out by 2032. Rising interest rates following the RBA’s hawkish pivot may make term deposits offered by many financial institutions appear more attractive, but with inflation eating into real returns, these perceived safer options often fail to preserve purchasing power. Today’s income investor faces a rare dilemma: how to generate potential inflation-beating yields and passive income in a low-income jungle.

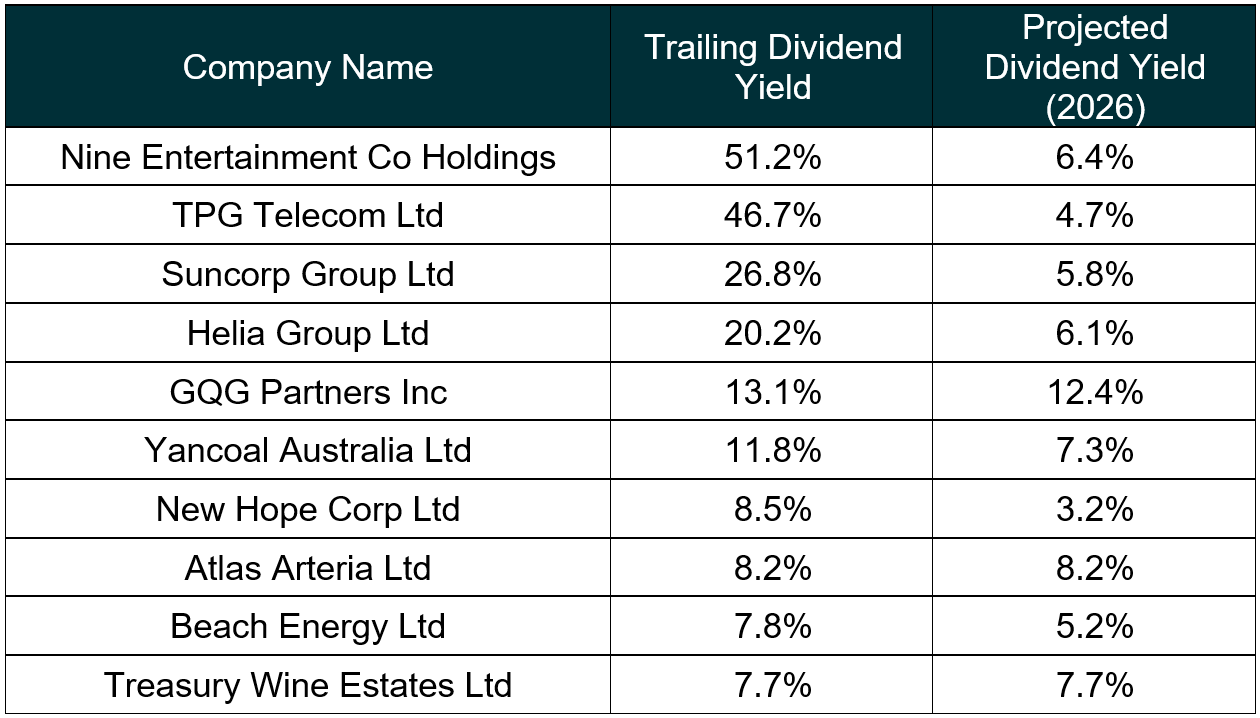

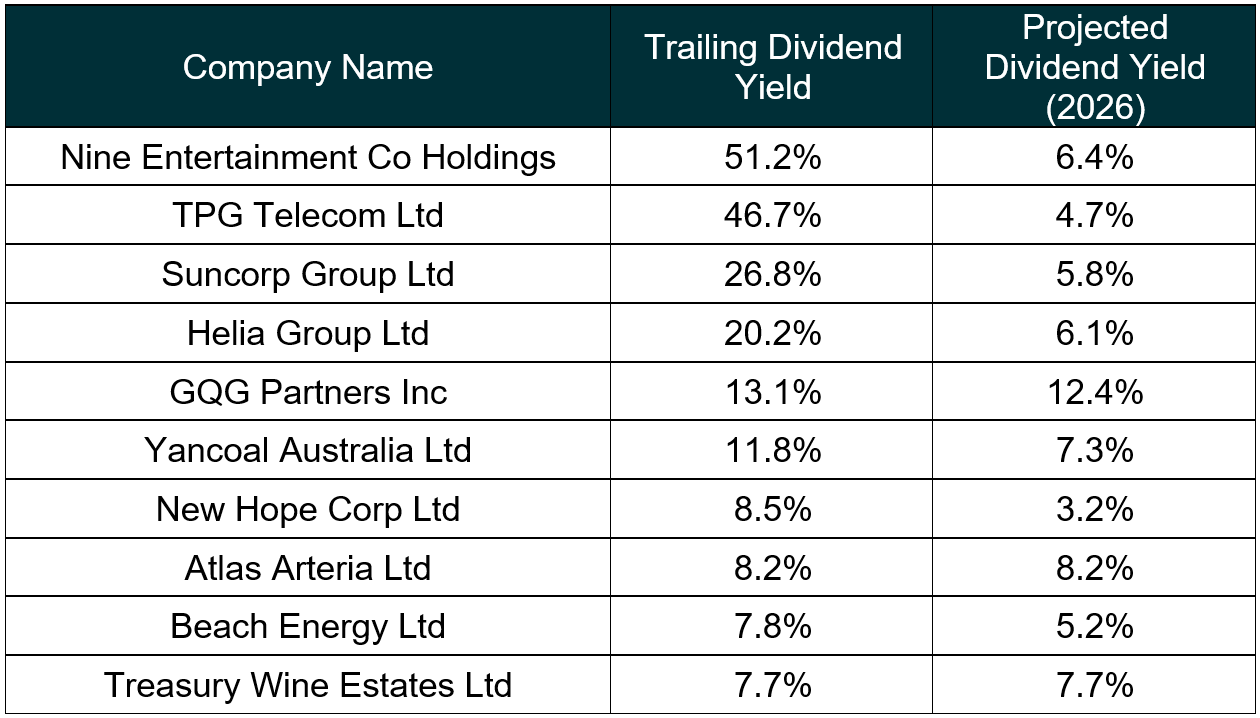

For investors seeking improved and reliable income, high-dividend focused strategies can offer potential assistance. However, it is crucially important to avoid blindly investing in shares that have high headline yields (i.e. dividend traps). Trailing dividend yields – which simply divide the last 12 months of dividends by today’s share price – can be misleading, often inflated by special dividends, one-off capital returns, or dramatic share price falls. For example, Nine Entertainment’s large special dividend following the Domain sale caused its share price to drop on the ex-dividend date, mechanically boosting the yield.1 TPG’s recent capital return and temporary share price volatility created a similar effect, while Suncorp’s headline yield was lifted by a one-off return of capital and special dividend tied to the sale of Suncorp Bank2, accompanied by a pro-rata share consolidation that mechanically inflated yield metrics rather than reflecting recurring earnings. In all cases, the high yield may overstate the income investors can realistically expect in the future, which is why it’s important to focus on a company’s forward-looking dividend projections.

Source: Bloomberg data accurate as of 31 December 2025. Forecasts are not guaranteed, and undue reliance should not be placed on them.

One way investors can access a potentially more reliable income stream is through the Global X S&P/ASX 200 High Dividend ETF (ZYAU), an ETF designed to focus on forward-looking positive dividend yields while ensuring it does not deviate too much from the benchmark in terms of sector weights. To achieve this, ZYAU applies a momentum filter that removes stocks experiencing sharp price falls, helping to reduce the risk of being exposed to dividend traps. The fund has also demonstrated a discipline of focusing on dividend sustainability. ZYAU removed Commonwealth Bank (CBA) in mid-2024 due to concerns around forward-looking yields. While this meant the fund didn’t participate in CBA’s subsequent upside in late 2024 and early 2025, it remained true to its mandate of prioritising consistent and reliable dividend payers and has outperformed the broader ASX 200 and the majority of other high dividend Australian-focused ETFs in 2025.

Another avenue to potentially solve the low-income conundrum is diversifying sources of income procurement by manufacturing yield through the listed options market via a covered call investment strategy. In a world where dividends are scarce, being able to meet lifestyle expenses may require some ingenuity. Thankfully, an ETF like the Global X S&P/ASX 200 Covered Call Complex ETF (AYLD) currently has a trailing annual distribution income of ~10% p.a., made up of dividends, franking credits, and options premium yield, and is currently the only index-based Australian share covered call ETF on the market.3 AYLD is a purely income-focused strategy with limited capital gain upside, making it well-suited to sideways or falling markets while helping investors supplement portfolio returns in a challenging environment.

Source: Bloomberg as of 31 December 2025. Indices used: S&P/ASX BuyWrite Index, Solactive Australian Hybrid Securities Index, S&P/ASX 200 High Dividend Index, Bloomberg AusBond Composite 0+ Yr Index, RBA 1 Year Term Deposit Rate, S&P/ASX 200 Index, S&P/ASX 300 A-REIT Index. Inflation is represented by the average of the Australian CPI over the last three years. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

An Australian covered call strategy has delivered returns comparable to the broader market while taking on only around two-thirds of the overall risk.4 For investors seeking potential enhanced quarterly income, these strategies provide a way to enhance cash flow through the options market and monetise volatility (since higher market volatility generally leads to higher option premiums as investors seek protection), making them a powerful tool to address the income challenge in today’s low-yield environment.

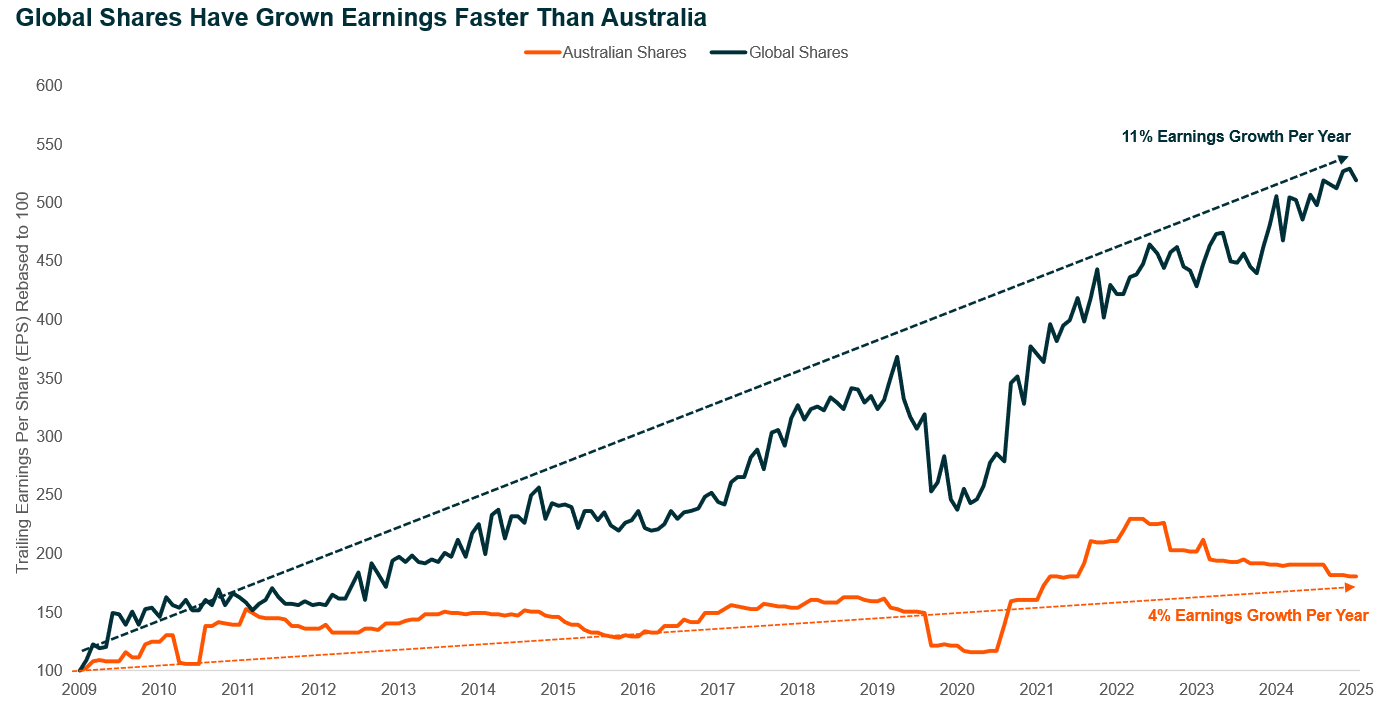

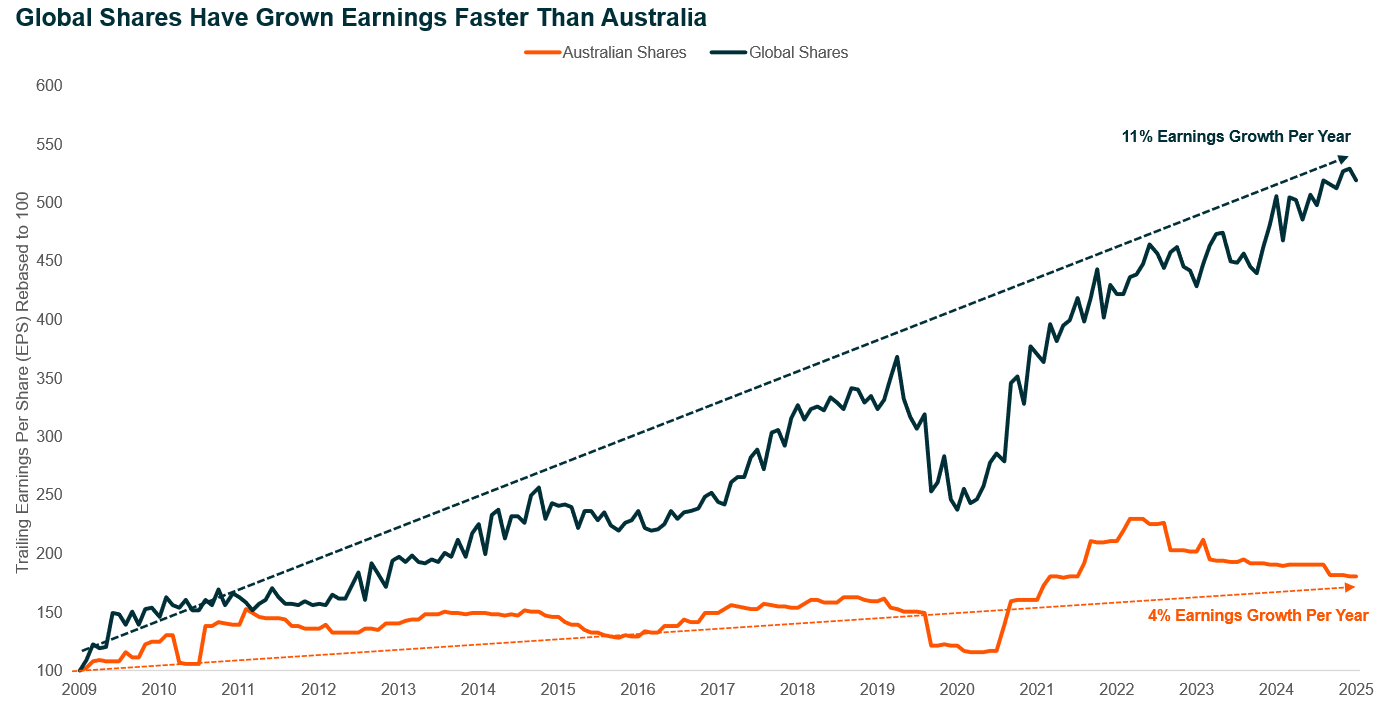

Lack of Earnings Growth

Australian share market growth has been relatively muted for more than a decade. Since the global financial crisis, Australian equities have delivered earnings growth of around 4% per year, compared with roughly 11% per year for global shares. Unlike global markets, Australia has lacked the earnings dominance of large technology companies (like the Magnificent Seven or FANG stocks), with returns instead driven by more cyclical sectors such as banks and miners. This matters because earnings growth does the heavy lifting in determining long-term equity returns, particularly when valuations are already elevated, with the Australian market trading in its most expensive percentile.

Source: Bloomberg as of 31 December 2025 using S&P/ASX 200 Index and MSCI World ex Australia Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

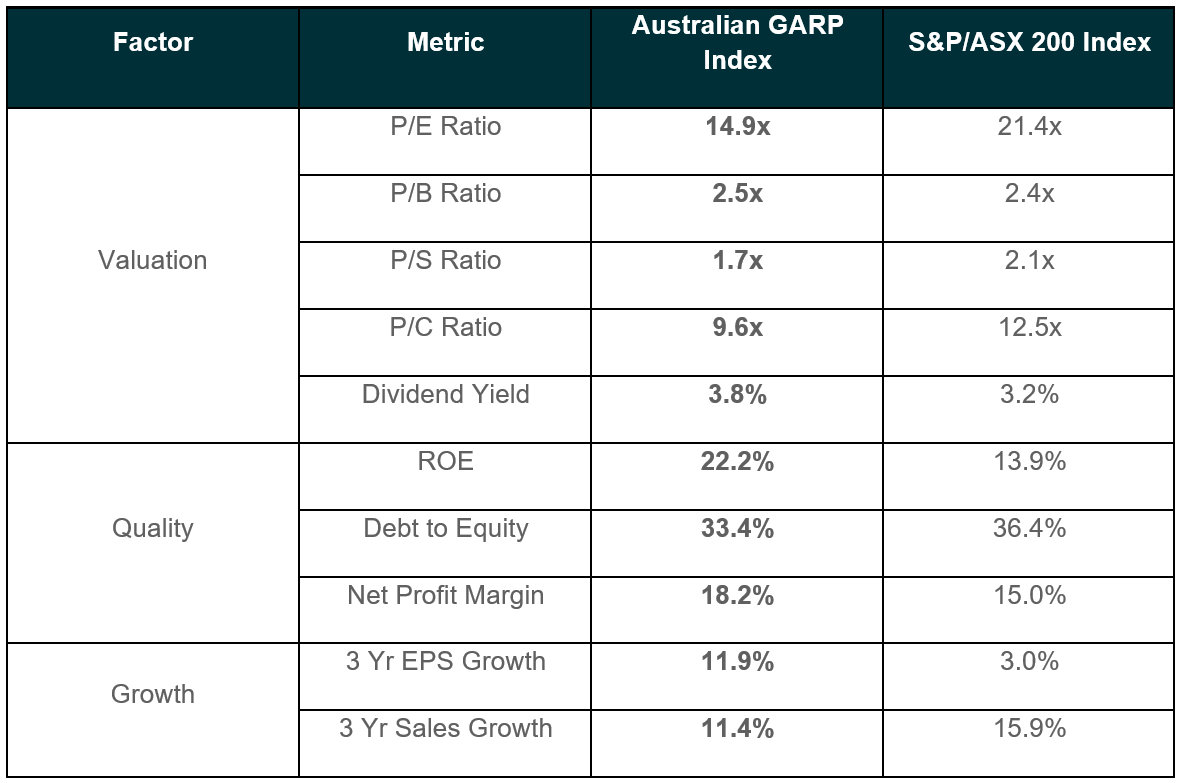

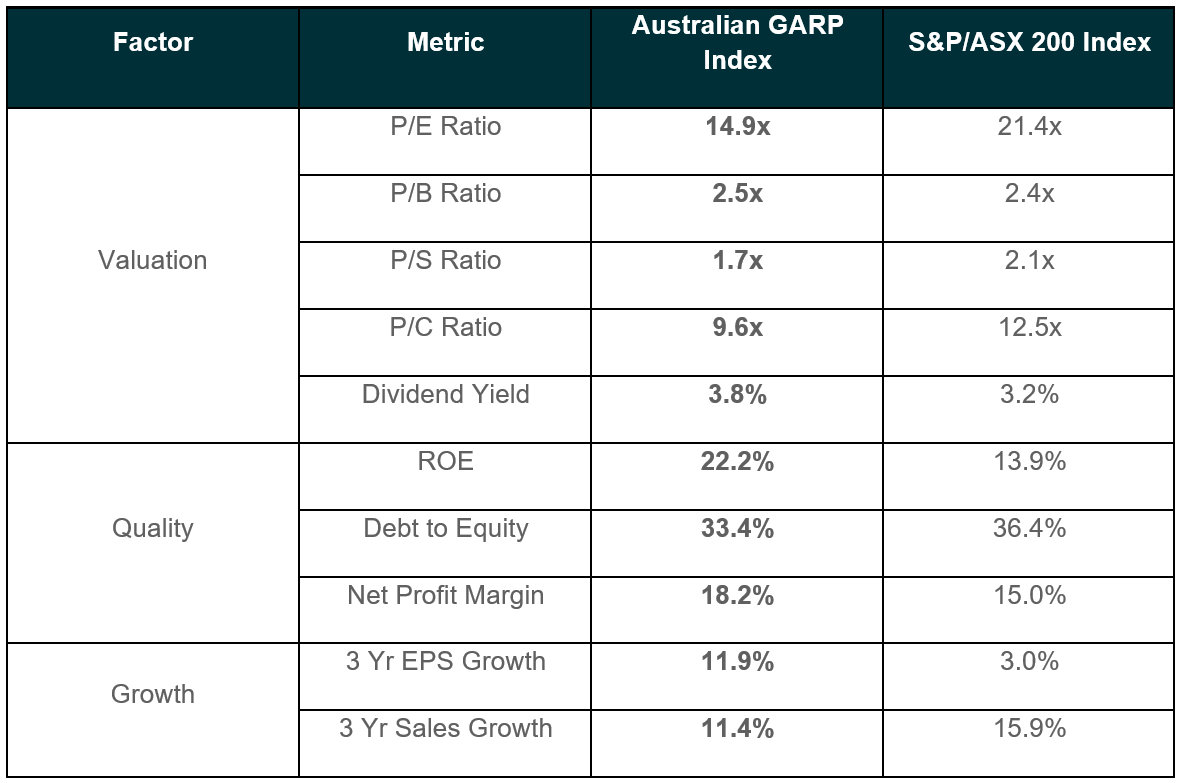

In this environment, growth at a reasonable price (GARP) can be a compelling framework. Earnings growth is scarce in Australia, but combining growth with quality and valuation disciplines helps investors target companies with sustainable earnings momentum without overpaying. The Global X S&P Australia GARP ETF (GRPA) reflects this balance, offering stronger growth, quality and valuation metrics than the broader market.

Source: S&P Dow Jones Indices, FactSet as of December 2025.

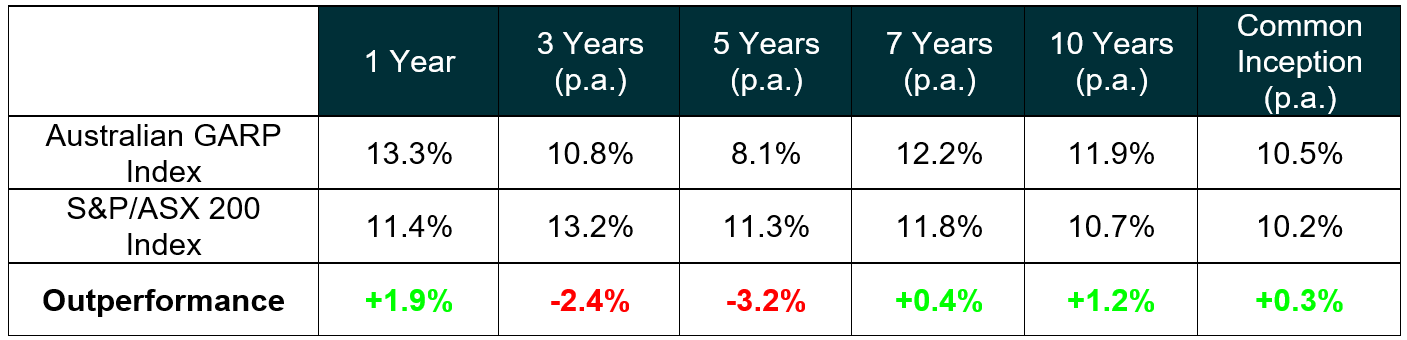

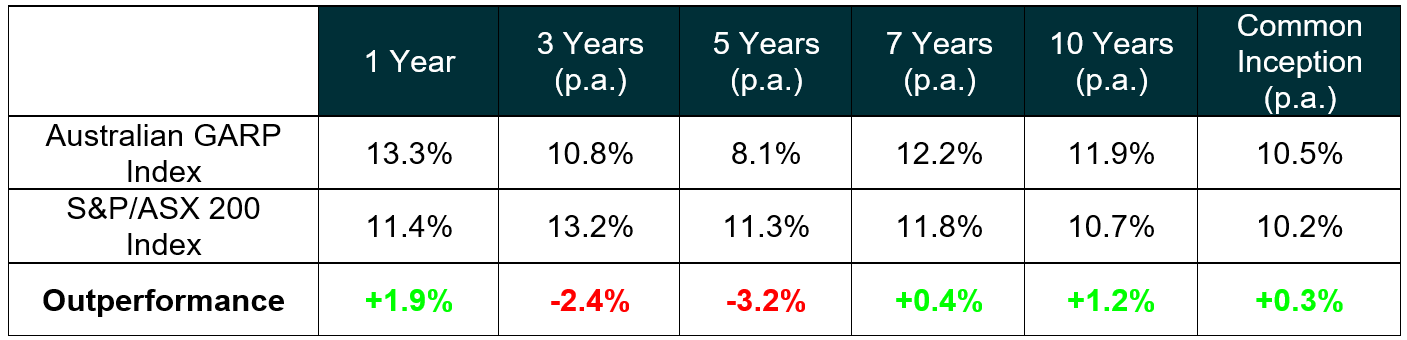

Over the long term, an Australian GARP approach has outperformed the broader market (by ~1.2% p.a. over the last decade). The strategy deliberately avoided the Australian banks, which are considered the most expensive financial institutions in the world, despite dominating the ASX in terms of market capitalisation weighting without superior earnings growth, and has remained structurally underweight these names. While this has caused the Australian GARP basket to underperform over the past 3-5 years relative to the index, as bank share prices surged on multiple re-rating rather than earnings, the approach has stayed true to its philosophy by focusing on quality companies with sustainable growth at reasonable prices, providing a more valuation-disciplined and earnings-driven path to long-term returns.

Source: Bloomberg as of 31 December 2025 using S&P/ASX 200 GARP Index and S&P/ASX 200 Index. Common inception is 18 June 2004. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

For Australian investors facing the challenge of limited domestic earnings growth, there’s no need to chase risky small caps or overhyped tech stocks. Instead, investors can look to gain exposure to a diversified basket of Australian quality companies with solid growth profiles that aren’t too expensive, aiming to capture sustainable upside while managing overvaluation risk.

Building a Robust Australian Equities Portfolio

Many Australian investors may already hold a broad-based Australian shares index like the Global X Australia 300 ETF (A300) or the top 20 Australian stocks directly, forming the core of their portfolio. By layering in a combination of smart strategies targeting high-dividend stocks, a covered call mechanic, and a GARP-focused filter, investors can try to solve the previously mentioned common problems facing the Australian market. By diversifying across these strategies, it can potentially help investors boost income, capture growth, and stay diversified, potentially turning a standard portfolio into a more robust, resilient, and well-rounded Australian equities strategy.

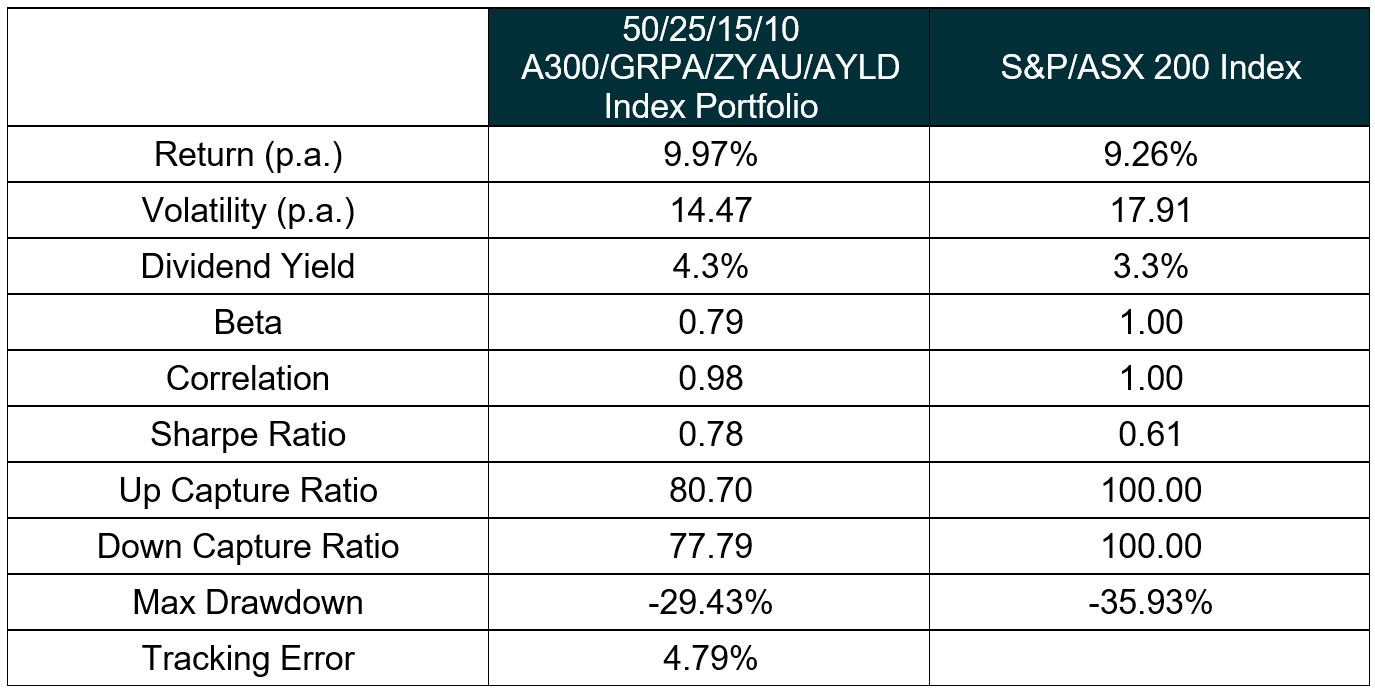

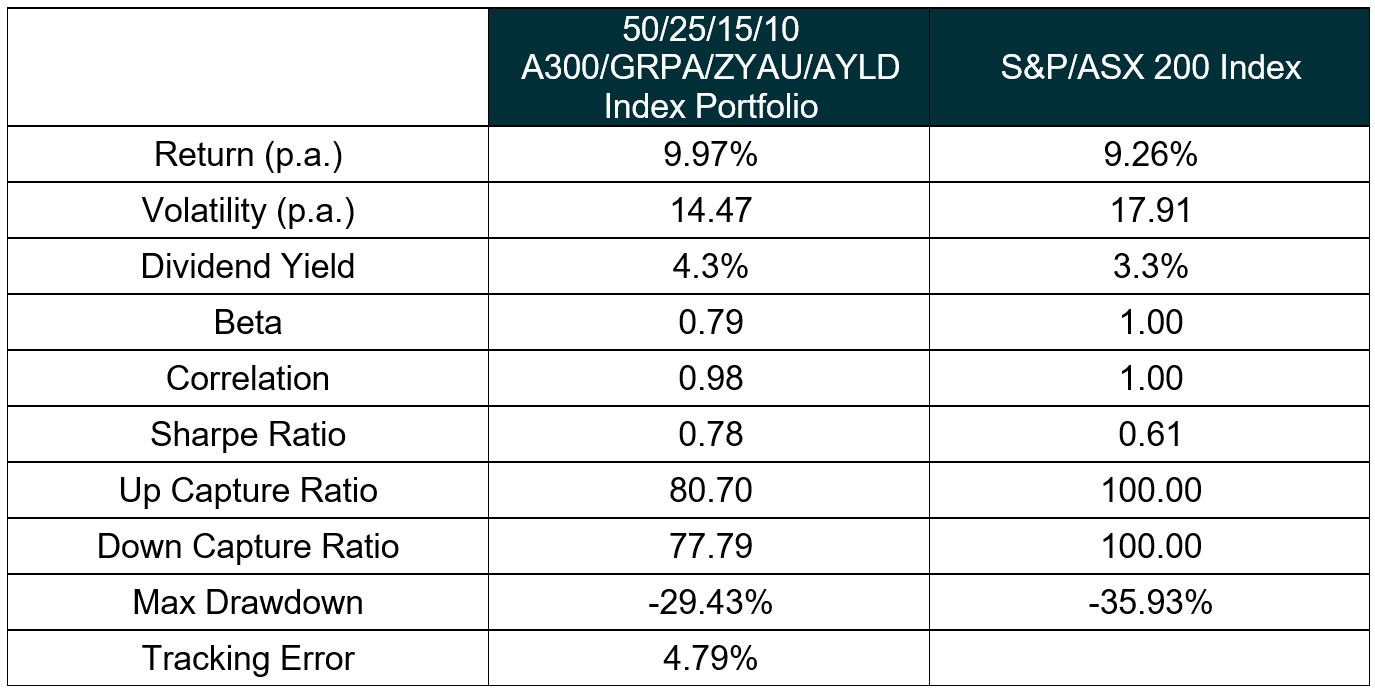

Since the strategies’ common inception nearly 15 years ago, we modelled various portfolio mixes and found that a blend of 50% broad Australian shares, 25% Australian GARP shares, 15% Australian high dividend shares, and 10% Australian covered calls shares has historically delivered higher income, captured earnings growth, and improved overall risk-adjusted returns.

Source: S&P Dow Jones Indices, FTSE, Morningstar from July 2011 to December 2025 using 50% FTSE Australia 300 Index, 25% S&P/ASX 200 GARP Index, 15% S&P/ASX 200 High Dividend Index and 10% S&P/ASX BuyWrite Index vs 100% S&P/ASX 200 Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Examining the data more closely, this blended portfolio has historically outperformed the broader market in 98% of rolling five-year periods, delivering an average excess return of 0.76% per year. Put simply, over most market cycles, combining these strategies has consistently helped investors outperform by capturing additional income and growth while managing risk.

Source: S&P Dow Jones Indices, FTSE, Morningstar from July 2011 to December 2025 using 50% FTSE Australia 300 Index, 25% S&P/ASX 200 GARP Index, 15% S&P/ASX 200 High Dividend Index and 10% S&P/ASX BuyWrite Index vs 100% S&P/ASX 200 Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Final Thoughts: Turning Challenges into Solutions

The challenges facing Australian investors are real: low yields, limited growth, high valuations, and concentrated market exposure – but they are not insurmountable. By leveraging smarter ETF strategies such as high dividend, covered call, and GARP-focused funds, investors can build smarter solutions that address these initial challenges. Australia’s market may be smaller and slower to innovate, but thinking beyond ordinary strategies can potentially unlock meaningful opportunities.

Source: Bloomberg data accurate as of 31 December 2025. Forecasts are not guaranteed, and undue reliance should not be placed on them.

Source: Bloomberg data accurate as of 31 December 2025. Forecasts are not guaranteed, and undue reliance should not be placed on them.

Source: Bloomberg as of 31 December 2025. Indices used: S&P/ASX BuyWrite Index, Solactive Australian Hybrid Securities Index, S&P/ASX 200 High Dividend Index, Bloomberg AusBond Composite 0+ Yr Index, RBA 1 Year Term Deposit Rate, S&P/ASX 200 Index, S&P/ASX 300 A-REIT Index. Inflation is represented by the average of the Australian CPI over the last three years. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: Bloomberg as of 31 December 2025. Indices used: S&P/ASX BuyWrite Index, Solactive Australian Hybrid Securities Index, S&P/ASX 200 High Dividend Index, Bloomberg AusBond Composite 0+ Yr Index, RBA 1 Year Term Deposit Rate, S&P/ASX 200 Index, S&P/ASX 300 A-REIT Index. Inflation is represented by the average of the Australian CPI over the last three years. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: Bloomberg as of 31 December 2025 using S&P/ASX 200 Index and MSCI World ex Australia Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: Bloomberg as of 31 December 2025 using S&P/ASX 200 Index and MSCI World ex Australia Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: S&P Dow Jones Indices, FactSet as of December 2025.

Source: S&P Dow Jones Indices, FactSet as of December 2025.

Source: Bloomberg as of 31 December 2025 using S&P/ASX 200 GARP Index and S&P/ASX 200 Index. Common inception is 18 June 2004. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: Bloomberg as of 31 December 2025 using S&P/ASX 200 GARP Index and S&P/ASX 200 Index. Common inception is 18 June 2004. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: S&P Dow Jones Indices, FTSE, Morningstar from July 2011 to December 2025 using 50% FTSE Australia 300 Index, 25% S&P/ASX 200 GARP Index, 15% S&P/ASX 200 High Dividend Index and 10% S&P/ASX BuyWrite Index vs 100% S&P/ASX 200 Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: S&P Dow Jones Indices, FTSE, Morningstar from July 2011 to December 2025 using 50% FTSE Australia 300 Index, 25% S&P/ASX 200 GARP Index, 15% S&P/ASX 200 High Dividend Index and 10% S&P/ASX BuyWrite Index vs 100% S&P/ASX 200 Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: S&P Dow Jones Indices, FTSE, Morningstar from July 2011 to December 2025 using 50% FTSE Australia 300 Index, 25% S&P/ASX 200 GARP Index, 15% S&P/ASX 200 High Dividend Index and 10% S&P/ASX BuyWrite Index vs 100% S&P/ASX 200 Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

Source: S&P Dow Jones Indices, FTSE, Morningstar from July 2011 to December 2025 using 50% FTSE Australia 300 Index, 25% S&P/ASX 200 GARP Index, 15% S&P/ASX 200 High Dividend Index and 10% S&P/ASX BuyWrite Index vs 100% S&P/ASX 200 Index. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.